The top of analysis on the on-chain analytics agency CryptoQuant has defined why promoting strain from Bitcoin merchants could also be declining.

Bitcoin Quick-Time period Holder Realized Worth Has Risen To $60,000

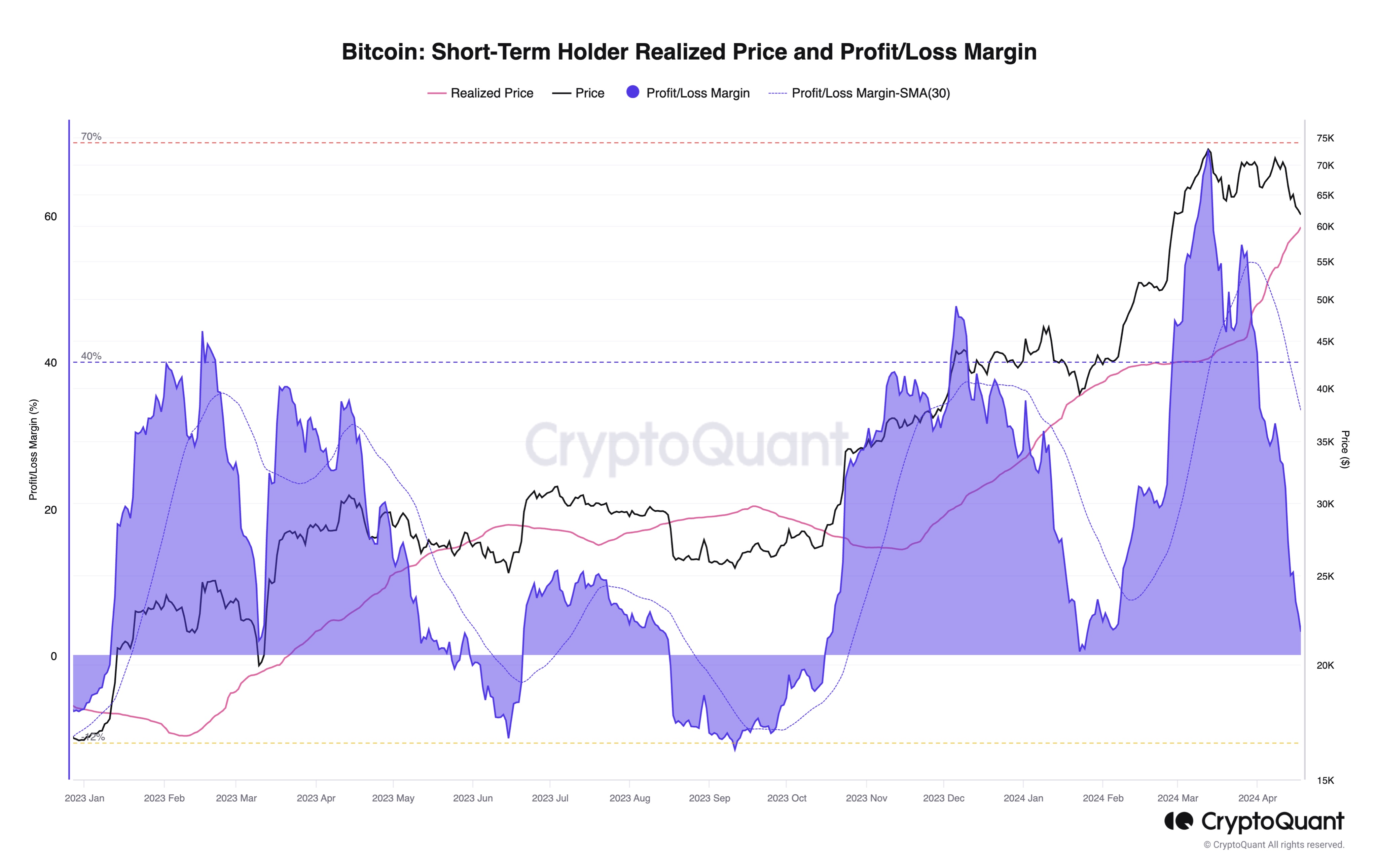

In a brand new submit on X, CryptoQuant head of analysis Julio Moreno has mentioned why the short-term holder promoting strain could also be declining for BTC. The “short-term holders” (STHs) check with the Bitcoin traders who’ve been holding onto their cash since lower than 155 days in the past.

The STHs embody the “merchants” of the market who make many strikes inside quick intervals and don’t are inclined to HODL their cash. This group will be fairly reactive to market actions, simply panic promoting at any time when a crash or rally takes place.

Typically, traders in earnings usually tend to promote their cash, so one option to gauge whether or not the STHs could be possible to participate in a selloff is thru their revenue/loss margin.

Right here, Moreno has cited the revenue/loss margin of this cohort primarily based on its realized value.

The realized value of the group seems to have been going up in latest weeks | Supply: @jjcmoreno on X

The STH realized value (highlighted in pink) right here refers back to the common value foundation or acquisition value of the traders a part of this cohort calculated utilizing blockchain transaction historical past.

When the spot worth of the cryptocurrency is above this stage, it signifies that these holders as a complete are sitting on some web earnings proper now. However, the value being beneath the metric implies the dominance of losses.

From the above chart, it’s seen that Bitcoin has been above the STH realized value for the previous few months, which means that these merchants have been having fun with earnings.

That is typical throughout bull markets as the value retains pushing up, letting these traders make earnings. Whereas STHs have a tendency to remain within the inexperienced in these intervals, tops do develop into possible to happen if these earnings get excessive.

As is clear within the graph, the revenue/loss margin spiked to vital ranges simply as BTC set its newest all-time excessive, which continues to be the highest to this point.

Lately, as Bitcoin has consolidated between the $60,000 to $70,000 vary, the STH realized value has quickly risen, now attaining a worth of round $60,000. This happens as a result of as STHs have traded on this vary, their acquisition costs have been repriced at these greater ranges, thus pushing up the typical.

BTC has been fairly near this stage not too long ago in order that the STHs wouldn’t be holding that a lot revenue now. “Bitcoin promoting strain from merchants could also be declining as unrealized revenue margins are principally zero now,” notes the CryptoQuant head.

BTC Worth

Bitcoin has continued to indicate motion contained inside its latest vary as its value continues to be buying and selling round $65,200.

Seems like the value of the asset has rebounded prior to now day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site totally at your individual danger.