Up to now month cryptocurrency has made a critical leap and it appears that evidently it’s nonetheless reaching for brand spanking new heights. With this crypto development, although no development lasts without end, crypto buying and selling is changing into increasingly more standard. In the present day we’re going to study extra about buying and selling CFDs on cryptocurrencies on the IQ Choice platform.

What’s Crypto?

Evidently everybody is aware of the names of massive cryptocurrencies – Bitcoin, Etherium, Ripple, Litecoin and so forth. Many merchants have already had some expertise buying and selling these currencies, and even buying them to carry on a long-term foundation. However what’s a cryptocurrency and what’s the purpose for his or her fall or rise in worth?

Cryptos are digital currencies, which signifies that they don’t have a bodily type like paper cash. One principal characteristic that the majority cryptocurrencies have is that they aren’t issued by a government, which, theoretically, makes them resistant to any manipulation or authorities interference. Many cryptocurrencies are primarily based on the blockchain know-how the place the safety of transactions is ensured by confirmations. As cryptocurrencies get accepted as a cost methodology, their recognition as a safe, nameless and decentralized foreign money grows.

Cryptocurrency phrases

As in any space, crypto buying and selling has its personal necessary guidelines and lots of phrases that merchants should know to be able to comply with the market and perceive the situations properly. Listed here are among the mostly used phrases:

Order – an order positioned on the change to buy or promote the cryptocurrency

Fiat – common cash, issued and supported by a state (like for instance USD, EUR, GBP and so forth)

Mining – processing and decrypting crypto transactions, with the aim of getting new cryptocurrency

HODL – a misspelling of “maintain” that caught round with the that means of buying cryptocurrency with the intention to maintain it for a very long time, with the expectation of the value rising

Satoshi – 0,00000001 BTC – the smallest a part of a BTC, it may be in comparison with a cent in USD

Bulls – merchants who consider that the value will rise and like to purchase at low worth to promote at the next worth later

Bears – merchants who consider the asset worth will lower and should presumably profit from the asset worth taking place.

The right way to commerce CFDs on Crypto with IQ Choice?

Cryptocurrencies on IQ Choice are supplied as CFD-based buying and selling. It signifies that when merchants open offers, they make a prediction relating to the change within the worth of the asset. Merchants might speculate on the adjustments in worth, nonetheless, they don’t personal the crypto coin itself.

Here’s a step-by-step rationalization of CFD crypto buying and selling on the IQ Choice platform:

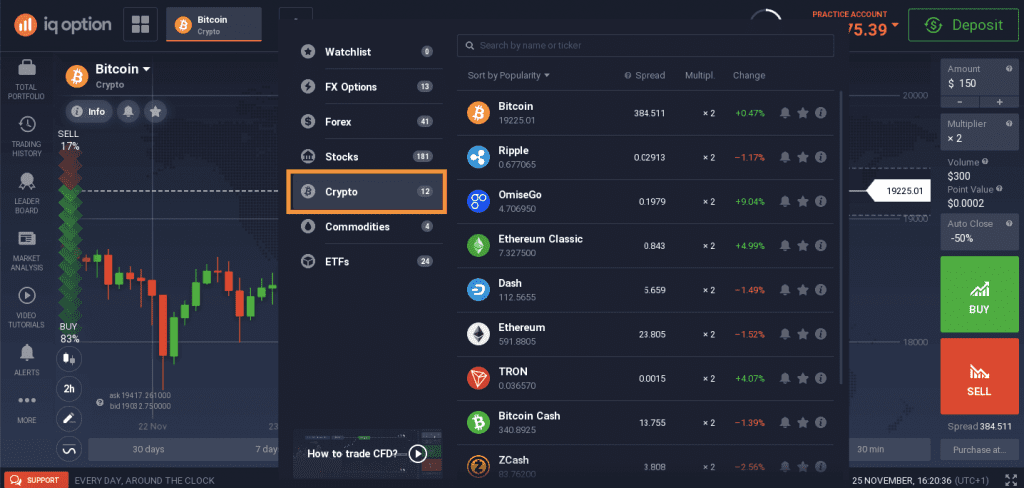

1. To start buying and selling on cryptocurrencies, you could open the traderoom and click on the plus signal on the prime to seek out the asset checklist

