On-chain information exhibits the latest Bitcoin drawdown has shaken up the short-term holders, main them to make massive alternate deposits at a loss.

Bitcoin Quick-Time period Holders Have Transferred Big Quantity In Loss To Exchanges

As analyst James Van Straten identified in a submit on X, the BTC short-term holders have not too long ago participated in a considerable amount of loss-taking. The “short-term holders” (STHs) are the Bitcoin traders who purchased their cash throughout the previous 155 days.

The STHs make up one of many two most important divisions of the BTC market, which is completed on the idea of holding time, with the opposite cohort being often known as the long-term holders (LTHs).

Statistically, the longer an investor holds onto their cash, the much less seemingly they turn into to promote them at any level. As such, the STHs would mirror the weak-minded aspect of the market, whereas the LTHs can be the persistent diamond arms.

Given their fickle nature, the STHs often simply react every time a notable sector change happens, like a value rally or crash. Not too long ago, BTC has registered a big drawdown, so these traders would seemingly have made some strikes.

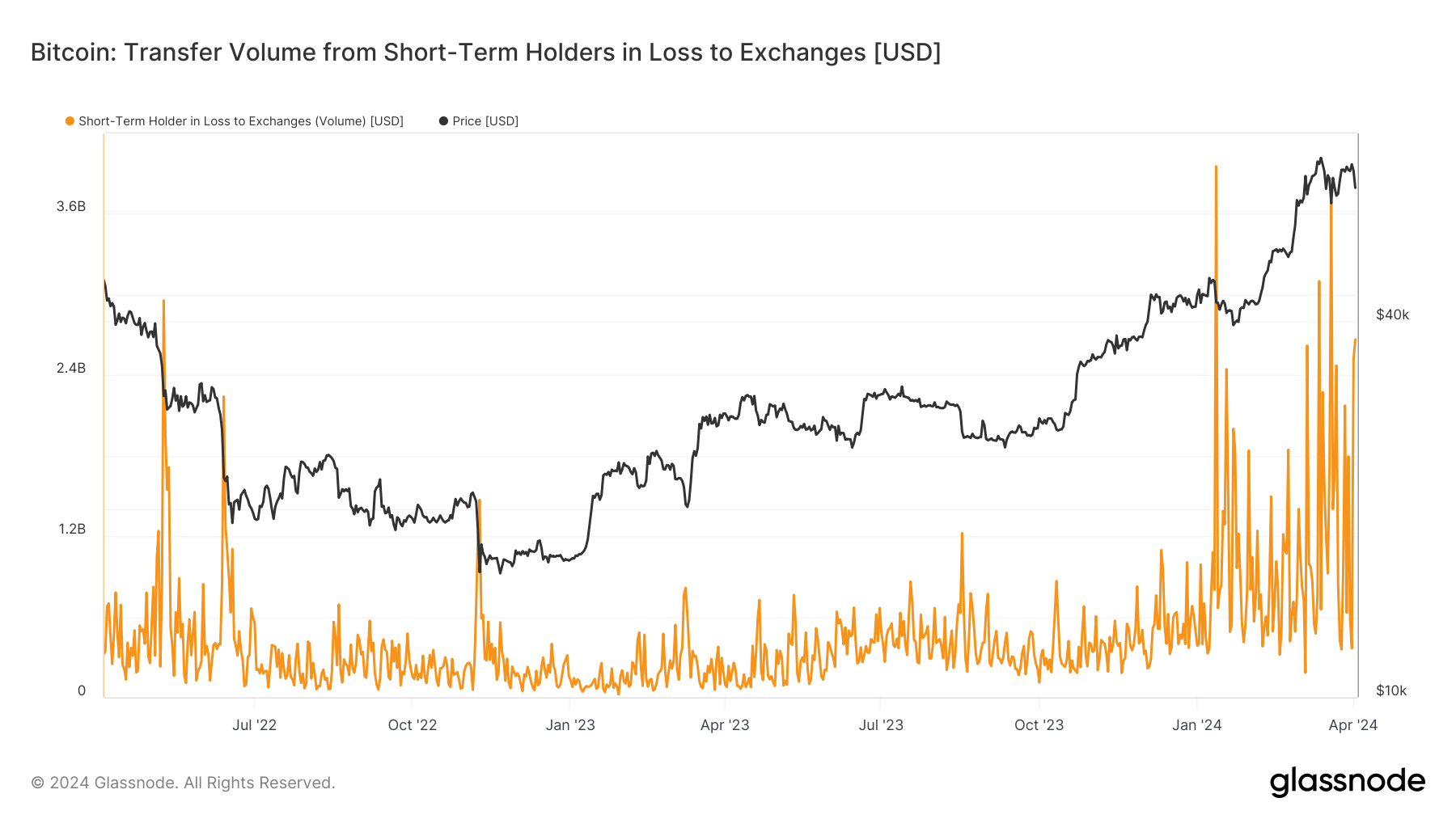

Certainly, on-chain information would verify this. Under is a Glassnode chart shared by Straten, which reveals the development within the switch quantity in loss (in USD) going from the wallets of the STHs to centralized exchanges.

The worth of the metric seems to have been fairly excessive in latest days | Supply: @jvs_btc on X

As displayed within the above graph, Bitcoin short-term holders have not too long ago deposited a lot of tokens holding a loss into exchange-affiliated wallets.

Trade inflows often counsel demand for utilizing the companies these platforms present, which might embrace promoting. As these newest deposits from the STHs have come following a pointy drop within the value, it might seem attainable that the panic-sellers certainly made these inflows.

Because the Bitcoin value is at present close to the all-time excessive (ATH), many of the STH group can be holding a revenue. So, all this loss quantity can solely come from those that purchased on the latest highs.

This isn’t the primary time the market has noticed such fast capitulation from FOMO patrons this 12 months. The chart exhibits that the alternate switch quantity in loss from the STHs additionally spiked very excessive throughout the plunge that adopted the newest value ATH.

The spike again then was even larger in scale than the one witnessed not too long ago and recommended the shakeout of the holders who the information of the ATH had pushed in.

Within the newest capitulation occasion, the Bitcoin STHs have deposited $5.2 billion value of underwater cash to the exchanges inside a two-day window.

BTC Value

For the reason that plunge a number of days in the past, Bitcoin has been unable to search out any vital upward momentum, as its value has solely been in a position to get well to $66,500.

Appears like the value of the asset has been buying and selling sideways over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site completely at your personal danger.