As increasingly more traders select to maintain their Ethereum property frozen quite than actively promoting them, the Ethereum ecosystem all of the sudden finds itself severely wanting provides. The second-largest cryptocurrency on the planet might face severe challenges going ahead relying on the deliberate habits of market gamers.

Associated Studying

Ethereum Provide Tightens Up

The primary signal of this provide hole got here earlier this month when an unknown market participant moved a staggering 6,400 Ethereum to the Beacon Chain depositor pockets. The Beacon Chain, which checks not too long ago added blocks to the community, is the premise of Ethereum 2.0 This large motion means that traders is perhaps inclined to lock down their ETH holdings as an alternative of aggressive buying and selling.

🚨 6,400 #ETH (20,015,930 USD) transferred from unknown pockets to Beacon Depositorhttps://t.co/wrOSlw2LaR

— Whale Alert (@whale_alert) July 11, 2024

In response to cryptocurrency analysts, this can be a blatant signal that a number of Ethereum customers are optimistic concerning the community’s long-term prospects. They’re successfully eradicating a sizeable chunk of the ETH provide from the market by locking up their cash on the Beacon Chain, which could have a big effect on the asset’s value dynamics.

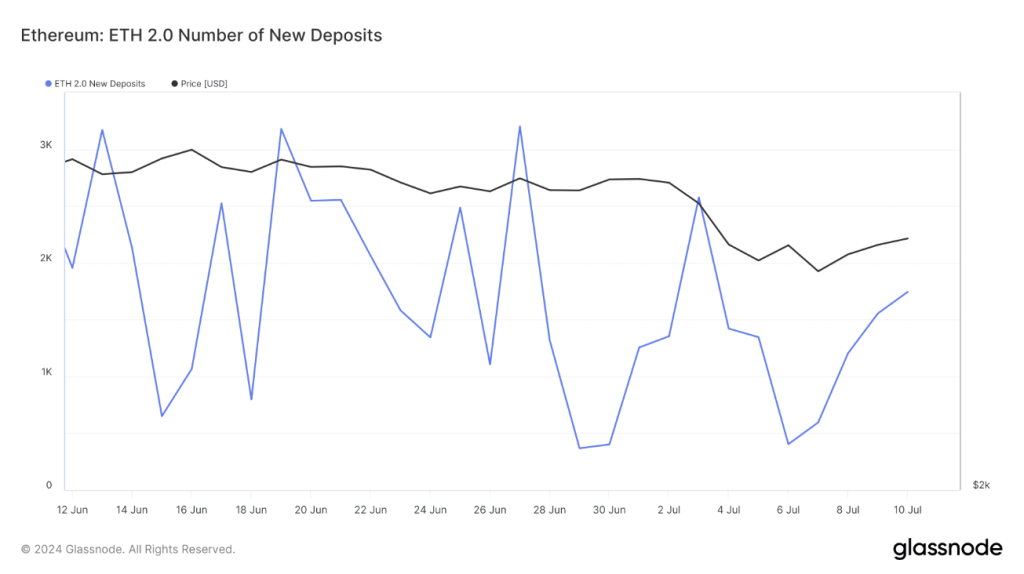

Following this development, Glassnode information exhibits that Ethereum 2.0 recent deposits have not too long ago grown. Key to the following Ethereum 2.0 replace, this measure screens the variety of customers staking a minimum of 32 ETH to take part within the rewards system on the community.

The rising staking exercise means that the neighborhood is quite optimistic about the way forward for the Ethereum ETF, which is quick approaching.

Bullish Momentum Surge Forward

An examination of Ethereum’s alternate influx and outflow information supplies much more proof in favor of the bullish story. Santiment claims that the community’s alternate outflow has been larger than its inflow, which suggests a lessening of sell-side strain.

When ETH is being taken from exchanges greater than being deposited, patrons are definitely in energy. Along with the rising quantity of locked-up cash, this dynamic might present the right atmosphere for an ETH value surge .

Associated Studying

The report additionally predicts that Ethereum could be set to surpass Bitcoin within the fourth quarter of 2024, per regular altcoin market cycle sample. This prediction acquires additional weight from the Bulls and Bears indicator from IntoTheBlock, which now exhibits bullish towards bearish dominance for Ether.

Market knowledgeable Benjamin Cowen believes Ethereum might attain $3,300 within the subsequent weeks or months and would possibly presumably hit $3,500 ought to shopping for demand overcome promoting strain.

Featured picture from Pexels, chart from TradingView