One of many extra attention-grabbing long-term sensible advantages of the know-how and idea behind decentralized autonomous organizations is that DAOs permit us to in a short time prototype and experiment with a facet of our social interactions that’s up to now arguably falling behind our speedy developments in info and social know-how elsewhere: organizational governance. Though our fashionable communications know-how is drastically augmenting people’ naturally restricted potential to each work together and collect and course of info, the governance processes we’ve got right this moment are nonetheless depending on what could now be seen as centralized crutches and arbitrary distinctions similar to “member”, “worker”, “buyer” and “investor” – options that had been arguably initially needed due to the inherent difficulties of managing giant numbers of individuals up thus far, however maybe now not. Now, it might be attainable to create programs which are extra fluid and generalized that make the most of the complete energy legislation curve of individuals’s potential and want to contribute. There are a selection of recent governance fashions that attempt to make the most of our new instruments to enhance transparency and effectivity, together with liquid democracy and holacracy; the one which I’ll talk about and dissect right this moment is futarchy.

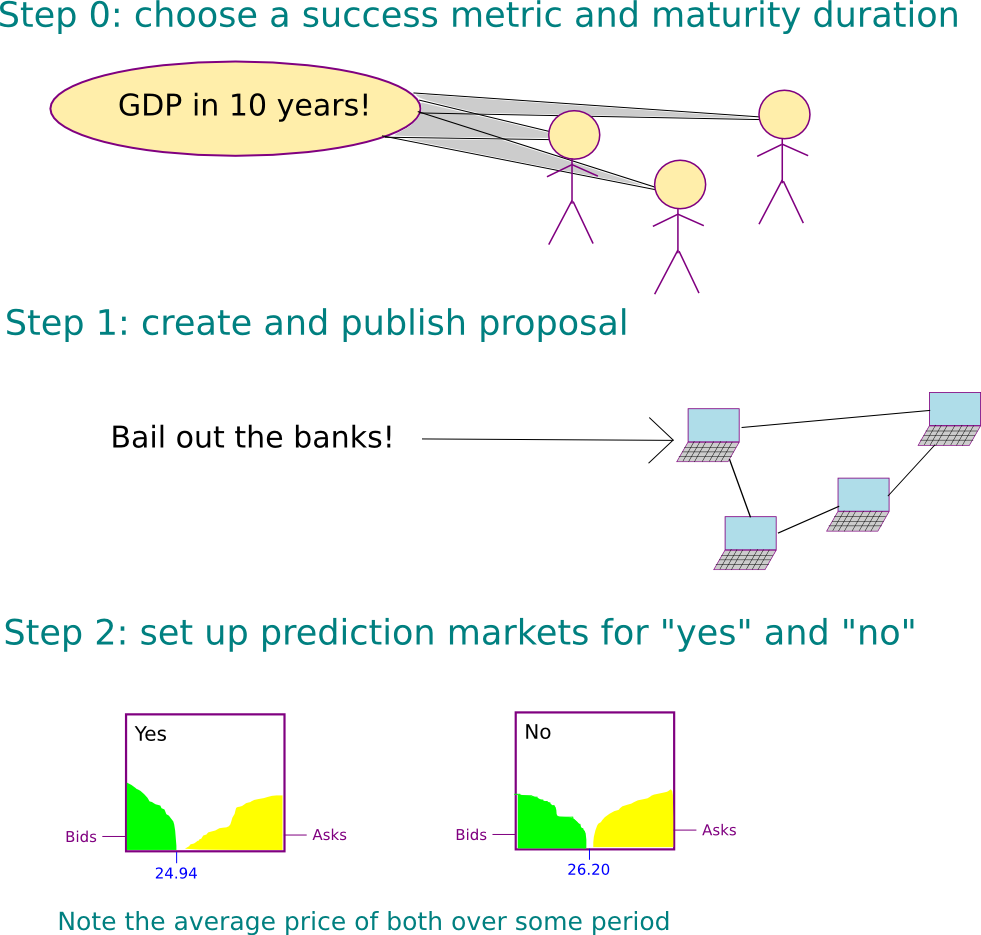

The thought behind futarchy was initially proposed by economist Robin Hanson as a futuristic type of authorities, following the slogan: vote values, however guess beliefs. Underneath this technique, people would vote not on whether or not or to not implement specific insurance policies, however somewhat on a metric to find out how effectively their nation (or charity or firm) is doing, after which prediction markets could be used to select the insurance policies that finest optimize the metric. Given a proposal to approve or reject, two prediction markets could be created every containing one asset, one market comparable to acceptance of the measure and one to rejection. If the proposal is accepted, then all trades on the rejection market could be reverted, however on the acceptance market after a while everybody could be paid some quantity per token primarily based on the futarchy’s chosen success metric, and vice versa if the proposal is rejected. The market is allowed to run for a while, after which on the finish the coverage with the upper common token value is chosen.

Our curiosity in futarchy, as defined above, is in a barely totally different type and use case of futarchy, governing decentralized autonomous organizations and cryptographic protocols; nonetheless, I’m presenting the usage of futarchy in a nationwide authorities first as a result of it’s a extra acquainted context. So to see how futarchy works, let’s undergo an instance.

Suppose that the success metric chosen is GDP in trillions of {dollars}, with a time delay of ten years, and there exists a proposed coverage: “bail out the banks”. Two property are launched, every of which guarantees to pay $1 per token per trillion {dollars} of GDP after ten years. The markets may be allowed to run for 2 weeks, throughout which the “sure” token fetches a median value of $24.94 (which means that the market thinks that the GDP after ten years might be $24.94 trillion) and the “no” token fetches a median value of $26.20. The banks usually are not bailed out. All trades on the “sure” market are reverted, and after ten years everybody holding the asset on the “no” market will get $26.20 apiece.

