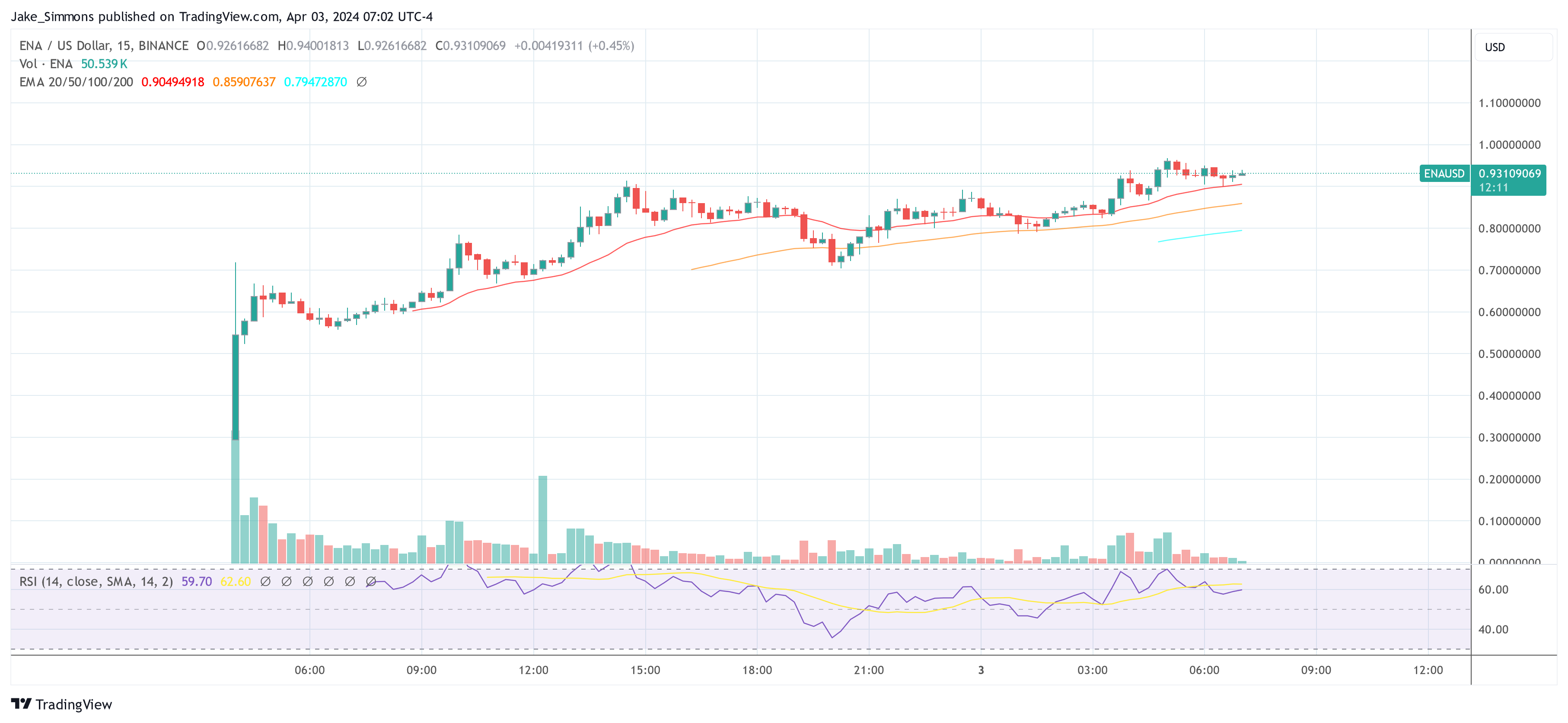

Ethena Labs’ new governance token, ENA, is witnessing a staggering 60% improve in its worth, shortly after its introduction to the market. The spike in ENA’s value to roughly $0.96 has catapulted its market capitalization to just about $1.34 billion, rating ENA because the eightieth largest cryptocurrency by market cap.

