Cryptocurrency analyst and dealer Ali Martinez is predicting that XRP might see decrease costs because it faces rejection from a key resistance degree.

Martinez tells his 36,200 followers on the social media platform X that XRP has failed to shut above the mid-point of an ascending parallel channel on the three-day chart.

In accordance with the crypto dealer, the rejection means that XRP could right towards the diagonal help of the sample.

“XRP is transferring inside an ascending parallel channel! After dealing with rejection on the channel’s mid-line, XRP would possibly see a pullback towards the decrease boundary, round $0.55.”

Whereas ascending parallel channels are usually bullish patterns over the long run, the worth motion contained in the channel varies from bearish to bullish and vice versa with the higher boundary performing as resistance and the decrease boundary as help.

XRP is buying and selling at $0.611 at time of writing, nonetheless beneath the channel’s mid-line.

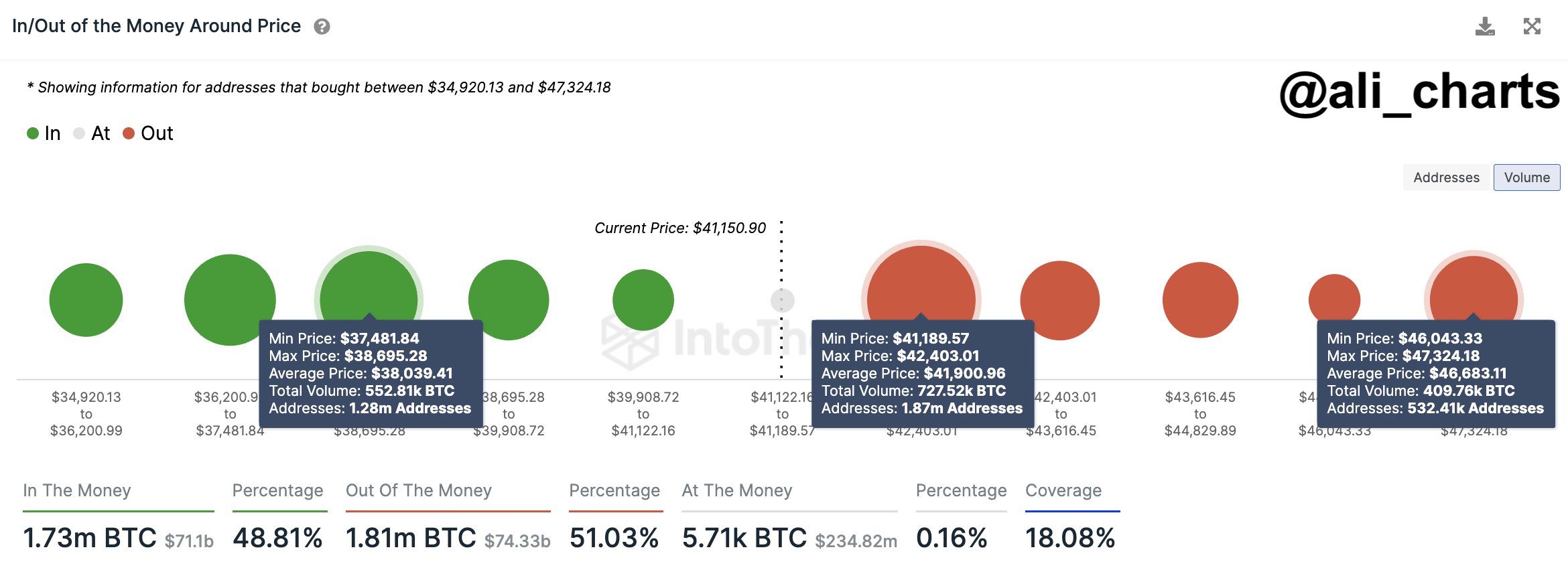

Turning to Bitcoin (BTC), Martinez says that the flagship crypto asset is near transferring to a zone the place it’d face much more downward strain primarily based on knowledge from the blockchain analytics platform IntoTheBlock.

In accordance with the dealer, 1.87 million addresses accrued 730,000 BTC between $41,200 and $42,400, and a transfer beneath these ranges might set off the holders to chop their losses.

“If promoting strain will increase, look ahead to a potential decline to the subsequent demand zone between $37,500 and $38,700. Right here, 1.28 million addresses are holding 553,000 BTC.”

Bitcoin is buying and selling at $43,051 at time of writing.

Martinez additionally says that Bitcoin is flashing a bearish on-chain sign as its community development has fallen over the previous month per knowledge from crypto analytics agency Glassnode.

“There’s been a noticeable dip in Bitcoin community development over the previous month, casting doubt on the sustainability of BTC’s latest transfer to $44,000.

For a strong continuation of the bull rally, it’s essential to see an uptick within the variety of new BTC addresses. This would supply the wanted help for sustained bullish momentum.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: DALLE3