Sometimes, the property in a futarchy are zero-supply property, much like Ripple IOUs or BitAssets. Because of this the one manner the tokens could be created is thru a derivatives market; people can place orders to purchase or promote tokens, and if two orders match the tokens are transferred from the customer to the vendor in change for USD. It is attainable to promote tokens even when you should not have them; the one requirement in that case is that the vendor should put down some quantity of collateral to cowl the eventual unfavourable reward. An essential consequence of the zero-supply property is that as a result of the optimistic and unfavourable portions, and subsequently rewards cancel one another out, barring communication and consensus prices the market is definitely free to function.

The Argument For

Futarchy has develop into a controversial topic because the concept was initially proposed. The theoretical advantages are quite a few. Initially, futarchy fixes the “voter apathy” and “rational irrationality” downside in democracy, the place people should not have sufficient incentive to even study doubtlessly dangerous insurance policies as a result of the chance that their vote will have an impact is insignificant (estimated at 1 in 10 million for a US authorities nationwide election); in futarchy, when you’ve got or get hold of info that others should not have, you possibly can personally considerably revenue from it, and in case you are unsuitable you lose cash. Primarily, you might be actually placing your cash the place your mouth is.

Second, over time the market has an evolutionary stress to get higher; the people who’re unhealthy at predicting the end result of insurance policies will lose cash, and so their affect in the marketplace will lower, whereas the people who’re good at predicting the end result of insurance policies will see their cash and affect in the marketplace enhance. Word that that is basically the very same mechanic by way of which economists argue that conventional capitalism works at optimizing the manufacturing of non-public items, besides on this case it additionally applies to frequent and public items.

Third, one might argue that futarchy reduces doubtlessly irrational social influences to the governance course of. It’s a well-known incontrovertible fact that, not less than within the twentieth century, the taller presidential candidate has been more likely to win the election (curiously, the reverse bias existed pre-1920; a attainable speculation is that the switchover was attributable to the contemporaneous rise of tv), and there may be the well-known story about voters selecting George Bush as a result of he was the president “they’d somewhat have a beer with“. In futarchy, the participatory governance course of will maybe encourage focusing extra purely on proposals somewhat than personalities, and the first exercise is probably the most introverted and unsocial affair possible: poring over fashions, statistical analyses and buying and selling charts.

