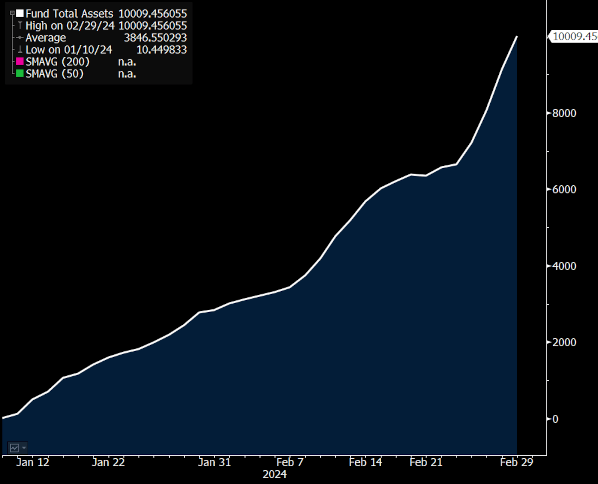

BlackRock’s iShares Bitcoin Belief (IBIT) now has greater than $10 billion in property below administration (AUM), based on knowledge from CoinGlass.

Bloomberg ETF analyst Eric Balchunas famous that IBIT is one in all simply 152 exchange-traded funds (ETFs) which have reached the $10 billion mark. Presently, roughly 3,400 ETFs exist in whole.

He noticed that IBIT is the quickest to succeed in $10 billion in AUM. The fund started buying and selling lower than two months in the past on Jan. 11, that means that it reached its present stage in lower than two months. ETF.com individually famous that the primary gold ETF didn’t attain $10 billion in AUM for 2 years.

The competing Grayscale Bitcoin Belief (GBTC) stories a bigger AUM, with $27 billion in property below administration. Nevertheless, GBTC originated as an funding fund in 2013 earlier than it was transformed to an ETF this 12 months, and in contrast to BlackRock’s IBIT, it didn’t begin with zero property.

The third largest spot Bitcoin ETF, the Constancy Clever Origin Bitcoin Fund (FBTC), now holds $6.5 billion in property below administration. All ten current spot Bitcoin ETFs have $48.2 billion in AUM mixed.

Causes for IBIT’s development

Balchunas implied that IBIT’s rising AUM is because of inflows. He recommended that ETFs usually wrestle to attain the primary $10 billion in AUM as a result of that worth should originate from inflows, whereas the second $10 billion is simpler to attain due to market appreciation.

IBIT surpassed the $10 billion mark on March 1. Round that point, the ETF reported $7.7 billion in inflows since launch, together with $603 million in inflows on Feb. 29. In accordance with Balchunas, this makes IBIT the ETF with the third-longest run of inflows.

Rising Bitcoin costs could also be a further contributor to IBIT’s development. As of March 4, Bitcoin is price $67,200. Its worth is up 25.3% over the previous week and up 51.0% over two months.

Moreover, sure monetary establishments, together with Financial institution of America’s Merrill Lynch and Wells Fargo, have reportedly begun to supply entry to BlackRock’s Bitcoin ETF and competing exchange-traded funds. This improvement could have contributed to current development.