Fast Take

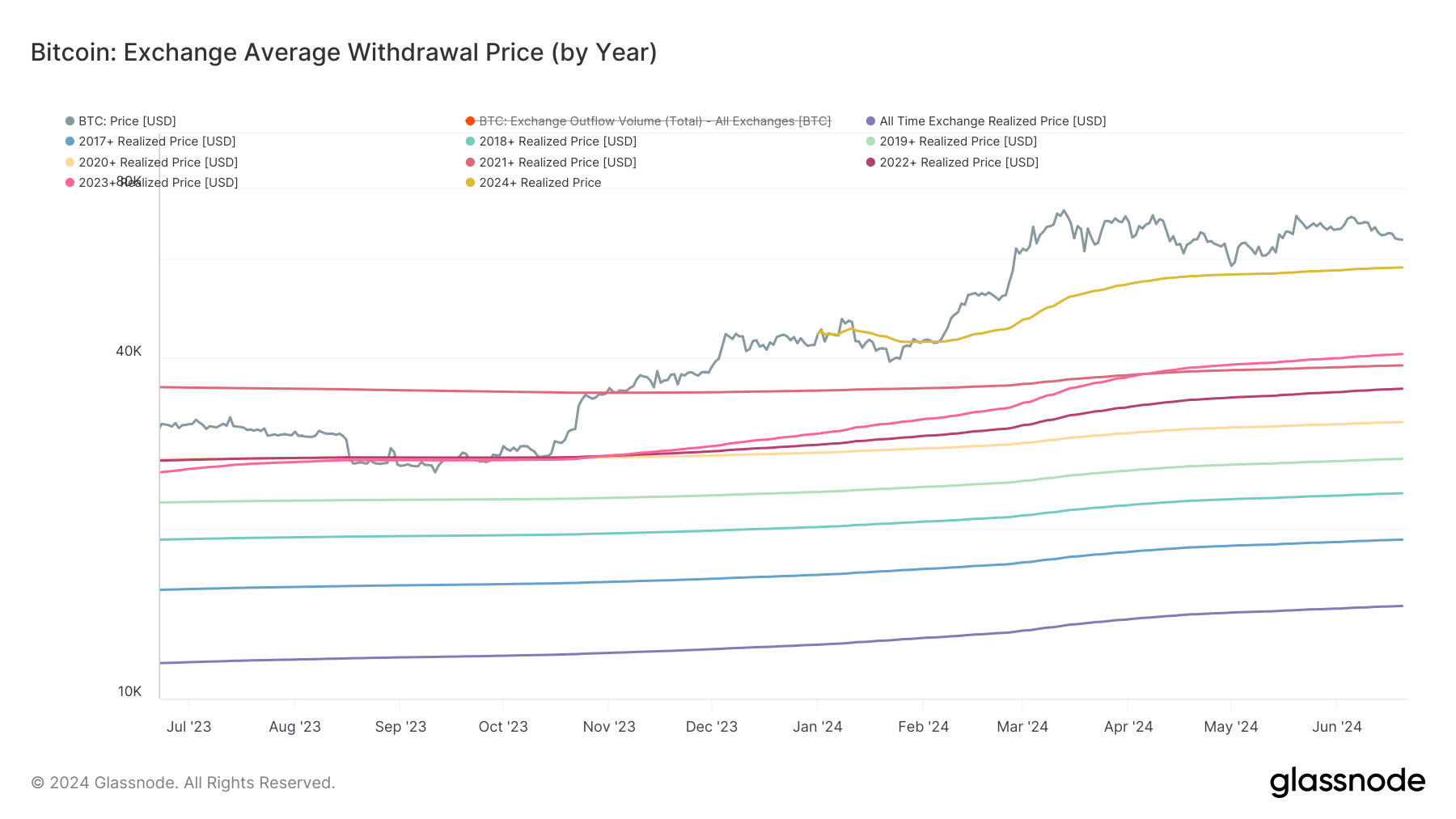

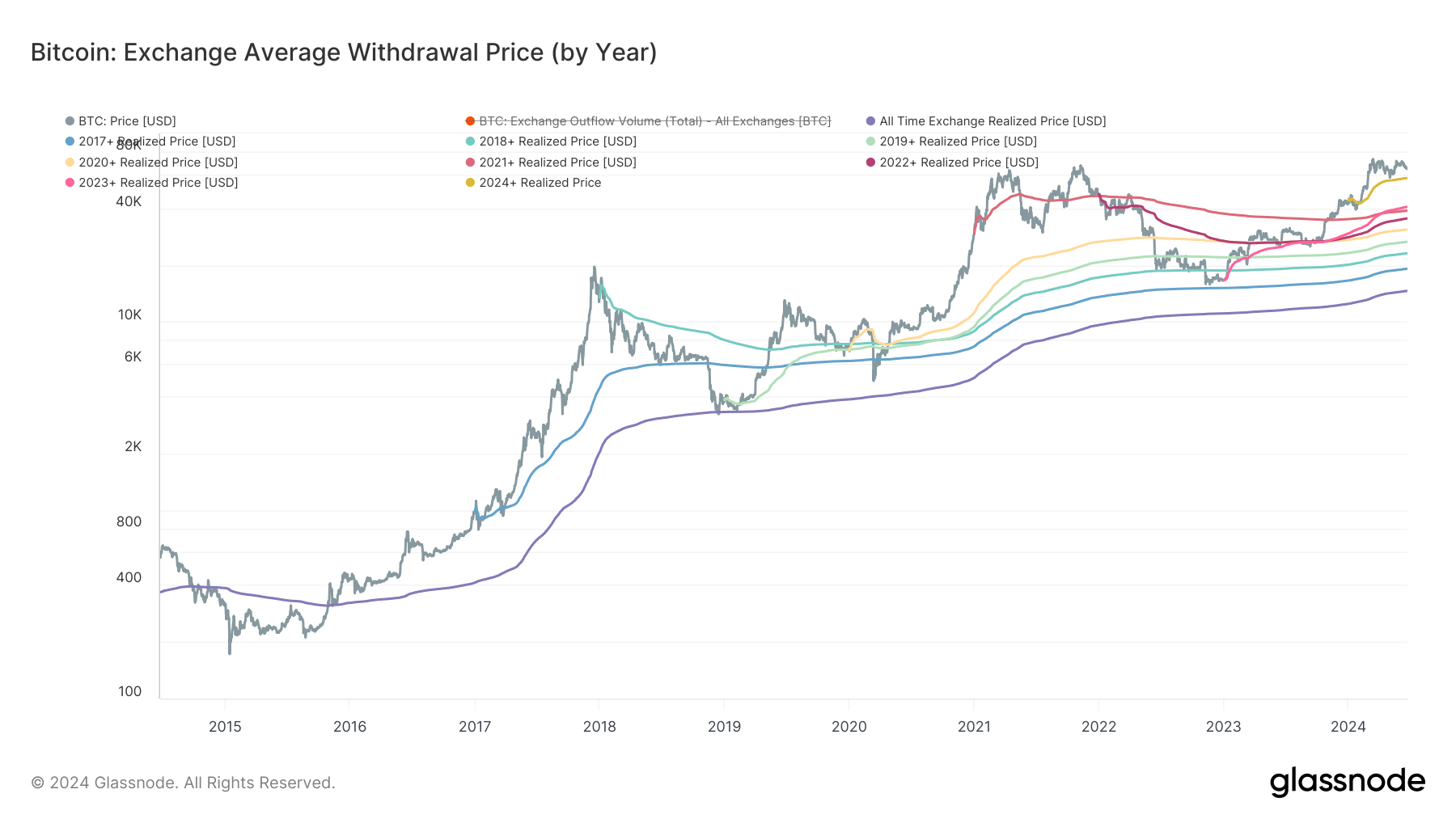

Analyzing transferring averages such because the 200-day and 200-week transferring averages can present insights into Bitcoin’s help and resistance ranges. One other important pattern to watch is the realized worth by the 12 months, which helps estimate the market-wide value foundation by monitoring the common worth at which cash are withdrawn from exchanges every year. By inspecting these common withdrawal costs for various cohorts based mostly on the 12 months, we will gauge market sentiment and potential worth actions.

In keeping with the newest Glassnode knowledge, Bitcoin consumers from all years are presently theoretically in a revenue based mostly on their value foundation. Nonetheless, the 2024 purchaser cohort, lots of whom bought the US ETFs launched on Jan. 11, is at a important juncture. These ETF consumers have a value foundation of $57.9k, indicating they’re nonetheless worthwhile however might face stress if costs fall beneath this stage.

Jim Bianco, head of Bianco Analysis, highlights that these ETF consumers are primarily retail buyers, known as “retail degens,” who may panic and promote if Bitcoin’s worth falls beneath their value foundation. Subsequently, $57.9k turns into a important stage to look at, as it could affect market stability and investor conduct.