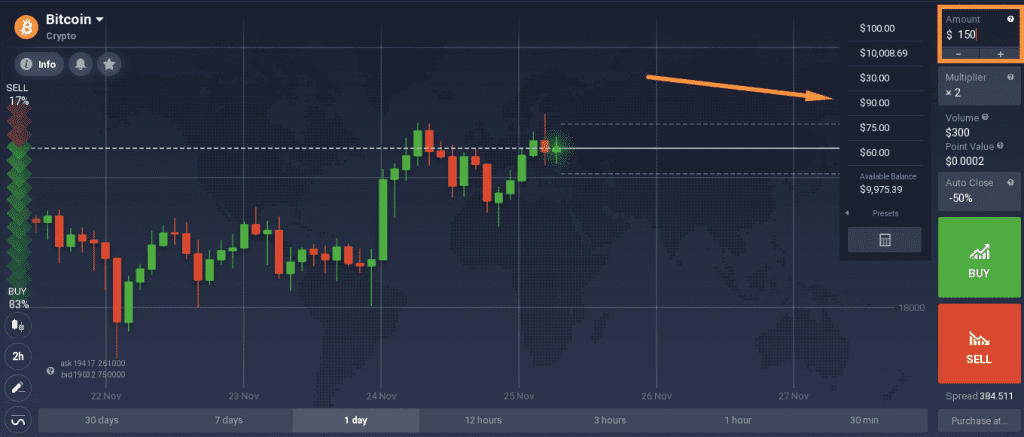

2. Discover the cryptocurrency that you’re inquisitive about and select the quantity that you simply want to put money into a deal

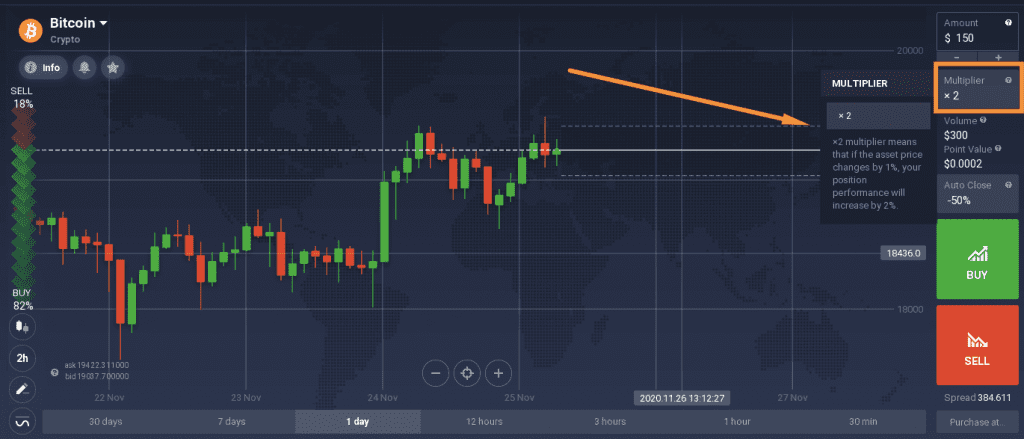

3. Observe that cryptocurrencies are traded with a multiplier.

The multiplier is an analogue of ordinary leverage. It supplies you with the potential of greater end result, though it will increase the potential threat of loss.

Primarily based in your funding and the chosen multiplier, you will notice the full buying and selling quantity of your deal. The buying and selling quantity is the quantity which the result of the deal will depend upon.

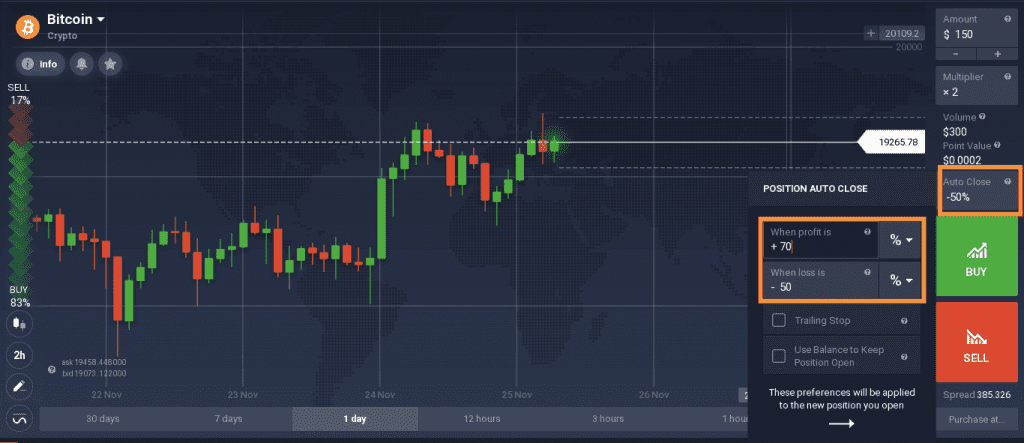

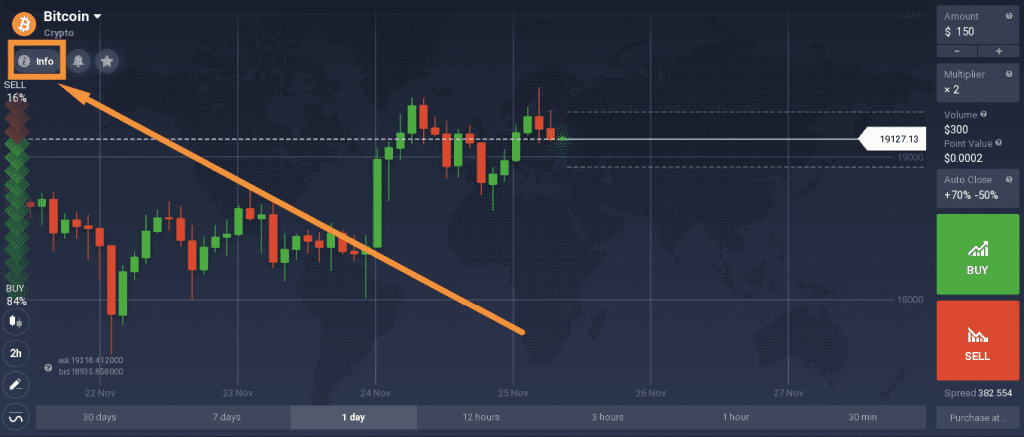

4. The final step earlier than opening a deal is to set autoclose ranges to be able to regulate the deal to your most well-liked threat administration strategy

