A extensively adopted crypto analyst is warning that Bitcoin (BTC) may pull again additional earlier than subsequent month’s halving occasion when miners’ rewards are minimize in half.

Pseudonymous crypto dealer Rekt Capital tells his 433,000 followers on the social media platform X that Bitcoin has entered a “hazard zone” when traditionally the crypto king has corrected between 20% and 40%.

“It’s been two days since Bitcoin formally entered the ‘hazard zone’ (orange) the place historic pre-halving retraces have begun. Traditionally, Bitcoin has carried out pre-halving retraces 14-28 days earlier than the halving. At present, BTC is roughly 26 days away from the halving and has pulled again nearly -18% in complete since final week.

Whether or not the retrace backside is in already or not is unsure. However what’s clear is that this: Bitcoin has only recently entered its ‘hazard zone’ time window. Technically, there’s nonetheless time for added draw back.”

The dealer says Bitcoin’s value sample is displaying similarities to the 2016 cycle, which may point out a deeper dip forward earlier than the halving occasion.

“In 2016, Bitcoin carried out its pre-halving retrace roughly 28 days earlier than the halving. In 2024, Bitcoin carried out its pre-halving retrace roughly 32 days earlier than the halving. Apparently, when Bitcoin started its 2016 pre-halving retrace, value initially produced an extended draw back wick earlier than retracing additional.

Lately, Bitcoin has additionally produced an extended draw back wick on its pre-halving retrace. Bitcoin might want to proceed to keep up these present highs to keep away from a 2016-like destiny the place the preliminary response was sturdy however short-lived.”

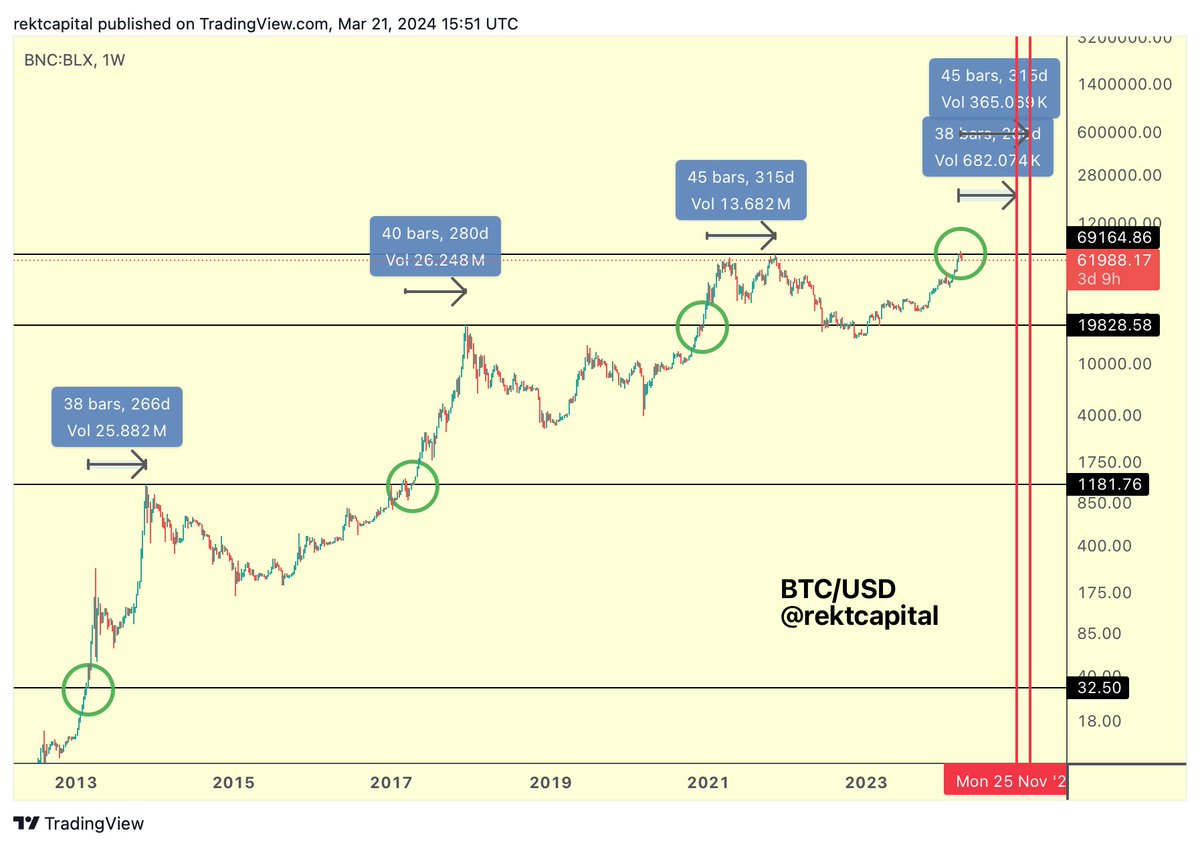

The dealer can be predicting when Bitcoin may attain the height of the present bull market cycle.

“When may Bitcoin peak on this bull market? Bitcoin tends to carry out a bull market high 266-315 days after it breaks its outdated all-time excessive. Bitcoin broke its outdated all-time highs final week. The subsequent bull market peak could thus happen in 266-315 days. That’s very late November 2024 or very late January 2025.”

Nonetheless, the dealer says that traditionally Bitcoin is taking longer to hit peaks every cycle, which may push the height of the present bull market to December 2024 or mid-February 2025.

“Traditionally, the quantity of days that Bitcoin has spent past outdated all-time highs have elevated by roughly 14 days to 35 days…

If we add 14-35 days to the preliminary bull market peak vary of 266-315 days, that might deliver the entire to 280-350 days. This in flip may push the Bitcoin bull market peak to mid-December 2024 or mid-February 2025.”

Bitcoin is buying and selling for $65,410 at time of writing, down greater than 3% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: DALLE3