In a current report by market intelligence agency Chainalysis, it has been revealed that world crypto features in 2023 amounted to a staggering $37.6 billion. This revenue surge displays improved asset costs and market sentiment in comparison with 2022.

Though this determine falls in need of the $159.7 billion features witnessed in the course of the 2021 bull market, it signifies a big restoration from the estimated losses of $127.1 billion skilled in 2022.

Sharp Surge In Crypto Good points

The report means that regardless of related development charges in crypto asset costs in 2021 and 2023, the full features for the latter 12 months have been decrease. In keeping with Chainalysis, this discrepancy may doubtlessly be attributed to buyers’ decreased inclination to transform their crypto property into money.

The evaluation additional means that buyers in 2023 appear to have anticipated additional value will increase, as crypto asset costs didn’t exceed earlier all-time highs (ATHs) in the course of the 12 months, not like in 2021.

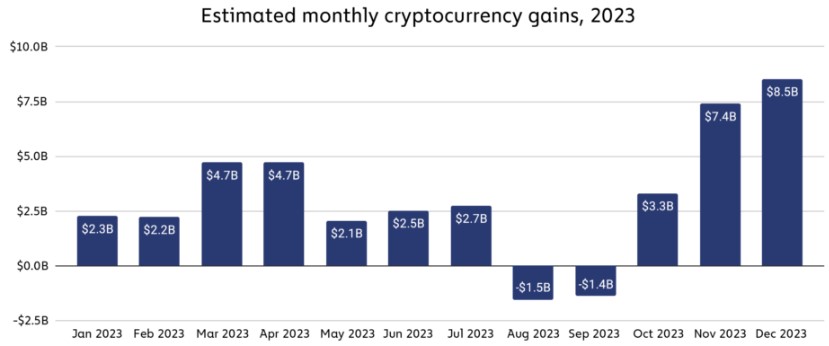

Cryptocurrency features remained comparatively constant all through 2023, besides for 2 consecutive months of losses in August and September, as seen within the picture above. Nonetheless, features surged sharply thereafter, with November and December eclipsing all earlier months.

United States Leads

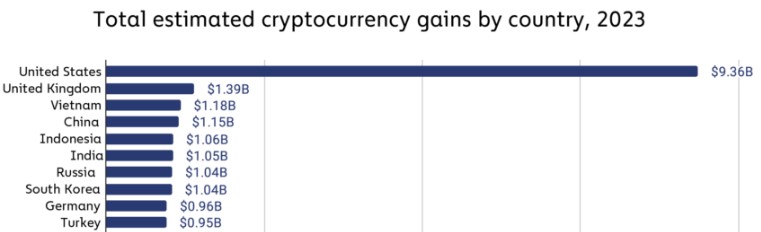

Main the pack in cryptocurrency features was the USA, with an estimated $9.36 billion in earnings in 2023. The UK secured the second place with an estimated $1.39 billion in crypto features.

Notably, a number of higher and lower-middle-income international locations, significantly in Asia, similar to Vietnam, China, Indonesia, and India, achieved vital features, every surpassing $1 billion and rating inside the prime six international locations worldwide.

Chainalysis had beforehand noticed sturdy cryptocurrency adoption in these revenue classes, significantly in “lower-middle-income” international locations, which demonstrated resilience even in the course of the current bear market. The features estimates point out that buyers in these international locations have reaped substantial advantages from embracing the asset class.

Finally, the Chainalysis report means that the constructive traits noticed in 2023 have carried over into 2024, with distinguished cryptocurrencies similar to Bitcoin (BTC) hitting all-time highs of $73,700 following the approval of Bitcoin exchange-traded funds (ETFs) and elevated institutional adoption.

If these traits persist, the agency believes that it’s conceivable that features in 2024 will align extra carefully with these witnessed in 2021.

As of this writing, the full crypto market cap valuation stands at $2.5 trillion, a pointy drop of over 4% within the final 24 hours alone, and down from Thursday’s two-year excessive of $2.7 trillion. Bitcoin, then again, is buying and selling at $68,400 after dropping as little as $65,500 however has shortly regained its present buying and selling value, limiting losses to 4% over the previous 24 hours.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site totally at your personal danger.