A market you’d somewhat have a beer with

The system additionally elegantly combines public participation {and professional} evaluation. Many individuals decry democracy as a descent to mediocrity and demagoguery, and like selections to be made by expert technocratic specialists. Futarchy, if it really works, permits particular person specialists and even complete evaluation companies to make particular person investigations and analyses, incorporate their findings into the choice by shopping for and promoting in the marketplace, and make a revenue from the differential in info between themselves and the general public – kind of like an information-theoretic hydroelectric dam or osmosis-based energy plant. However in contrast to extra rigidly organized and bureaucratic technocracies with a pointy distinction between member and non-member, futarchies permit anybody to take part, arrange their very own evaluation agency, and if their analyses are profitable ultimately rise to the highest – precisely the form of generalization and fluidity we’re searching for.

The Argument In opposition to

The opposition to futarchy is most well-summarized in two posts, one by Mencius Moldbug and the different by Paul Hewitt. Each posts are lengthy, taking on hundreds of phrases, however the common classes of opposition could be summarized as follows:

- A single highly effective entity or coalition wishing to see a selected consequence can proceed shopping for “sure” tokens in the marketplace and short-selling “no” tokens with a view to push the token costs in its favor.

- Markets normally are recognized to be unstable, and this occurs to a big extent as a result of markets are “self-referential” – ie. they consist largely of individuals shopping for as a result of they see others shopping for, and so they don’t seem to be good aggregators of precise info. This impact is especially harmful as a result of it may be exploited by market manipulation.

- The estimated impact of a single coverage on a worldwide metric is far smaller than the “noise” of uncertainty in what the worth of the metric goes to be whatever the coverage being applied, particularly in the long run. Because of this the prediction market’s outcomes could show to be wildly uncorrellated to the precise delta that the person insurance policies will find yourself having.

- Human values are advanced, and it’s onerous to compress them into one numerical metric; actually, there could also be simply as many disagreements about what the metric needs to be as there are disagreements about coverage now. Moreover, a malicious entity that in present democracy would attempt to foyer by way of a dangerous coverage would possibly as a substitute be capable to cheat the futarchy by lobbying in an addition to the metric that’s recognized to very extremely correllate with the coverage.

- A prediction market is zero-sum; therefore, as a result of participation has assured nonzero communication prices, it’s irrational to take part. Thus, participation will find yourself fairly low, so there is not going to be sufficient market depth to permit specialists and evaluation companies to sufficiently revenue from the method of gathering info.

On the primary argument, this video debate between Robin Hanson and Mencius Moldbug, with David Friedman (Milton’s son) later chiming in, is probably one of the best useful resource. The argument made by Hanson and Friedman is that the presence of a company doing such a factor efficiently would result in a market the place the costs for the “sure” and “no” tokens don’t truly mirror the market’s finest data, presenting a large profit-earning alternative for folks to place themselves on the other facet of the tried manipulation and thereby transfer the value again nearer to the right equilibrium. In an effort to give time for this to occur, the value utilized in figuring out which coverage to take is taken as a median over some time period, not at one prompt. So long as the market energy of individuals keen to earn a revenue by counteracting manipulation exceeds the market energy of the manipulator, the sincere members will win and extract a big amount of funds from the manipulator within the course of. Primarily, for Hanson and Friedman, sabotaging a futarchy requires a 51% assault.

The most typical rebuttal to this argument, made extra eloquently by Hewitt, is the “self-referential” property of markets talked about above. If the value for “trillions of US GDP in ten years if we bail out the banks” begins off $24.94, and the value for “trillions of US GDP in ten years if we do not bail out the banks” begins off $26.20, however then sooner or later the 2 cross over to $27.3 for sure and $25.1 for no, would folks truly know that the values are off and begin making trades to compensate, or would they merely take the brand new costs as an indicator of what the market thinks and settle for and even reinforce them, as is usually theorized to occur in speculative bubbles?

