On-chain knowledge reveals the Bitcoin provide in revenue has plunged following the most recent crash within the asset’s value in the direction of the $65,000 degree.

Bitcoin Provide In Revenue Is Now Down To Round 90%

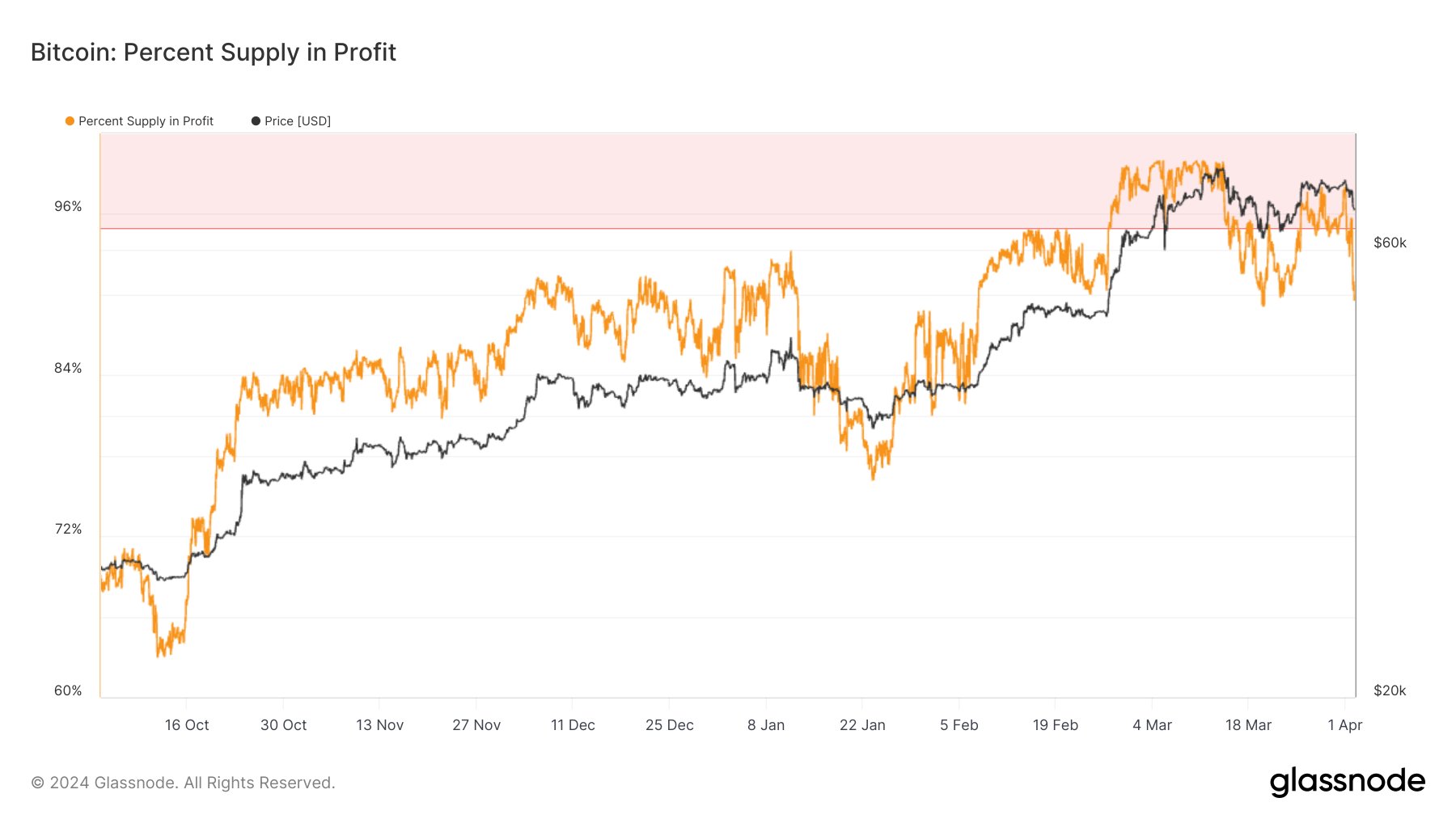

As analyst James Van Straten identified in a put up on X, round 10% of the BTC provide is now in a state of loss. The on-chain indicator of curiosity right here is the “% Provide in Revenue,” which tracks the proportion of the overall circulating Bitcoin provide holding an unrealized acquire.

This metric works by going by way of the blockchain historical past of every coin in circulation to see the worth at which it was final transferred. Assuming that this earlier transaction concerned a change of fingers, the worth at its second would function the associated fee foundation for the coin.

The cash with a value foundation that’s lower than the present spot value of the cryptocurrency would naturally be thought of to be holding a revenue, and as such, they’d be counted below the provision in revenue.

The % Provide in Revenue provides up all such cash and calculates what a part of the overall provide they make up for. The alternative metric, the % Provide in Loss, provides up the cash not satisfying this situation.

For the reason that whole circulating provide should add as much as 100%, the % Provide in Loss will be deduced from the % Provide in Revenue by subtracting its worth from 100.

Now, here’s a chart that reveals the development within the % Provide in Revenue for Bitcoin over the previous few months:

Appears to be like like the worth of the metric has taken a plunge in latest days | Supply: @jvs_btc on X

As displayed within the above graph, the Bitcoin % Provide in Revenue has seen a pointy drop not too long ago because the cryptocurrency value has gone by way of a big drawdown.

The indicator’s worth has dropped to across the 90% mark, which implies that about 10% of the provision is presently carrying a loss. The chart reveals that the final time the metric touched these ranges was again on 22 March. Apparently, the asset additionally discovered its backside round then.

Earlier, the % Provide In Revenue had pushed in the direction of the 100% mark, which was a pure consequence of the worth setting a new all-time excessive (ATH), since at contemporary highs, all the provide should be out of the purple.

Typically, the buyers in revenue usually tend to promote their cash, so if many come into beneficial properties, the potential of a mass selloff rises. As a consequence of this cause, excessive ranges of the % Provide In Revenue have typically led to tops.

Equally, bottoms develop into extra probably when investor profitability ranges drop comparatively low. The present worth of 90% remains to be fairly excessive, however this isn’t uncommon throughout bull runs, as there may be sturdy demand and ATHs are being explored.

The truth that the profitability has cooled off in comparison with earlier ranges could also be constructive for the rally’s possibilities to see a continuation, similar to it did final month.

BTC Value

On the time of writing, Bitcoin has been buying and selling at across the $65,700 degree, down greater than 5% over the previous week.

The value of the asset appears to have been tumbling down over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.