Fast Take

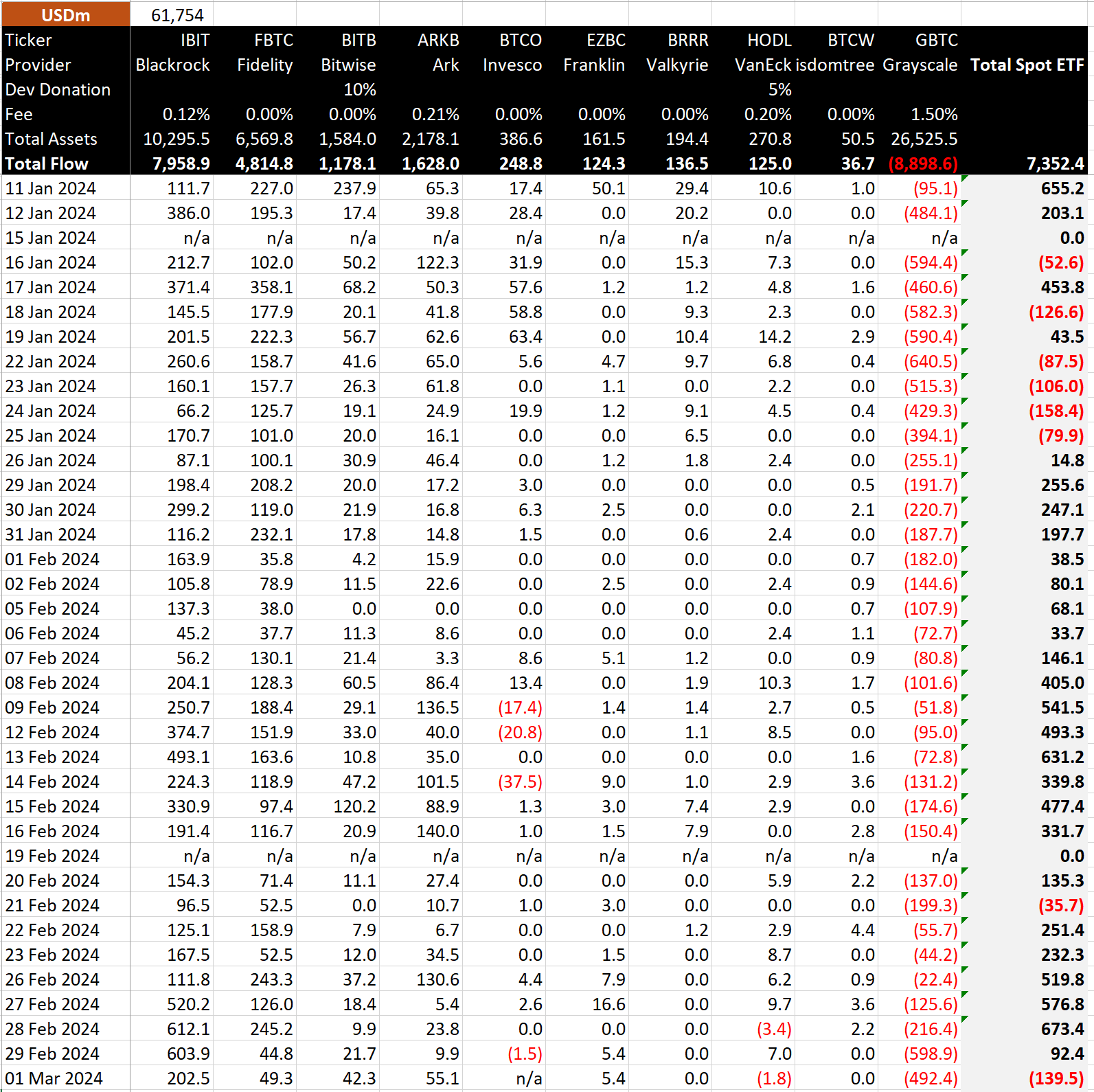

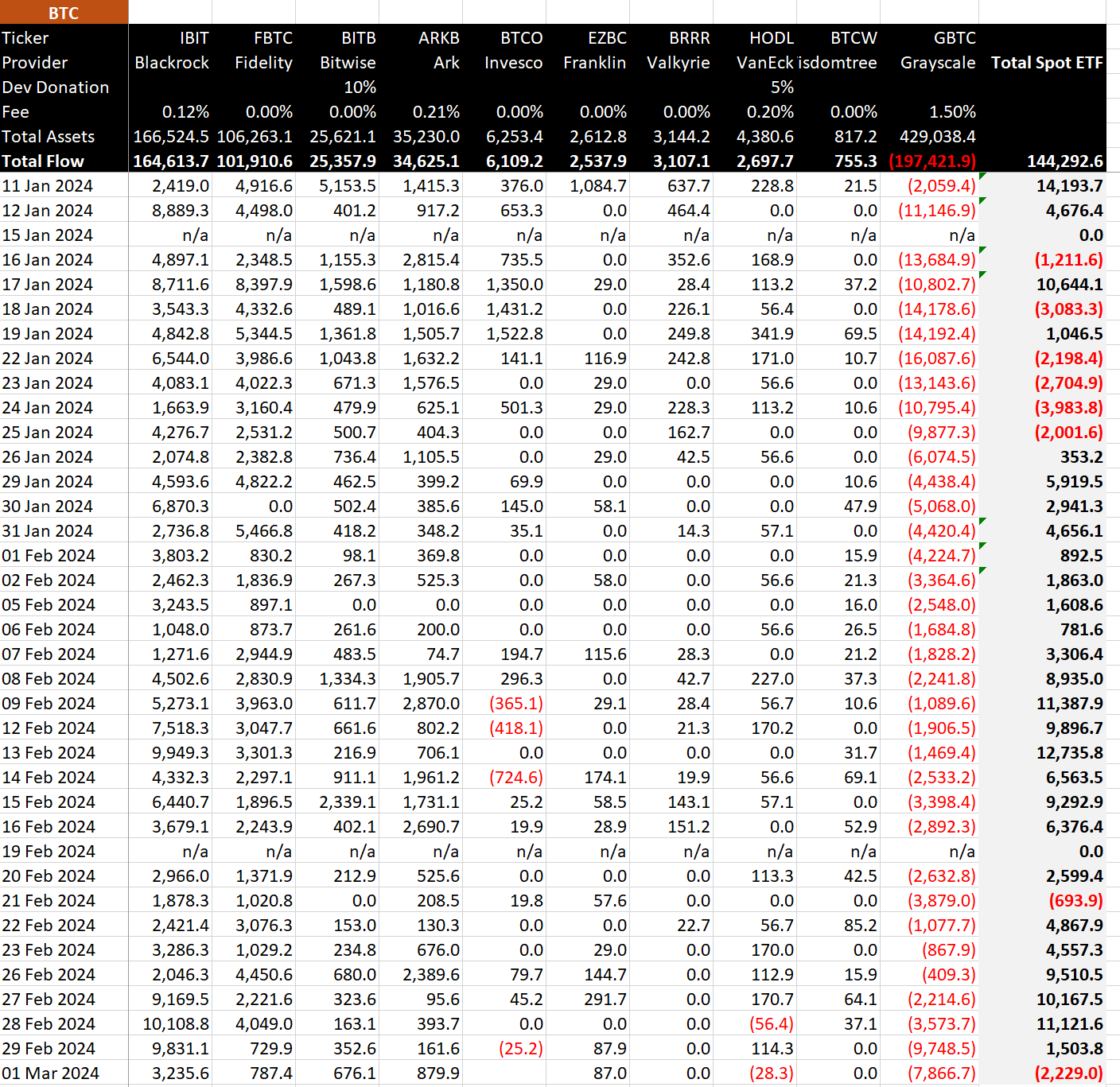

Information from BitMEX exhibits March started with the primary whole outflow since Feb. 21. The day noticed an outflow of $140 million, considerably impacted by a large $492 million outflow from the Grayscale Bitcoin Belief (GBTC), marking one of many largest single-day outflows.

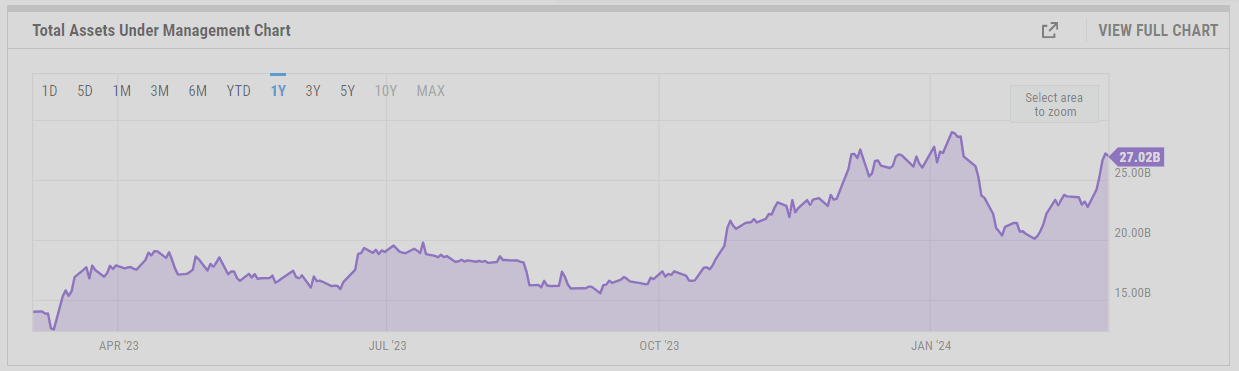

In keeping with BitMEX information, the Grayscale Bitcoin Belief (GBTC) has skilled outflows totaling $8.9 billion. Regardless of this vital outflow, the belongings underneath administration (AUM) of GBTC solely decreased by $1.6 billion, shifting from $28.6 billion to $27 billion, as reported by ycharts.

This comparatively small lower in AUM, within the face of enormous outflows, might be attributed to the rise in Bitcoin’s value, which rose from $49,000 to $65,000 because the ETF was launched on Jan. 11.

Regardless of these outflows, GBTC maintains a robust market presence with a 55% share, although down from 100% two months in the past, as famous by ETF Retailer President Nate Geraci.

Moreover, GBTC’s annual price income stands at a major $398 million, dwarfing the $53 million from the 9 new ETFs, not together with price waivers, in accordance with Geraci.

In the meantime, BlackRock’s IBIT noticed a lot quieter inflows of $203 million on Mar. 1, following consecutive record-breaking days. These inflows have taken their whole internet influx to $8 billion, roughly equal to holding 165,000 Bitcoin, in accordance with BitMEX.

BitMEX has famous that Invesco Galaxy Bitcoin ETF (BTCO) has not disclosed its information for Mar. 1.

The put up GBTC AUM sees modest $1.6 billion drop post-ETF launch, regardless of main outflows appeared first on CryptoSlate.