Self-reference

There’s truly one purpose to be optimistic right here. Conventional markets could maybe be usually self-referential, and cryptocurrency markets particularly so as a result of they don’t have any intrinsic worth (ie. the one supply of their worth is their worth), however the self-reference occurs partially for a unique purpose than merely buyers following one another like lemmings. The mechanism is as follows. Suppose that an organization is interested by elevating funds by way of share issuance, and at present has one million shares valued at $400, so a market cap of $400 million; it’s keen to dilute its holders with a ten% enlargement. Thus, it could actually elevate $40 million. The market cap of the corporate is meant to focus on the full quantity of dividends that the corporate will ever pay out, with future dividends appropriately discounted by some rate of interest; therefore, if the value is secure, it implies that the market expects the corporate to ultimately launch the equal of $400 million in whole dividends in current worth.

Now, suppose the corporate’s share value doubles for some purpose. The corporate can now elevate $80 million, permitting it to do twice as a lot. Often, capital expenditure has diminishing returns, however not at all times; it might occur that with the additional $40 million capital the corporate will be capable to earn twice as a lot revenue, so the brand new share value might be completely justified – despite the fact that the reason for the leap from $400 to $800 could have been manipulation or random noise. Bitcoin has this impact in an particularly pronounced manner; when the value goes up, all Bitcoin customers get richer, permitting them to construct extra companies, justifying the upper value stage. The shortage of intrinsic worth for Bitcoin implies that the self-referential impact is the one impact having affect on the value.

Prediction markets should not have this property in any respect. Except for the prediction market itself, there isn’t any believable mechanism by which the value of the “sure” token on a prediction market may have any impression on the GDP of the US in ten years. Therefore, the one impact by which self-reference can occur is the “everybody follows everybody else’s judgement” impact. Nevertheless, the extent of this impact is debatable; maybe due to the very recognition that the impact exists, there may be now a longtime tradition of sensible contrarianism in funding, and politics is actually an space the place persons are keen to maintain to unorthodox views. Moreover, in a futarchy, the related factor isn’t how excessive particular person costs are, however which one of many two is greater; in case you are sure that bailouts are unhealthy, however you see the yes-bailout value is now $2.2 greater for some purpose, you understand that one thing is unsuitable so, in principle, you would possibly be capable to fairly reliably revenue from that.

Absolutes and differentials

That is the place we get to the crux of the actual downside: it isn’t clear how one can. Think about a extra excessive case than the sure/no bailouts resolution: an organization utilizing a futarchy to find out how a lot to pay their CEO. There have been research suggesting that ultra-high-salary CEOs truly don’t enhance firm efficiency – actually, a lot the other. In an effort to repair this downside, why not use the facility of futarchy and the market determine how a lot worth the CEO actually gives? Have a prediction marketplace for the corporate’s efficiency if the CEO stays on, and if the CEO jumps off, and take the CEO’s wage as a regular proportion of the distinction. We will do the identical even for lower-ranking executives and if futarchy finally ends up being magically excellent even the lowliest worker.

Now, suppose that you just, as an analyst, predict that an organization utilizing such a scheme may have a share value of $7.20 in twelve months if the CEO stays on, with a 95% confidence interval of $2.50 (ie. you are 95% certain the value might be between $4.70 and $9.70). You additionally predict that the CEO’s profit to the share value is $0.08; the 95% confidence interval that you’ve got right here is from $0.03 to $0.13. That is fairly reasonable; typically errors in measuring a variable are proportional to the worth of that variable, so the vary on the CEO might be a lot decrease. Now suppose that the prediction market has the token value of $7.70 if the CEO stays on and $7.40 in the event that they depart; briefly, the market thinks the CEO is a rockstar, however you disagree. However how do you profit from this?

