Former U.S. Treasury Secretary Lawrence Summers says an old-fashioned methodology of monitoring inflation could reveal the actual quantity of financial ache that People have needed to endure.

Summers has co-authored and launched a brand new paper exploring the impact of excessive rates of interest on the American client.

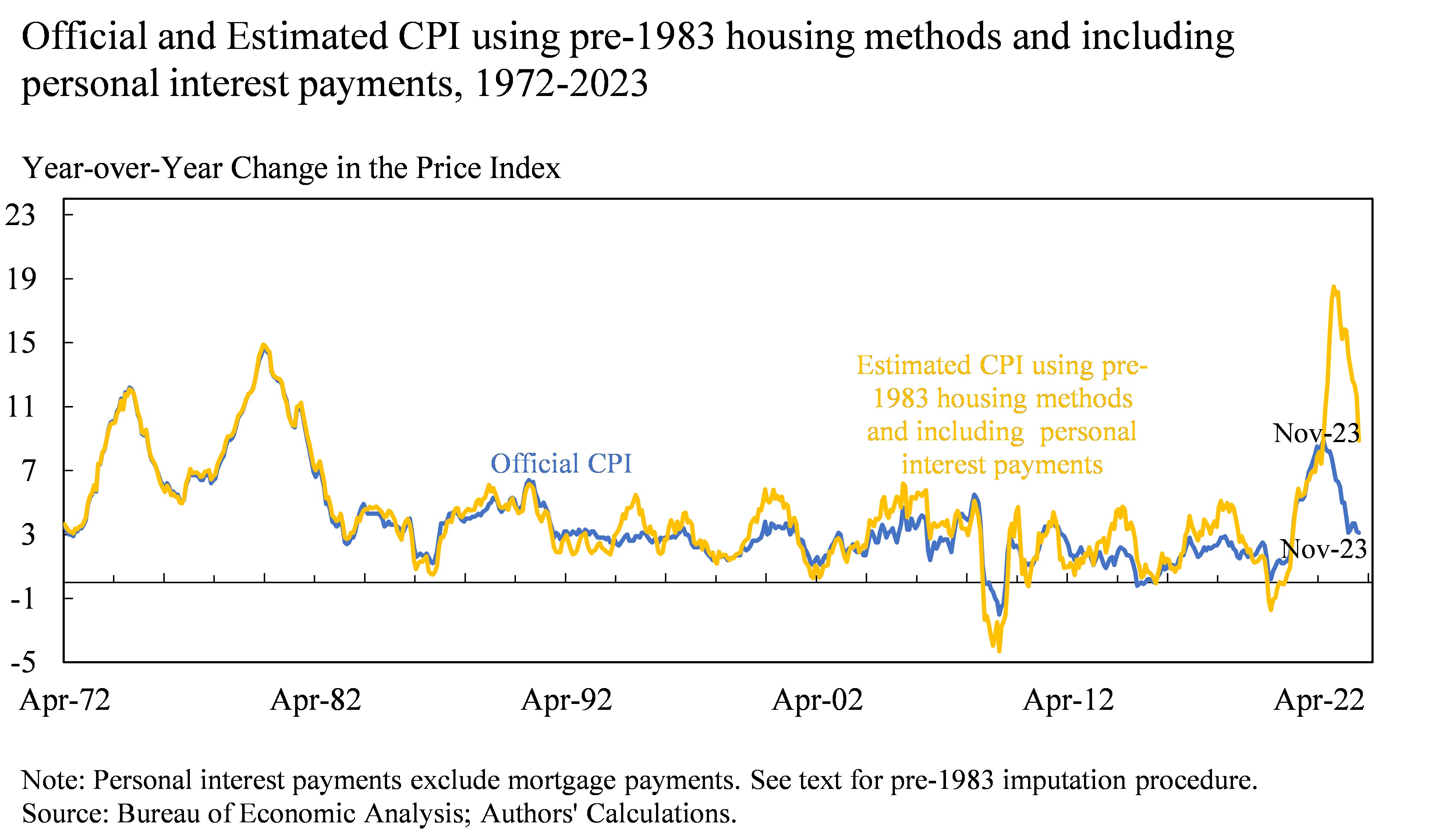

The paper, partially, goals to color an alternate and extra correct view of inflation by incorporating economist Arthur Okun’s pre-1983 system of measuring inflation, which took under consideration private rates of interest and housing financing prices.

After 1983, these metrics have been taken out of the buyer worth index (CPI), which Summers and the authors of the paper argue could also be giving an inaccurate portrayal of inflation within the US.

Utilizing the pre-1983 methodology of measuring inflation, the report says that in November of 2022, CPI spiked by about 18% – opposite to the official 4.1% quantity decided by the federal government.

The brand new numbers paint a darker image of the inflation that People are coping with to today, with the report stating the pre-1983 measure gives a “extra worrying image of inflation within the present second than the official inflation numbers.”

Summers broke down the discrepancy by way of Twitter,

“Pre-1983, mortgage prices have been within the CPI as have been automobile funds pre-1998. Now, worth indexes don’t embody borrowing prices. Thus, when rates of interest jumped final yr, official inflation didn’t absolutely seize the results it could have on client well-being…

We present that if we make an effort to reconstruct the CPI of Okun’s period—which might have had inflation peak final yr round 18%, we’re capable of clarify 70% of the hole in client sentiment we noticed final yr.”

The revelation that inflation was doubtless a lot larger than reported could clarify the discrepancy between the official numbers and the hovering price of on a regular basis bills like groceries and housing.

Summers additionally notes that private curiosity funds, which aren’t integrated into the federal government’s CPI system, elevated by greater than 50% in 2023.

Summers and the co-authors of the paper additionally argue that the upper price of borrowing has created a “deeply felt ache level” for customers by placing the housing market in a “lock-in” state whereby owners are deterred from promoting because of probably larger mortgage funds on their subsequent residence, whereas underwhelming worth drops aren’t engaging new consumers.

“The Federal Reserve’s charge hikes have pushed mortgage charges to two-decade highs whereas home costs have but to return down in the direction of pre-pandemic ranges. The market is in stasis with each owners and would-be consumers reporting excessive ranges of disappointment.”

The paper, titled “The Value of Cash is A part of the Value of Dwelling: New Proof on the Shopper Sentiment Anomaly,” could be learn right here.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney