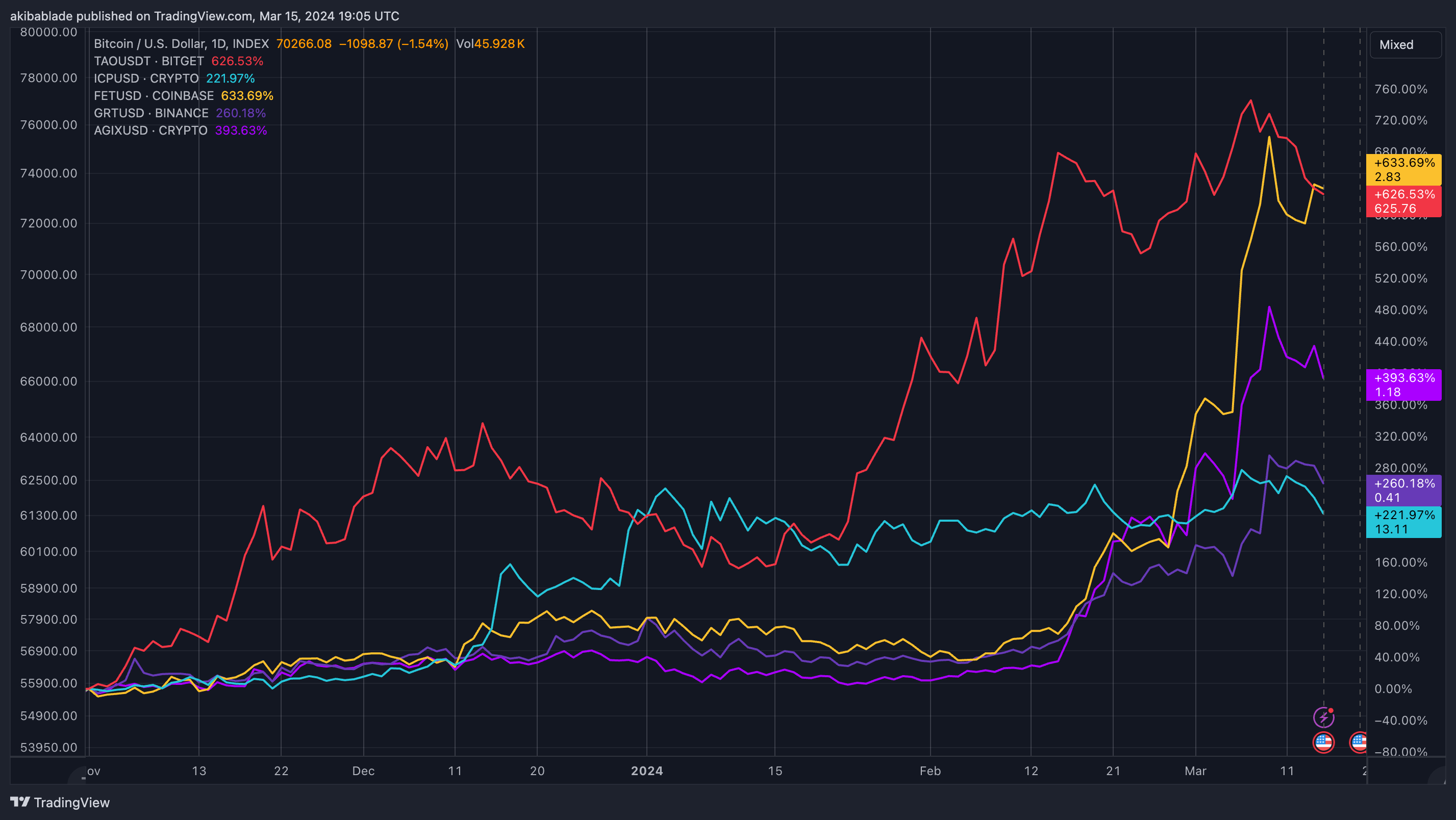

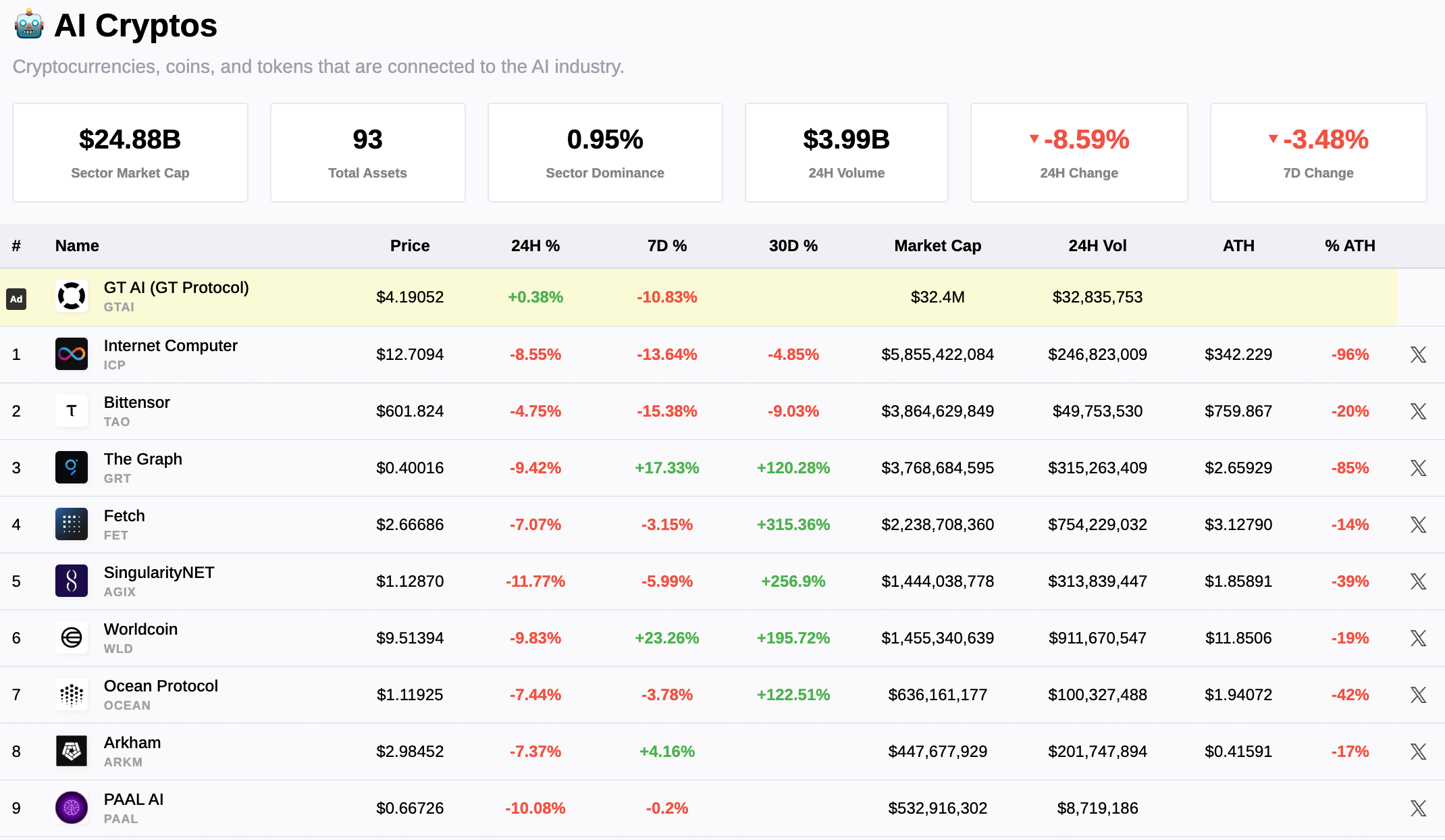

After a face-melting rally within the AI crypto sector over the previous few months, buyers seem to have taken a profit-taking strategy over the previous few days. The sector soared previous $10 billion in mid-February, buoyed by Bittensor’s exceptional climb to a $4 billion market cap with a rise of over 220% in 2024. By March, the sector had exploded to over $25 billion in market cap.

Round March 9, a number of initiatives hit new all-time highs, together with Bittensor, Fetch, OriginTrail, Worldcoin, and Arkham, pushing the market cap near $30 billion.