The preliminary intuition is to purchase “no” shares and short-sell “sure” shares. However what number of of every? You would possibly assume “the identical variety of every, to stability issues out”, however the issue is that the possibility the CEO will stay on the job is far greater than 50%. Therefore, the “no” trades will in all probability all be reverted and the “sure” trades is not going to, so alongside shorting the CEO what you might be additionally doing is taking a a lot bigger danger shorting the corporate. When you knew the proportion change, then you might stability out the quick and lengthy purchases such that on web your publicity to unrelated volatility is zero; nonetheless, since you do not, the risk-to-reward ratio could be very excessive (and even when you did, you’d nonetheless be uncovered to the variance of the corporate’s international volatility; you simply wouldn’t be biased in any specific path).

From this, what we are able to surmise is that futarchy is more likely to work effectively for large-scale selections, however a lot much less effectively for finer-grained duties. Therefore, a hybrid system may match higher, the place a futarchy decides on a political occasion each few months and that political occasion makes selections. This seems like giving whole management to 1 occasion, however it’s not; observe that if the market is afraid of one-party management then events might voluntarily construction themselves to be composed of a number of teams with competing ideologies and the market would favor such combos; actually, we might have a system the place politicians enroll as people and anybody from the general public can submit a mix of politicians to elect into parliament and the market would decide over all combos (though this could have the weak point that it’s as soon as once more extra personality-driven).

Futarchy and Protocols and DAOs

All the above was discussing futarchy primarily as a political system for managing authorities, and to a lesser extent firms and nonprofits. In authorities, if we apply futarchy to particular person legal guidelines, particularly ones with comparatively small impact like “cut back the period of patents from 20 years to 18 years”, we run into most of the points that we described above. Moreover, the fourth argument in opposition to futarchy talked about above, the complexity of values, is a selected sore level, since as described above a considerable portion of political disagreement is exactly by way of the query of what the right values are. Between these issues, and political slowness normally, it appears unlikely that futarchy might be applied on a nationwide scale any time quickly. Certainly, it has not even actually been tried for firms. Now, nonetheless, there may be a completely new class of entities for which futarchy may be a lot better suited, and the place it might lastly shine: DAOs.

To see how futarchy for DAOs would possibly work, allow us to merely describe how a attainable protocol would run on prime of Ethereum:

