Rumors relating to a possible spot Litecoin (LTC) Alternate-Traded Fund (ETF) have sparked a big value surge, with the digital asset gaining 10% amid hypothesis of institutional curiosity. Fox Enterprise journalist Eleanor Terrett, via a publish on X (previously Twitter), unveiled insights suggesting rising institutional intrigue in the direction of a Litecoin ETF.

Terrett shared, “SCOOP: Listening to rumblings on the institutional stage about potential curiosity in a Litecoin ETF. The logic is that due to LTC practical similarities to BTC, the SEC could also be extra inclined to approve it, presumably much more so than ETH.”

Why A Spot Litecoin ETF Might Be Potential

This assertion comes at a pivotal time because the crypto market continues to navigate via regulatory uncertainties and rising curiosity from conventional monetary establishments. Including to the excitement, Terrett highlighted latest actions by the Coinbase Derivatives to launch futures contracts for Dogecoin, Litecoin, and Bitcoin Money, all set to start on April 1st, 2024.

These futures contracts, as detailed, are a part of Coinbase’s strategic transfer to diversify its choices, leveraging the self-certification method beneath CFTC Regulation 40.2(a). This method permits entities to launch new merchandise with out the specific approval of the CFTC, supplied they adjust to the Commodity Alternate Act and accompanying laws.

Furthermore, the latest classification of Ethereum (ETH) and Litecoin (LTC) as commodities by the Commodity Futures Buying and selling Fee (CFTC) in its lawsuit in opposition to KuCoin has added one other layer of legitimacy to the discourse surrounding Litecoin’s regulatory standing. The CFTC’s motion emphasizes its view of sure cryptocurrencies as commodities.

Amidst these regulatory clarifications and developments, discussions concerning the potential approval of a spot Litecoin ETF have intensified. Luke Martin, a famend crypto analyst, echoed the sentiment, suggesting that the approval of an Ethereum ETF may pave the way in which for different “outdated altcoins,” like Litecoin, which can have a stronger case for not being categorized as securities.

He acknowledged, “When the ETH ETF launches and passes, the query then turns into particularly with the SEC’s observe report versus tokens […] there’s different dinosaur outdated altcoins which you can also make nearly a stronger case [that] they’re not a safety, one which sounds ridiculous however should you assume deeply about it, it’s true – Dogecoin you could possibly in all probability show simpler isn’t a safety than ETH. Why wouldn’t they launch Litecoin, Dogecoin?”

CFTC FILING: COINBASE FILES TO LIST FUTURES FOR $DOGE $LTC $BCH

Is that this a touch for which alts are getting ETFs subsequent?!

Spoke with @zhusu a number of weeks in the past about this actual situation, and the distinctive buying and selling alternatives that include a $DOGE ETF. pic.twitter.com/tlyFgDvUhR

— Luke Martin (@VentureCoinist) March 21, 2024

Including to the momentum, Alan Austin, Managing Director on the Litecoin Basis, expressed enthusiasm concerning the prospects of a spot Litecoin ETF, stating, “I’ll say it once more, love or hate ETFs, the primary firm to launch a Litecoin ETF goes to crush it!”

LTC Worth Is Lagging Behind

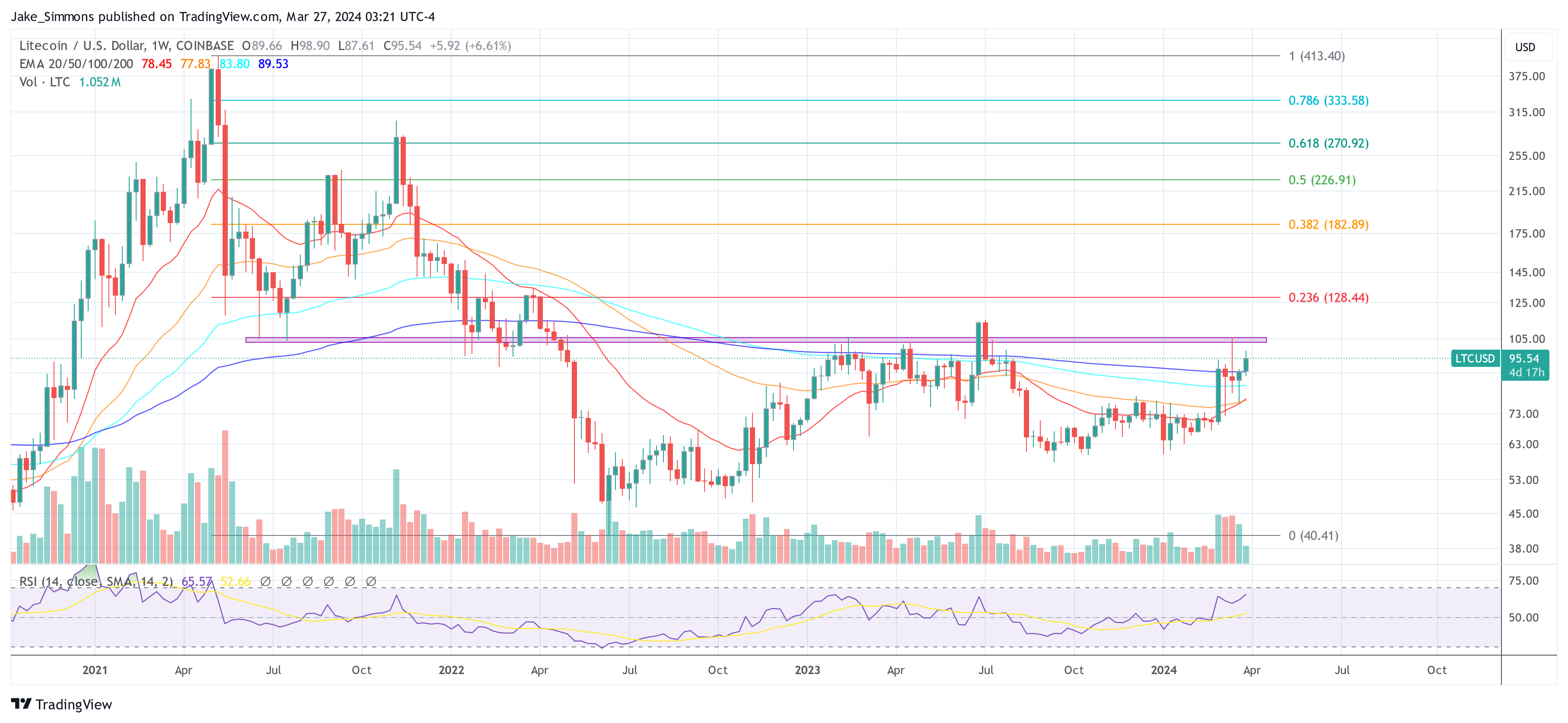

Regardless of the present buzz, Litecoin’s value evaluation signifies that it’s nonetheless down by 77% from it’s all-time excessive in Might 2021, signaling a bearish development compared to different cryptocurrencies which have already surpassed their 2021 peaks. Nonetheless, a latest break above the 200-week EMA has ignited a glimmer of bullish momentum.

Overcoming the purple resistance zone between $102 and $106 could possibly be important for Litecoin to succeed in new heights, with the $128 mark (0.236 Fibonacci retracement stage) as a possible near-term goal.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site completely at your personal danger.