Observe {that a} cease loss degree of fifty% is ready to all offers routinely. It’s potential to scale back this degree (as an example, set it at 30%).

If a dealer needs to extend the extent, they could make the most of their stability funds to be able to preserve the deal open longer, even after the extent of -50% is reached. A trailing cease loss might also be used to be able to safe sure outcomes in case of a constructive worth change.

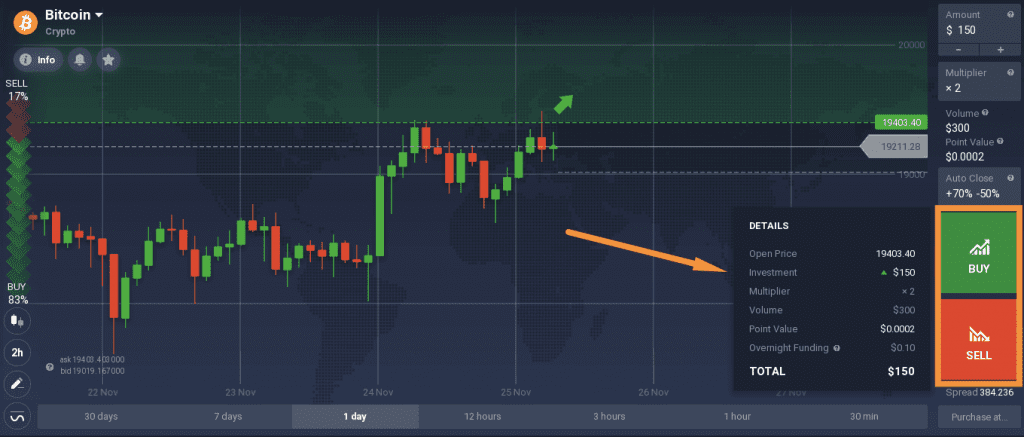

5. To open a deal, a dealer might want to click on the Purchase or Promote button, relying on the anticipated worth change: up or down respectively

When a dealer clicks one of many buttons, the main points of the deal they’re about to open can be found: the open worth, funding, multiplier, quantity, level worth in addition to the in a single day fees. This fashion it’s potential to double verify all the data earlier than confirming the deal.

Market evaluation

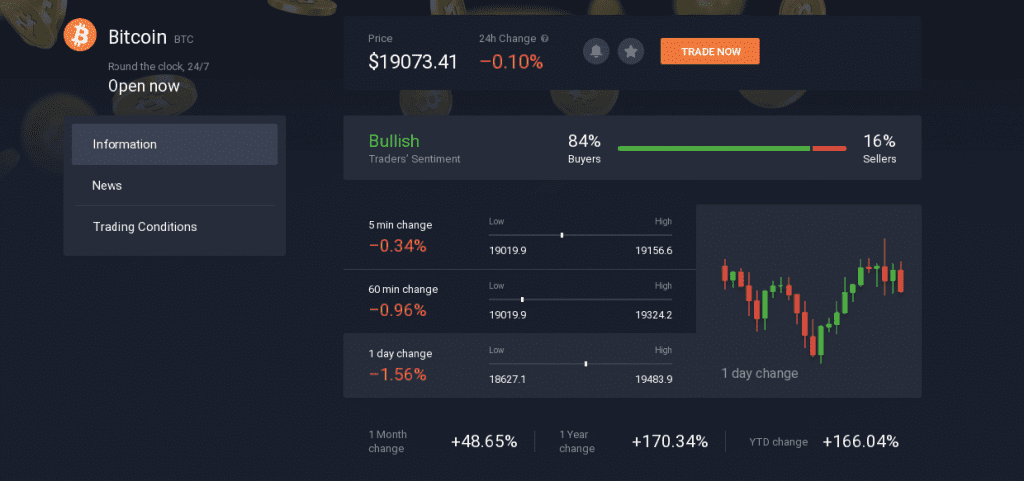

To decide relating to shopping for or promoting of the cryptocurrency, merchants might use technical indicators supplied on the platform, or try the “Information” part accessible for each asset within the traderoom.

This part shows the details about the present development tendency (bearish or bullish), the abstract of indicators’ alerts and much more helpful data that might help a dealer in making a well-informed resolution.

You may additionally discover the newest and most related updates in regards to the asset within the “Information” part. Although this part can not exchange a dealer’s personal evaluation, it could assist with forming a full image of how the asset and the business is doing.