The Bitcoin market is presently on edge as outstanding analyst Crypto Rover warns of a possible liquidation occasion that would negatively have an effect on the brief holders.

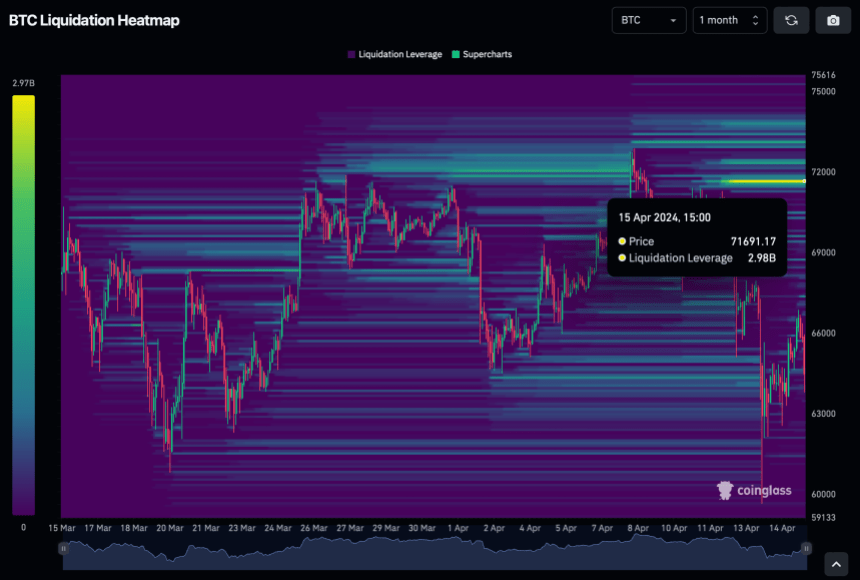

With Bitcoin buying and selling inside a major consolidation section, as revealed by Rover, evaluation means that over $3 billion briefly positions may face liquidation ought to Bitcoin climb again to a selected value mark.

Bitcoin Bears Beware Of This Worth Vary

In accordance with Rover, the essential value mark, which is the $71,600 area, is the place the $3 billion brief liquidation would happen if Bitcoin reclaims it. Rover’s evaluation is predicated on information gathered from CoinGlass, a famend by-product market tracker, indicating a considerable liquidity accumulation at larger value ranges.

The latest warning from Crypto Rover comes amidst a interval of turbulence within the crypto market, marked by sharp value actions and heightened buying and selling exercise.

Significantly, Bitcoin skilled a sudden decline over the weekend, bringing its value to as little as $62,000 within the zone. Nonetheless, within the early hours of Monday, the asset confirmed indicators of restoration, briefly reaching a excessive of $66,797 earlier than retracing to its present value of $64,711.

The market downturn over the weekend witnessed a report variety of liquidations, with over $1.2 billion in Bitcoin lengthy positions liquidated in a single day, in response to WhaleWire.

JUST IN: Over $1.2 Billion in #Bitcoin longs have been liquidated during the last 24 hours, amid market decline, setting a brand new report. The earlier report was $879M.

At this time, extra Bitcoin bulls have been liquidated than on any day within the final 15 years.

Another excuse why shopping for up… pic.twitter.com/itnwb7rj1d

— WhaleWire (@WhaleWire) April 13, 2024

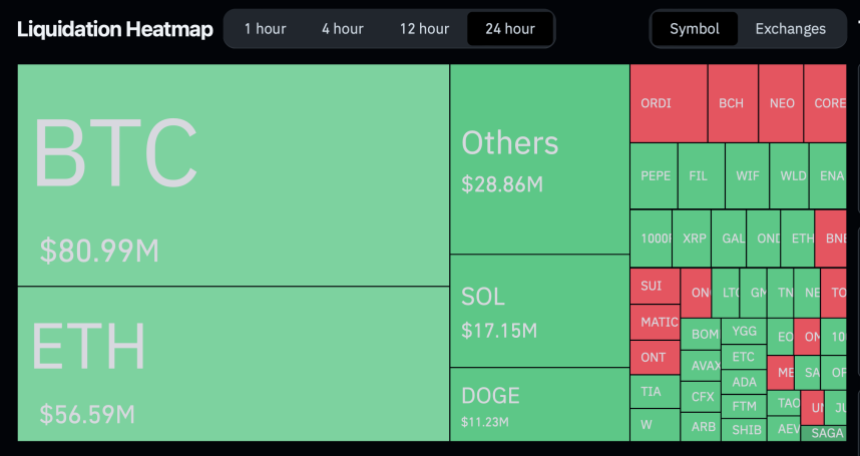

The liquidation hasn’t stopped, as the newest information from Coinglass reveals that previously 24 hours alone, 89,151 merchants have been liquidated, leading to a complete lack of $266.10 million.

Analyst Insights And Market Dynamics

It’s value noting that Bitcoin’s recorded slight restoration comes as Hong Kong regulators granted provisional approval for asset managers to launch spot Bitcoin and Ethereum exchange-traded funds (ETFs).

Crypto analyst Willy Woo has shared his perspective on the potential impression of Bitcoin exchange-traded funds (ETFs) on market dynamics.

In accordance with Woo, introducing the brand new Bitcoin ETFs may result in important value targets, with projections starting from $91,000 on the bear market backside to $650,000 on the bull market high.

The brand new #Bitcoin ETFs brings value targets of $91k on the bear market backside and $650k on the bull market high as soon as ETF buyers have absolutely deployed in response to asset supervisor suggestions***.

These are very conservative numbers. #Bitcoin will beat gold cap when ETFs have…

— Willy Woo (@woonomic) April 15, 2024

Woo’s evaluation underscores the rising institutional curiosity in BTC, with asset managers anticipated to allocate a considerable portion of their funds to the cryptocurrency.

Nonetheless, Woo emphasizes that these projections are conservative estimates, and Bitcoin’s market capitalization may exceed gold as extra capital is deployed into the asset.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site totally at your individual threat.