The on-chain analytics agency Santiment has revealed that over 85% of all altcoins within the sector are at the moment within the historic “alternative zone.”

MVRV Would Counsel Most Altcoins Are Prepared For A Bounce

In a brand new submit on X, Santiment mentioned how the altcoin market seems to be based mostly on their MVRV ratio mannequin. The “Market Worth to Realized Worth (MVRV) ratio” is a well-liked on-chain indicator that compares the market cap of Bitcoin towards its realized cap.

The market cap right here is the same old whole valuation of the asset’s circulating provide based mostly on the present spot worth. On the identical time, the latter is an on-chain capitalization mannequin that calculates the asset’s worth by assuming the “true” worth of any coin in circulation is the final worth at which it’s transferred on the blockchain.

Provided that the final transaction of any coin would have doubtless been the final time it modified fingers, the value at its time would act as its present value foundation. As such, the realized cap primarily sums up the associated fee foundation of each token within the circulating provide.

Subsequently, one option to view the mannequin is as a measure of the full quantity of capital the traders have put into the asset. In distinction, the market cap measures the worth holders are carrying.

Because the MVRV ratio compares these two fashions, its worth can inform whether or not Bitcoin traders maintain kind of than their whole preliminary funding.

Traditionally, when traders have been in excessive earnings, tops have turn into possible to kind, as the danger of profit-taking can spike in such durations. However, a dominance of losses might result in backside formations as promoting stress runs out available in the market.

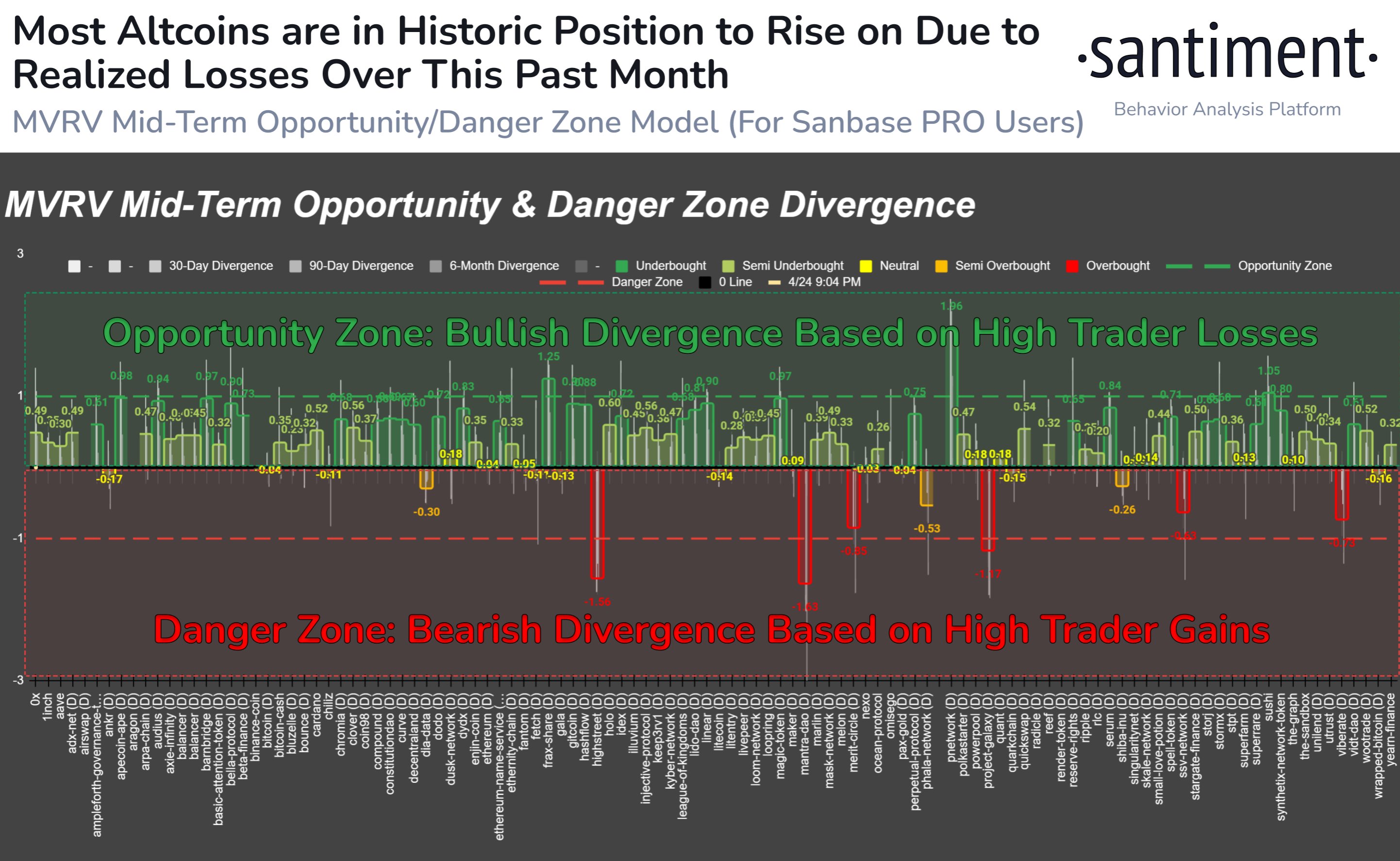

Based mostly on these info, Santiment has outlined an “alternative” and “hazard” zone mannequin for altcoins. The chart beneath exhibits how the market at the moment seems to be from the angle of this MVRV mannequin.

The info for the MVRV divergence for the varied altcoins | Supply: Santiment on X

Underneath this mannequin, when the MVRV divergence for any asset on some timeframe is larger than 1, the coin is taken into account to be contained in the bullish alternative zone. Equally, whether it is lower than -1, it suggests it’s within the bearish hazard zone.

The chart exhibits that MVRV divergence for a big a part of the market is within the alternative zone proper now. Because the analytics agency explains,

Over 85% of belongings we observe are in a historic alternative zone when calculating the market worth to realized worth (MVRV) of wallets’ collective returns over 1-month, 3-month, and 6-month cycles.

Thus, if the mannequin is to go by, now would be the time to go round altcoin procuring.

ETH Value

Ethereum, the biggest among the many altcoins, has noticed a 3% surge over the previous week, which has taken its worth to $3,150.

Appears like the value of the asset has gone up over the previous couple of days | Supply: ETHUSD on TradingView

Featured picture from Shutterstock.com, Santiment.internet, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site completely at your personal danger.