On-chain information exhibits the share of the PEPE traders at present within the inexperienced has fallen to 69% after the 26% plunge the memecoin has seen up to now week.

69% Of All PEPE Addresses Are Carrying Some Positive factors Proper Now

In a brand new submit on X, the market intelligence platform IntoTheBlock has posted an replace on how the investor profitability is searching for the memecoin PEPE at present.

The analytics agency’s metric gauges whether or not a holder is in revenue or not by reviewing their tackle’s on-chain historical past. Based mostly on when the pockets acquired the cash, the indicator calculates the investor’s common value foundation utilizing the spot worth of the asset on the time of these purchases.

If the present spot worth of the cryptocurrency is greater than this common value foundation for any tackle, then that individual investor is carrying web positive factors at present. IntoTheBlock categorizes such addresses to be “within the cash.”

Equally, traders with a value foundation greater than the most recent worth are thought of “out of the cash.” Naturally, the 2 values being precisely equal would recommend the holder is simply breaking even on their funding or is “on the cash.”

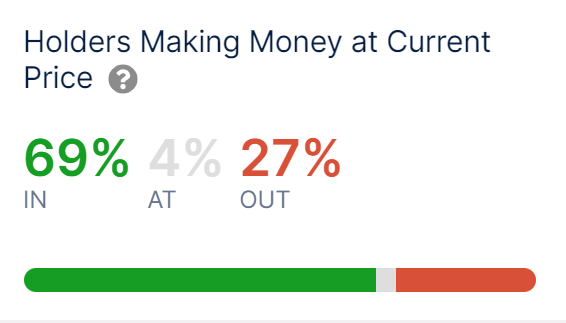

Now, right here is the information shared by the analytics agency that exhibits how this investor breakdown appears like for PEPE in the mean time:

The profit-loss standing of the traders proudly owning the memecoin | Supply: IntoTheBlock on X

As is seen above, 69% of the full addresses holding PEPE have their value foundation greater than the present spot worth of the coin, whereas 27% are in losses. 4% of the traders are sitting on their value foundation proper now.

This profitability ratio isn’t that prime, as, for instance, 89% of Bitcoin traders are at present in revenue, based on IntoTheBlock information. The explanation behind the decrease earnings for the memecoin is that its worth has seen a steep drawdown not too long ago.

Traditionally, the addresses within the inexperienced have been extra more likely to promote to reap their positive factors. As such, when the market profit-loss steadiness is overwhelmingly in direction of earnings, a mass selloff can happen.

Naturally, this implies the probabilities of a high being hit improve with rising investor earnings. Nonetheless, a low share of traders being in earnings may be conducive to bottoms forming, as profit-selling exhausts at these ranges.

At current, PEPE is neither dominated by inexperienced traders nor pink ones. In bull runs, nonetheless, profitability ranges usually stay greater, so any cooldown can assist costs rebound.

Thus, the truth that investor profitability has returned to the 69% degree for the memecoin might be an indication {that a} backside is shut if the bullish regime has to proceed.

PEPE Worth

PEPE has returned to the $0.0000050913 mark after having declined greater than 26% over the past seven days. The chart beneath exhibits the memecoin’s efficiency over the previous month.

Appears like the value of the coin has witnessed a steep decline over the previous couple of days | Supply: PEPEUSD on TradingView

Featured picture from Shutterstock.com, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site solely at your personal danger.