Open curiosity, the full variety of excellent by-product contracts that haven’t been settled, is a crucial metric for gauging market well being and sentiment. A rise in open curiosity means new cash coming into the market, exhibiting heightened buying and selling exercise and curiosity in Bitcoin. Conversely, a decline suggests closing positions, doubtlessly indicating a change in market sentiment or a consolidation section. Monitoring these traits is necessary for understanding the liquidity, volatility, and future worth expectations out there.

In a bullish market, a rise in open curiosity usually correlates with rising costs, suggesting that new cash is betting on additional worth appreciation. This situation usually displays a robust market sentiment and investor confidence in Bitcoin’s upward trajectory. However, in a bearish context, rising open curiosity would possibly point out that buyers are hedging towards anticipated worth declines, revealing a extra cautious or adverse market outlook.

Moreover, the steadiness between name and put choices throughout the open curiosity gives deeper insights into market sentiment. A predominance of calls suggests a bullish market sentiment, with many buyers anticipating worth rises, whereas a majority of places can point out bearish expectations.

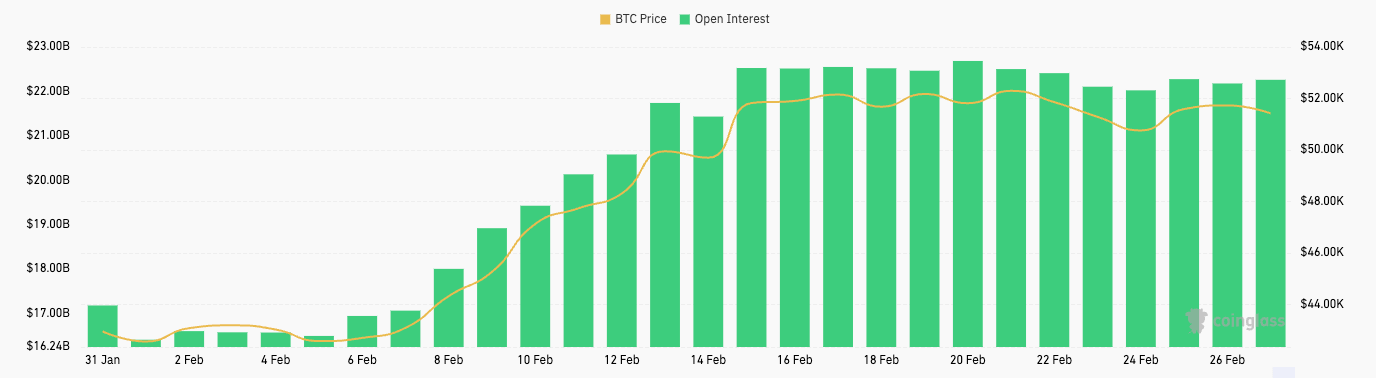

February noticed a major enhance in open curiosity for Bitcoin futures and choices.

From Feb. 1 to Feb. 20, Bitcoin futures open curiosity grew from $16.41 billion to $22.69 billion. This substantial rise means that merchants had been more and more coming into into futures contracts, anticipating increased volatility or making directional bets on Bitcoin’s worth. Curiously, this era aligns with a notable enhance in Bitcoin’s worth, from $42,560 to $52,303, suggesting a bullish sentiment amongst futures merchants. The slight lower in open curiosity by Feb.26 to $22.21 billion, alongside a marginal dip in Bitcoin’s worth to $51,716, may point out some merchants taking income or closing positions in anticipation of a consolidation section or to scale back publicity forward of potential volatility.

