The most recent US inflation information considerably impacted the Bitcoin worth and many of the cryptocurrency market, with some exceptions. In response to a report from the Labor Division, inflation rose greater than anticipated in January, pushed by greater shelter costs.

Moreover, the buyer worth index (CPI), which measures the costs shoppers face for items and companies throughout the economic system, noticed a 0.3% improve for the month. On a 12-month foundation, the CPI stood at 3.1%, barely decrease than December’s 3.4%.

Bitcoin Worth Retreats Amid Greater-Than-Anticipated CPI Figures

In response to latest stories, the higher-than-expected CPI figures may pose challenges for the Federal Reserve (Fed), as officers anticipate inflation to recede and attain their 2% annual goal. The central financial institution goals to regulate financial coverage, which has been tight over twenty years.

Nevertheless, the January improve in inflation could delay the Fed’s plans to ease charges, as it would require extra information earlier than initiating a rate-cutting cycle. This consequence disillusioned those that anticipated inflation to lower and prompted a reassessment of the timing for potential charge changes.

On this matter, market intelligence platform Santiment reported that the three.1% CPI consequence prompted market cap losses in cryptocurrency and equities markets. The Bitcoin worth, which had breached the $50,000 mark for the primary time in over two years, has fallen beneath $49,000 in response.

In response to the crypto platform’s evaluation, this gentle retrace will possible polarize crowd sentiment, probably resulting in important panic gross sales. In such a state of affairs, the justification for dip shopping for turns into extra viable, however sentiment could flip detrimental.

Bitcoin’s Market Cycle Patterns

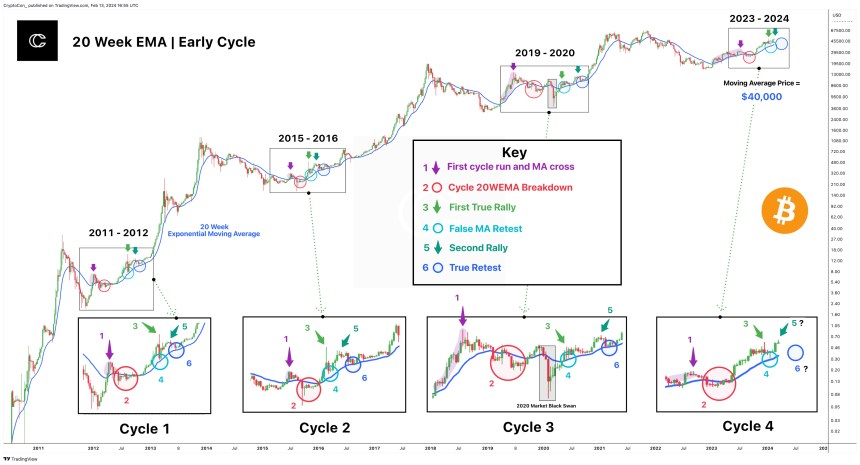

Market skilled Crypto Con has recognized a putting sample in Bitcoin’s market cycles, particularly regarding the 20 Week Exponential Shifting Common (EMA). Regardless of mounting considerations concerning inflation information, the evaluation means that the Bitcoin worth habits tends to observe a constant six-step sample, with important implications for assist and potential correction ranges.

In response to Crypto Con’s evaluation, Bitcoin’s worth motion in every market cycle has adhered to the same sample involving the 20-week EMA. The sample unfolds as follows:

First, as seen within the chart beneath, the Bitcoin worth breaks above the shifting common, marking the start of a brand new cycle and a notable uptrend. Nevertheless, after the completion of the preliminary run, the value retraces and falls beneath the shifting common, signaling a brief shift in sentiment.

Regardless of the short-term setback, Bitcoin’s worth then breaks above the shifting common as soon as extra, indicating the beginning of a real rally and resumption of the upward pattern. At this stage, worth motion creates a false retest of assist, narrowly lacking the shifting common as a vital assist degree. This false retest is a standard incidence in Bitcoin’s market cycles.

Following the false retest, Bitcoin embarks on a second run, representing an additional development available in the market cycle. Bitcoin’s worth is at present positioned throughout this part.

In response to the evaluation made by Crypto Con, the complete correction in Bitcoin’s worth could not have to be as deep, because the shifting common at present sits at roughly $40,000.

In the end, the evaluation’s suggestion that the Bitcoin worth could not dip beneath the $40,000 degree through the ongoing bull run, even within the face of anticipated corrections, is especially encouraging for bullish traders.

Bitcoin is buying and selling at 48,600, down 3% within the final 24 hours.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site totally at your individual danger.