This ascent adopted Ethena’s strategic distribution of 750 million ENA tokens, representing 5% of its complete provide, by means of an airdrop to holders of its USDe token. The USDe, an artificial greenback, is central to Ethena’s providing, leveraging a mix of ether liquid staking tokens and brief Ether (ETH) perpetual futures positions to take care of a goal worth close to $1.

The Ethena Labs airdrop went reside 2 hours in the past, with $450M of ENA to distribute.

The most important $ENA recipient to date has been 0xb56, who obtained 3.30M ENA price $1.96M.

Monitor ENA on Arkham:https://t.co/coFsTcBUCa https://t.co/RSZwXLhCB6 pic.twitter.com/l6c7bqKghG

— Arkham (@ArkhamIntel) April 2, 2024

On the coronary heart of Ethena’s worth proposition is the ENA token, engineered to facilitate a digital greenback platform on the Ethereum blockchain. This platform seeks to supply a viable different to standard banking mechanisms by means of its modern ‘Web Bond’. By harnessing the potential of spinoff markets and staked Ethereum, the Web Bond provides a dollar-denominated financial savings instrument accessible globally, unbiased of conventional banking infrastructure.

The full provide of ENA tokens is capped at 15 billion, with an preliminary issuance of 1.425 billion tokens. The distribution plan prioritizes ecosystem growth (30%), core contributor rewards (30%), investor engagement (25%), and basis help (15%), embodying a holistic method to tokenomics. Notably, Binance’s endorsement of ENA because the fiftieth mission on its Binance Launchpool, enabling customers to farm ENA tokens by staking BNB and FDUSD, underscores the token’s attraction.

At press time, ENA traded at $0.93, up 60% prior to now 24 hours.

Fantom Co-Founder Warns Of Luna-Like Collapse

Andre Cronje, co-founder of the Fantom Basis, issued a warning on X, recalling the issues that preceded the collapse of Terra Luna. Cronje dissected the construction of perpetual contracts (perps), a spinoff product that allows merchants to invest on the worth motion of an asset with out holding the precise asset.

This mechanism operates on a system of funding charges meant to tether the perpetual value carefully to the underlying asset’s spot value. Nevertheless, Cronje highlighted a vital vulnerability on this system: the reliance on yield-generating property, resembling staked Ethereum (stETH), as collateral.

This method theoretically permits for a “impartial” place, the place the good points from yield ought to offset losses from the brief place if the asset’s value drops. But, this equilibrium is precarious, as detrimental shifts in funding charges can erode the collateral, resulting in liquidation.

“The mechanism – the idea right here is you can generate a ‘steady’ $1000, by shopping for $1000 of stETH, utilizing this as collateral to open a $1000 stETH brief, thereby attaining being ‘impartial’, whereas getting the advantage of the stETH yield (~3%) + no matter is paid in funding charges,” Cronje defined.

Cronje’s issues will not be unfounded. The crypto trade witnessed the dramatic implosion of Terra’s algorithmic stablecoin UST in 2021, a debacle that resulted in important monetary losses throughout the board. By drawing a parallel between the structural weaknesses he perceives in Ethena’s framework and the mechanisms that led to Terra’s downfall, Cronje raises a purple flag concerning the sustainability of advanced monetary merchandise that lack clear danger mitigation methods.

Occasionally we see one thing new on this house. I usually discover myself on the mid curve for an in depth period of time. I’m snug right here. That being stated, there have been occasions on this trade I want I used to be extra interested by, there have additionally been occasions I positively did…

— Andre Cronje (@AndreCronjeTech) April 3, 2024

Responding to Cronje’s critique, the founding father of Ethena Labs Man Younger aka Leptokurtic, acknowledged the validity of the issues raised. “These aren’t mid curve issues in any respect Andre Cronje, you rightly level out dangers that completely do exist right here. Will work on an extended kind response for you by finish of this week with some ideas,” Younger acknowledged on X.

Featured picture from LinkedIn, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site fully at your individual danger.