Knowledge exhibits that Bitcoin investor sentiment has cooled to the bottom degree since February, one thing that might facilitate a rebound within the worth.

Bitcoin Worry & Greed Index Now Factors At Simply ‘Greed’

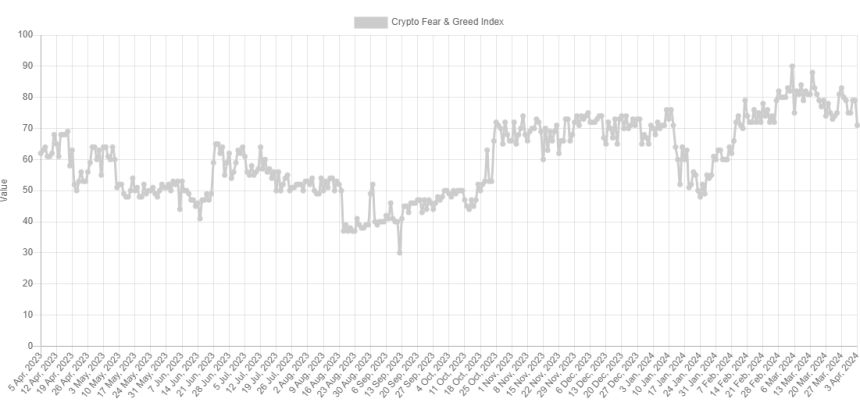

The “Worry & Greed Index” is an indicator created by Various that tells us in regards to the common sentiment amongst buyers within the Bitcoin and broader cryptocurrency sector.

This metric makes use of a numeric scale from zero to hundred to symbolize the sentiment. To calculate the rating, the index considers the info of 5 components: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Developments.

All values of the indicator above the 53 mark recommend the presence of greed among the many buyers, whereas beneath the 47 degree implies a fearful market. The area between these two corresponds to the impartial sentiment.

Right here is how the newest worth of the Bitcoin Worry & Greed Index appears:

The worth of the index seems to be 71 in the intervening time | Supply: Various

As is seen above, the Bitcoin Worry & Greed Index at the moment has a worth of 71, implying that the buyers share a majority sentiment of greed. Simply yesterday, the index’s worth had been notably greater than this, implying that there was a little bit of a cooldown of sentiment previously 24 hours.

Beneath is a chart that exhibits the pattern within the index over the previous 12 months.

The worth of the indicator appears to have registered a plunge just lately | Supply: Various

Apart from the three core sentiments, there are additionally two “excessive” sentiments: excessive greed and excessive worry. The previous happens at values above 75, whereas the latter happens below 25.

The Bitcoin Worry & Greed Index was 79 yesterday, implying that the market had been extraordinarily grasping. The indicator has been recurrently inside this zone for the previous month, so the present regular greed values go in opposition to the pattern.

The sentiment amongst buyers has naturally been so excessive just lately as a result of the BTC worth has gone by a pointy rally on this interval and has explored recent all-time highs (ATHs).

The Bitcoin worth has traditionally tended to go in opposition to the bulk’s expectations. And the stronger this expectation has been, the extra seemingly such a opposite transfer will happen.

As a result of this cause, the acute sentiments have been the place reversals within the asset have been probably the most possible to happen previously. As an example, the present ATH of the asset shaped when the index was at a worth of 88.

With the current worth drawdown, sentiment has additionally taken successful. The truth that it has fallen out of the acute greed zone, although, could also be conducive to a backside forming. The sooner backside, round 20 March, additionally shaped when the index exited the zone.

The present degree of the Bitcoin Worry & Greed Index shouldn’t be solely decrease than it was then but additionally the bottom since 11 February, when the asset was nonetheless buying and selling round $48,000.

BTC Worth

Bitcoin is now all the way down to the $65,800 degree after going through a drawdown of greater than 7% over the previous couple of days.

Seems to be like the worth of the asset has plunged to lows just lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Various.me, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site completely at your individual danger.