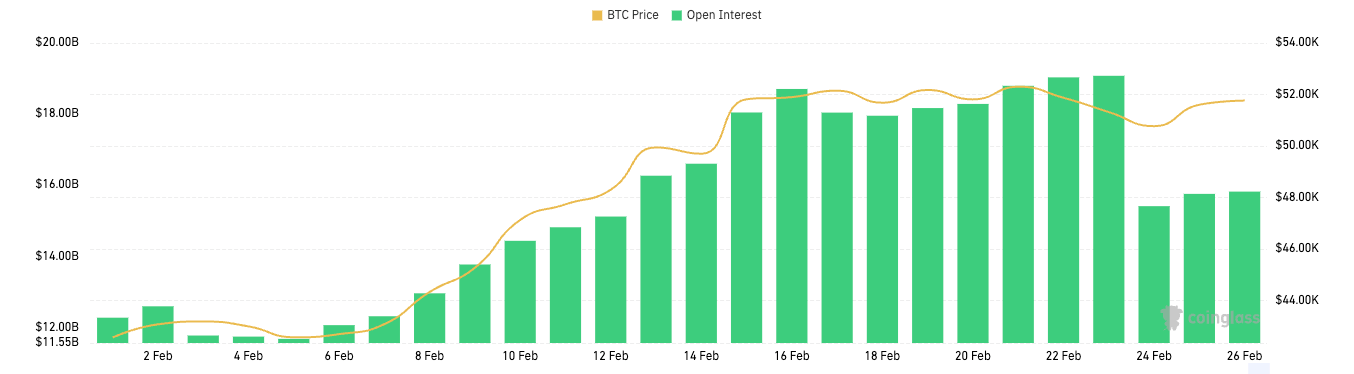

Equally, Bitcoin choices open curiosity noticed a dramatic enhance from $12.27 billion firstly of February to a peak of $19.08 billion by Feb.23 earlier than dialing again to $15.82 billion in direction of the month’s finish. Choices present the holder the correct, however not the duty, to purchase (name choice) or promote (put choice) Bitcoin at a specified worth, providing extra advanced methods for merchants to specific bullish or bearish views or to hedge present positions. The preliminary spike in choices open curiosity displays a strong engagement from buyers, leveraging choices for directional bets on Bitcoin’s worth and protecting measures towards potential downturns.

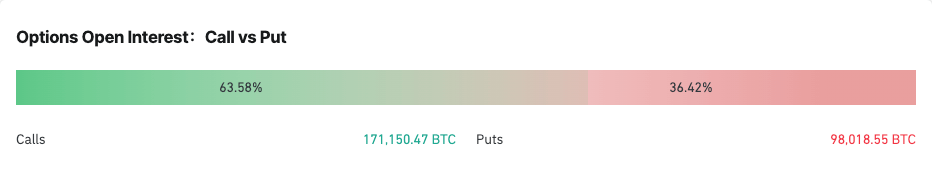

The ratio between calls and places for Bitcoin choices gives a deeper perception into market sentiment and potential expectations for Bitcoin’s worth course. The distribution between calls and places is a direct indicator of the market’s bullish or bearish inclinations, with calls representing bets on rising costs and places on falling costs.

As of Feb. 26, the open curiosity in Bitcoin choices was skewed in direction of calls, comprising 63.76% of the full, in comparison with 36.24% for places. This distribution reinforces the bullish sentiment noticed by the rise in choices open curiosity earlier within the month. A predominance of calls within the open curiosity means that a good portion of market members had been anticipating Bitcoin’s worth to proceed rising or had been using calls to hedge towards different positions.

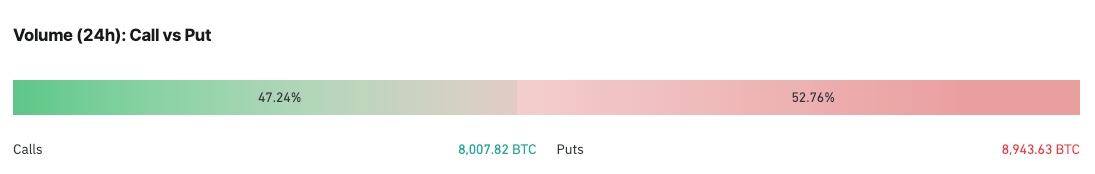

Nevertheless, the 24-hour quantity tells a barely totally different story, with calls accounting for 47.24% and places for 52.76%. In comparison with the general open curiosity, this shift in direction of places within the each day buying and selling quantity would possibly point out a short-term enhance in warning amongst merchants. It means that throughout the final 24 hours, there was a noticeable pick-up in defensive methods or bearish bets.

The rapid implication for Bitcoin’s worth is a possible enhance in volatility. The bullish sentiment, as evidenced by the rising open curiosity and excessive proportion of calls, helps a continued constructive outlook amongst many market members. Nevertheless, the latest uptick in places quantity might sign upcoming worth fluctuations as merchants alter their positions in anticipation of or in response to new info or market traits.

Contemplating these, the market seems to be at a crossroads, with a robust bullish sentiment tempered by short-term warning. This situation usually precedes intervals of heightened volatility as conflicting expectations play out by buying and selling actions.