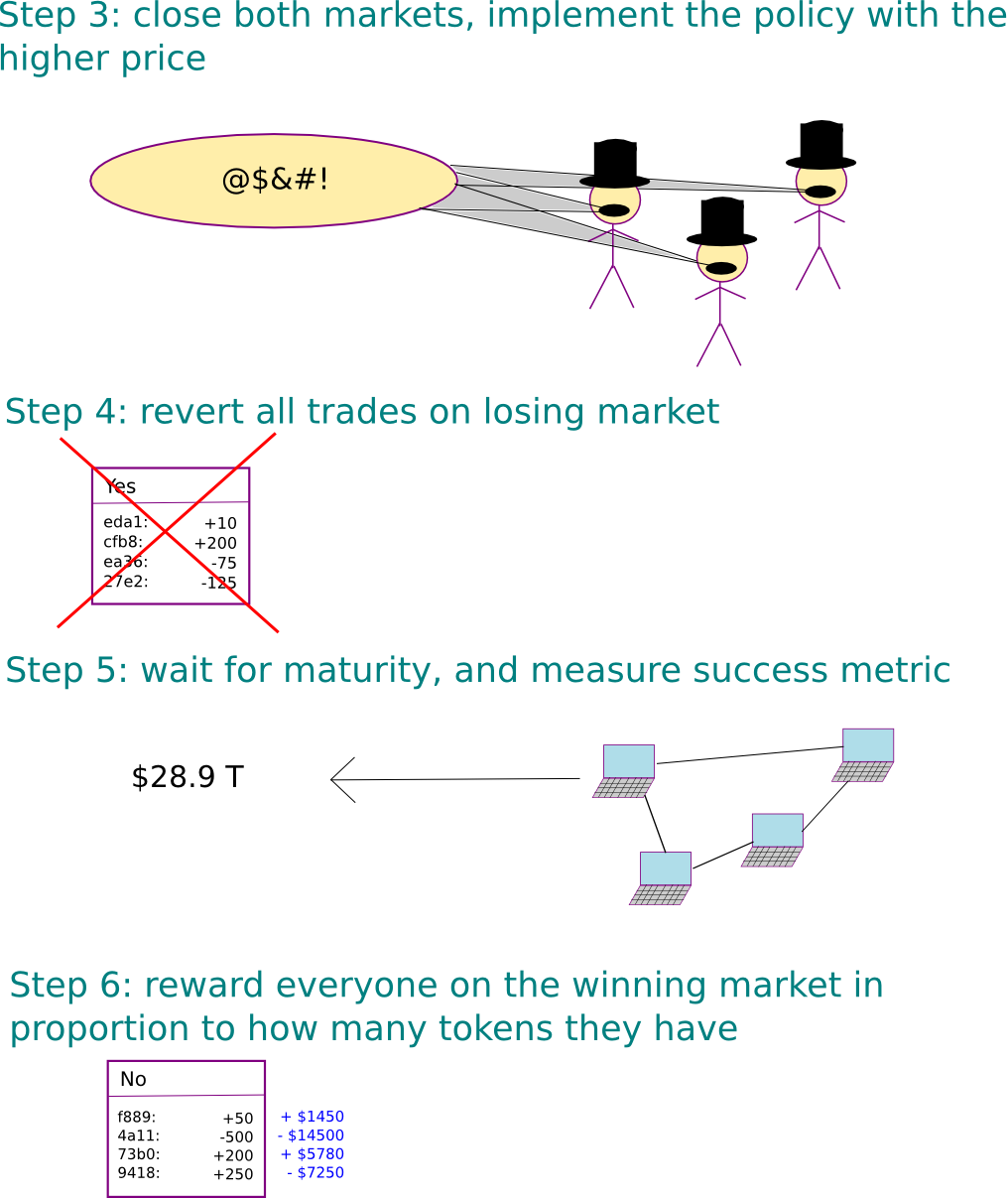

- Each spherical, T new DAO-tokens are issued. Initially of a spherical, anybody has the flexibility to make a proposal for the way these cash needs to be distributed. We will simplify and say {that a} “proposal” merely consists of “ship cash to this deal with”; the precise plan for the way that cash could be spent could be communicated on some higher-level channel like a discussion board, and trust-free proposals could possibly be made by sending to a contract. Suppose that n such proposals, P[1] … P[n], are made.

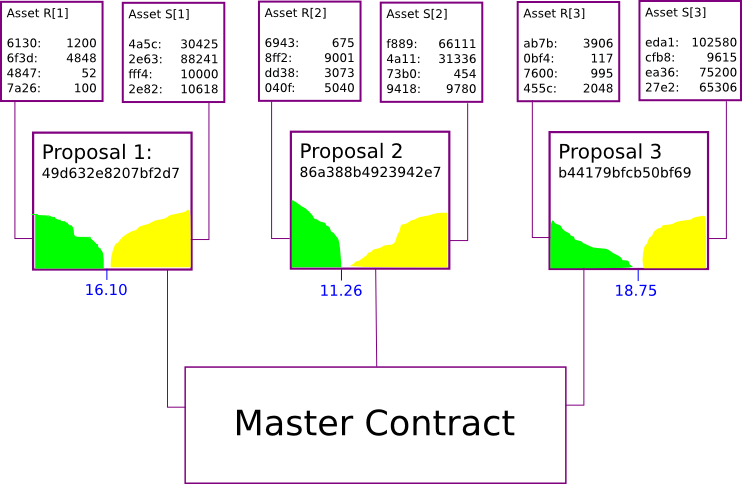

- The DAO generates n pairs of property, R[i] and S[i], and randomly distributes the T models of every sort of token in some vogue (eg. to miners, to DAO token holders, based on a components itself decided by way of prior futarchy, and many others). The DAO additionally gives n markets, the place market M[i] permits commerce between R[i] and S[i].