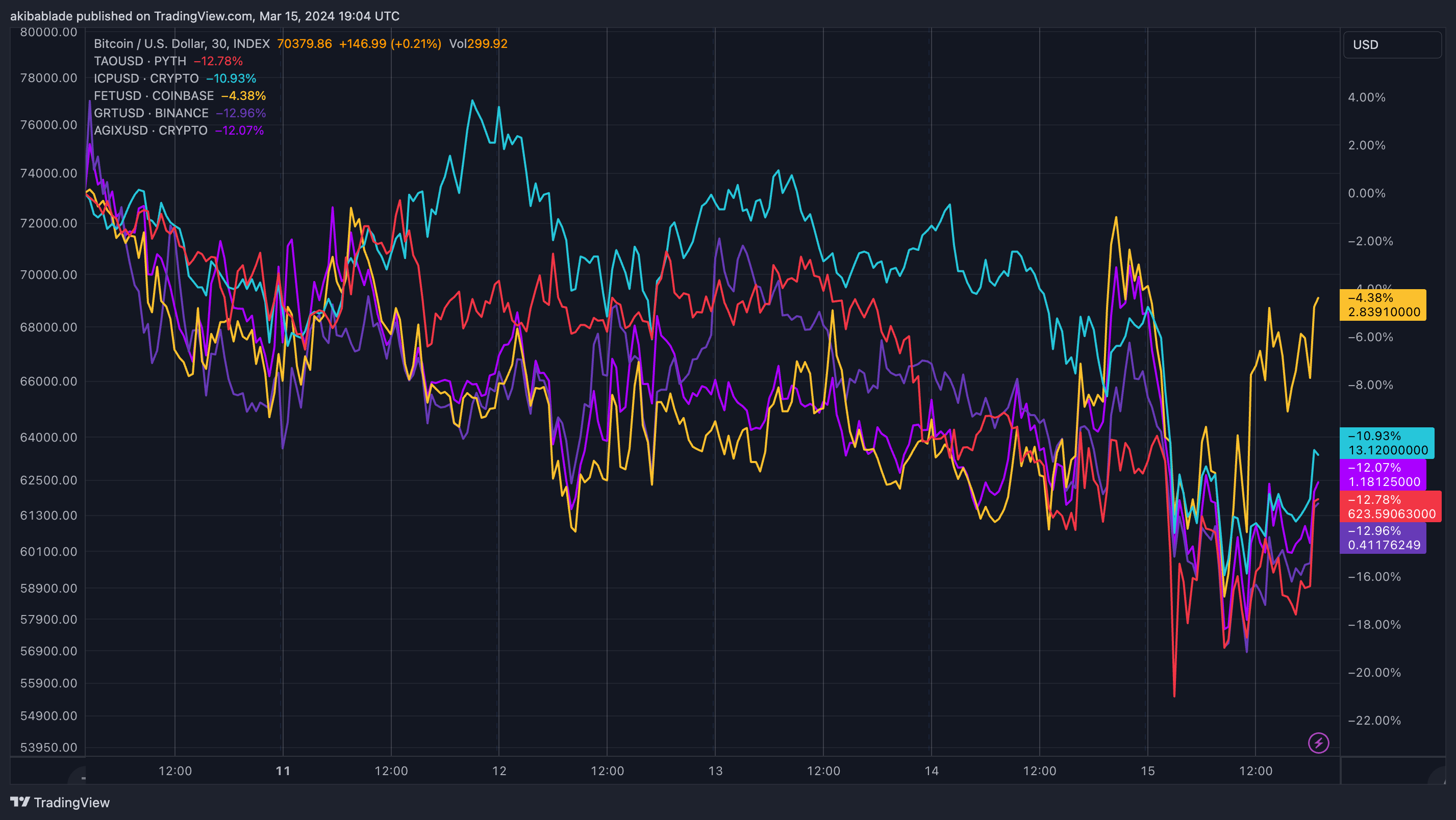

Prior to now few days, the sector has cooled to under $25 billion in market cap as buyers appear to be taking earnings after a doubtlessly overheated market surge. Whereas Bitcoin has additionally dipped, as of press time, it sits simply 6% under its all-time excessive, whereas the highest 10 AI crypto initiatives are principally down over 20%.

Curiously, many AI crypto cash haven’t lately been as carefully correlated with Bitcoin as the remainder of the market. Bittensor and Fetch, particularly have seemingly been treading their very own course, transferring down solely when Bitcoin has made substantial strikes. Even then, the cash typically had a delayed response or moved towards Bitcoin.

Fetch elevated 140% in 4 days since March 6 earlier than barely retracing roughly 20%. Throughout the board, because the sector’s peak on March 9, Fetch is down 4%, ICP is down 11%, The Graph is down 12%, Singularity is down 13%, and Bittensor is down 12.8%.

Whereas the rise of AI in 2023 noticed an inflow of recent AI-related memecoins and hype initiatives, these at present sitting towards the highest of the sector chart are primarily targeted on real-life implementation of decentralized AI tooling. The work has attracted the eye of Ethereum’s Vitalik Buterin, Erik Voorhees, and different notable gamers within the crypto house.

The significance of decentralized AI fashions doubtless aligns with that of decentralized finance because the progress of AI improvement continues to ramp up. Blockchain and tokenization seem stable bedfellows for a distributed AI community, indicating the latest retracement is presumably profit-taking slightly than buyers shedding religion within the burgeoning sector. Nonetheless, with such fast positive factors, it’s also doubtless that buyers shall be wanting to see progress in delivering expertise.

Most of the prime progress have stay mainnets with initiatives actively constructing. The important subsequent step is to see whether or not a community impact can carry customers on chain to have interaction with this fascinating cross-section of AI and blockchain. Bittensor, for one, is undoubtedly seeing demand for adoption as the fee to register considered one of its 32 subnets has risen from round $200,000 to over $5 million this month alone, with the value set by market forces slightly than any centralized entity.