Information exhibits the crypto derivatives market has suffered numerous liquidations up to now day as Bitcoin and others have plummeted.

Bitcoin Has Declined Extra Than 3% In The Final 24 Hours

Bitcoin has continued its current bearish momentum up to now day as its value has noticed an extra plunge, coming all the way down to the $56,600 stage. The chart under exhibits what the asset’s newest efficiency has appeared like.

Throughout this plunge, Bitcoin briefly went all the way down to the $55,600 stage for the primary time for the reason that first-third of August. Regardless of the coin’s rebound, its value has been down greater than 3% during the last 24 hours.

The remainder of the crypto market has additionally not been spared, with the altcoins seeing related or worse returns than the unique digital asset. Given this newest market volatility, it could be anticipated that the derivatives aspect would have seen a shakeup.

Crypto Derivatives Market Has Simply Witnessed Excessive Liquidations

In accordance with knowledge from CoinGlass, the crypto derivatives market has registered a excessive quantity of liquidations within the final 24 hours. A contract is claimed to be “liquidated” when its change has to forcibly shut it down because of it amassing losses of a sure diploma (the precise proportion of which can differ between platforms).

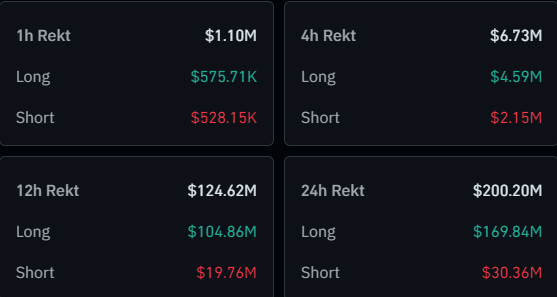

Beneath is a desk that breaks down the most recent liquidation knowledge for the sector.

As is seen, the crypto derivatives market has seen $200 million in liquidations throughout the previous day. Nearly $170 million of the flush concerned the lengthy aspect, representing 85% of the overall.

The liquidations being so lopsided in the direction of these buyers betting on a bullish final result is of course as a result of the sector as an entire has plunged on this window.

Bitcoin has topped the charts concerning the person share of the liquidations, with $55 million in contracts associated to the coin taking a beating.

Ethereum (ETH), the second largest crypto by market cap, hasn’t been far, although, because it has seen over $50 million in liquidations. Solana (SOL) has seen essentially the most liquidations at underneath $13 million.

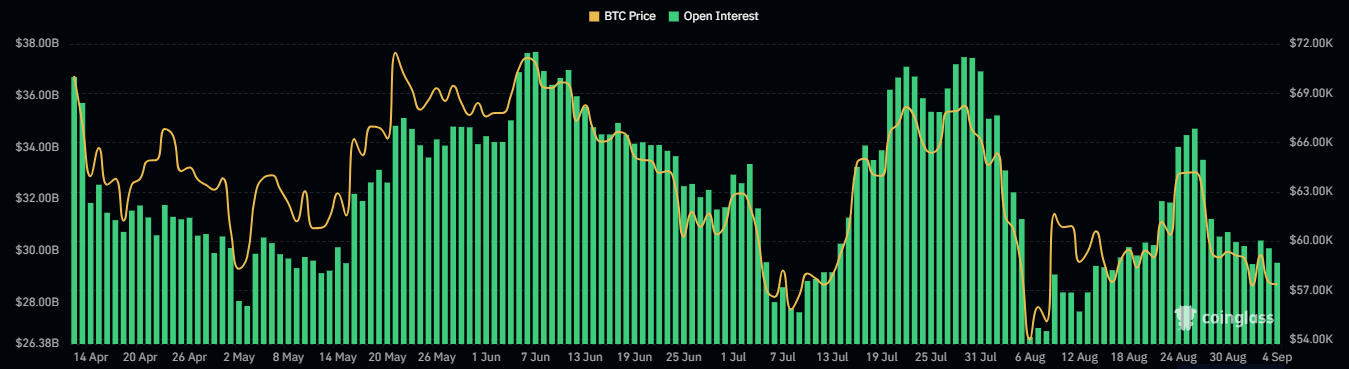

The Bitcoin Open Curiosity, a measure of the variety of positions associated to the at the moment open asset, has seen a cooldown alongside this mass liquidation occasion, suggesting new speculators haven’t jumped in simply but.

This development may counsel that the market might have seen a wholesome reset, resulting in extra stability for the asset’s value.