- The DAO watches the typical value of S[i] denominated in R[i] for all markets, and lets the markets run for b blocks (eg. 2 weeks). On the finish of the interval, if market M[k] has the very best common value, then coverage P[k] is chosen, and the subsequent interval begins.

- At that time, tokens R[j] and S[j] for j != ok develop into nugatory. Token R[k] is price m models of some exterior reference asset (eg. ETH for a futarchy on prime of Ethereum), and token S[k] is price z DAO tokens, the place a great worth for z may be 0.1 and m self-adjusts to maintain expenditures cheap. Word that for this to work the DAO would wish to additionally promote its personal tokens for the exterior reference asset, requiring one other allocation; maybe m needs to be focused so the token expenditure to buy the required ether is zT.

Primarily, what this protocol is doing is implementing a futarchy which is attempting to optimize for the token’s value. Now, let’s take a look at a few of the variations between this sort of futarchy and futarchy-for-government.

First, the futarchy right here is making solely a really restricted form of resolution: to whom to assign the T tokens which are generated in every spherical. This alone makes the futarchy right here a lot “safer”. A futarchy-as-government, particularly if unrestrained, has the potential to run into critical surprising points when mixed with the fragility-of-value downside: suppose that we agree that GDP per capita, even perhaps with some offsets for well being and setting, is one of the best worth operate to have. In that case, a coverage that kills off the 99.9% of the inhabitants that aren’t super-rich would win. If we decide plain GDP, then a coverage would possibly win that extraordinarily closely subsidizes people and companies from exterior relocating themselves to be contained in the nation, maybe utilizing a 99% one-time capital tax to pay for a subsidy. In fact, in actuality, futarchies would patch the worth operate and make a brand new invoice to reverse the unique invoice earlier than implementing any such apparent egregious instances, but when such reversions develop into too commonplace then the futarchy basically degrades into being a conventional democracy. Right here, the worst that might occur is for all of the N tokens in a selected spherical to go to somebody who will squander them.

Second, observe the totally different mechanism for the way the markets work. In conventional futarchy, we’ve got a zero-total-supply asset that’s traded into existence on a derivatives market, and trades on the shedding market are reverted. Right here, we concern positive-supply property, and the way in which that trades are reverted is that the complete issuance course of is actually reverted; each property on all shedding markets develop into price zero.

The most important distinction right here is the query of whether or not or not folks will take part. Allow us to return to the sooner criticism of futarchy, that it’s irrational to take part as a result of it’s a zero-sum sport. That is considerably of a paradox. If in case you have some inside info, then you definitely would possibly assume that it’s rational to take part, as a result of you understand one thing that different folks do not and thus your expectation of the eventual settlement value of the property is totally different from the market’s; therefore, you must be capable to revenue from the distinction. However, if everybody thinks this fashion, then even some folks with inside info will lose out; therefore, the right criterion for taking part is one thing like “you must take part when you assume you may have higher inside info than everybody else taking part”. But when everybody thinks this fashion then the equilibrium might be that nobody participates.

Right here, issues work otherwise. Individuals take part by default, and it is tougher to say what not taking part is. You can money out your R[i] and S[i] cash in change for DAO tokens, however then if there is a want to do this then R[i] and S[i] could be undervalued and there could be an incentive to purchase each of them. Holding solely R[i] can be not non-participating; it is truly an expression of being bearish on the deserves of coverage P[i]; similar with holding solely S[i]. In truth, the closest factor to a “default” technique is holding no matter R[i] and S[i] you get; we are able to mannequin this prediction market as a zero-supply market plus this further preliminary allocation, so in that sense the “simply maintain” strategy is a default. Nevertheless, we are able to argue that the barrier to participation is far decrease, so participation will enhance.

Additionally observe that the optimization goal is easier; the futarchy isn’t attempting to mediate the principles of a complete authorities, it’s merely attempting to maximise the worth of its personal token by allocating a spending finances. Determining extra attention-grabbing optimization goals, maybe ones that penalize frequent dangerous acts completed by present company entities, is an unsolved problem however an important one; at that time, the measurement and metric manipulation points would possibly as soon as once more develop into extra essential. Lastly, the precise day-to-day governance of the futarchy truly does observe a hybrid mannequin; the disbursements are made as soon as per epoch, however the administration of the funds inside that point could be left to people, centralized organizations, blockchain-based organizations or doubtlessly different DAOs. Thus, we are able to count on the variations in anticipated token worth between the proposals to be giant, so the futarchy truly might be pretty efficient – or not less than more practical than the present most well-liked strategy of “5 builders determine”.

Why?

So what are the sensible advantages of adopting such a scheme? What’s unsuitable with merely having blockchain-based organizations that observe extra conventional fashions of governance, or much more democratic ones? Since most readers of this weblog are already cryptocurrency advocates, we are able to merely say that the explanation why that is the case is similar purpose why we’re interested by utilizing cryptographic protocols as a substitute of centrally managed programs – cryptographic protocols have a a lot decrease want for trusting central authorities (in case you are not inclined to mistrust central authorities, the argument could be extra precisely rephrased as “cryptographic protocols can extra simply generalize to realize the effectivity, fairness and informational advantages of being extra participatory and inclusive with out resulting in the consequence that you find yourself trusting unknown people”). So far as social penalties go, this easy model of futarchy is way from utopia, as it’s nonetheless pretty much like a profit-maximizing company; nonetheless, the 2 essential enhancements that it does make are (1) making it tougher for executives managing the funds to cheat each the group and society for his or her short-term curiosity, and (2) making governance radically open and clear.

Nevertheless, up till now, one of many main sore factors for a cryptographic protocol is how the protocol can fund and govern itself; the first resolution, a centralized group with a one-time token issuance and presale, is mainly a hack that generates preliminary funding and preliminary governance at the price of preliminary centralization. Token gross sales, together with our personal Ethereum ether sale, have been a controversial matter, to a big extent as a result of they introduce this blemish of centralization into what’s in any other case a pure and decentralized cryptosystem; nonetheless, if a brand new protocol begins off issuing itself as a futarchy from day one, then that protocol can obtain incentivization with out centralization – one of many key breakthroughs in economics that make the cryptocurrency area normally price watching.

Some could argue that inflationary token programs are undesirable and that dilution is unhealthy; nonetheless, an essential level is that, if futarchy works, this scheme is assured to be not less than as efficient as a fixed-supply foreign money, and within the presence of a nonzero amount of probably satisfiable public items it is going to be strictly superior. The argument is easy: it’s at all times attainable to give you a proposal that sends the funds to an unspendable deal with, so any proposal that wins must win in opposition to that baseline as effectively.

So what are the primary protocols that we’ll see utilizing futarchy? Theoretically, any of the higher-level protocols which have their very own coin (eg. SWARM, StorJ, Maidsafe), however with out their very own blockchain, may benefit from futarchy on prime of Ethereum. All that they would wish to do is implement the futarchy in code (one thing which I have began to do already), add a fairly consumer interface for the markets, and set it going. Though technically each single futarchy that begins off might be precisely the identical, futarchy is Schelling-point-dependent; when you create a web site round one specific futarchy, label it “decentralized insurance coverage”, and collect a neighborhood round that concept, then it is going to be extra doubtless that that exact futarchy succeeds if it truly follows by way of on the promise of decentralized insurance coverage, and so the market will favor proposals that really have one thing to do with that exact line of improvement.

If you’re constructing a protocol that may have a blockchain however doesn’t but, then you should utilize futarchy to handle a “protoshare” that may ultimately be transformed over; and in case you are constructing a protocol with a blockchain from the beginning you possibly can at all times embody futarchy proper into the core blockchain code itself; the one change might be that you will want to seek out one thing to interchange the usage of a “reference asset” (eg. 264 hashes may match as a trust-free financial unit of account). In fact, even on this type futarchy can’t be assured to work; it is just an experiment, and will effectively show inferior to different mechanisms like liquid democracy – or hybrid options could also be finest. However experiments are what cryptocurrency is all about.