The analysis arm of the cryptocurrency trade BitMEX finds that greater than $1.2 billion flowed into spot Bitcoin (BTC) exchange-traded funds (ETFs) simply days after launching.

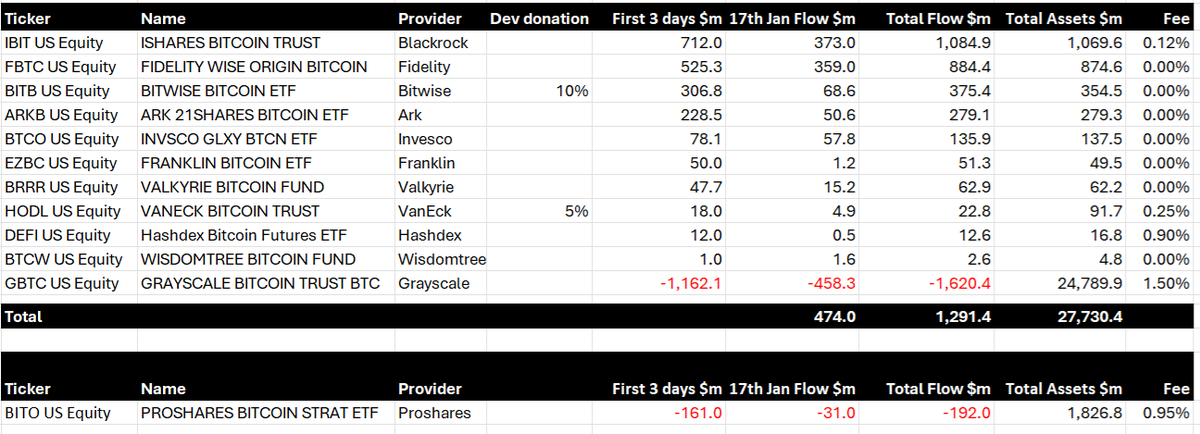

BitMEX says that after 4 buying and selling days, $1.29 billion flowed into the varied new ETF merchandise with BlackRock’s ETF receiving a lot of the funding.

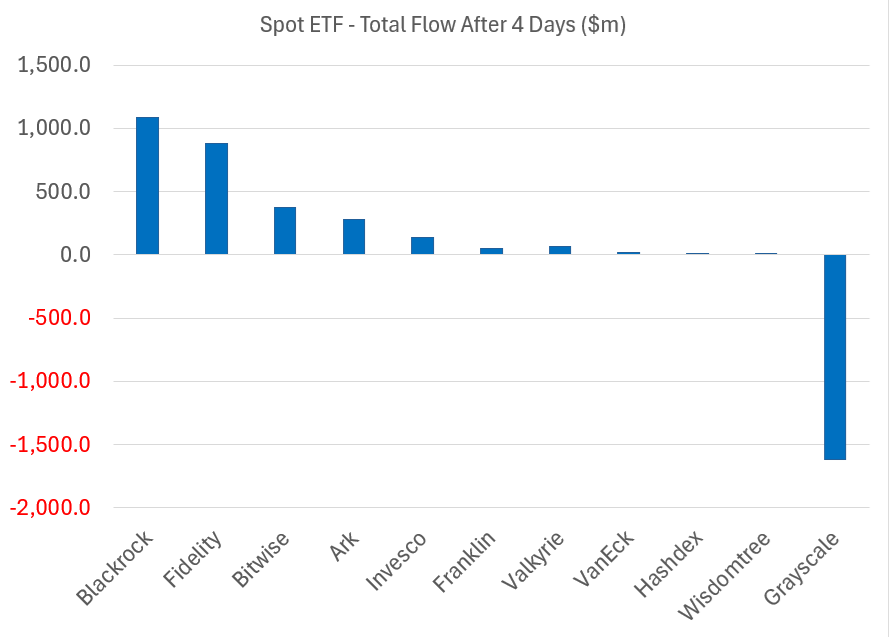

“Bitcoin spot ETFs day 4 replace chart: right here is the entire image of the ETFs after 4 buying and selling days.

Internet influx of $1.291 billion into the spot ETF merchandise.

BlackRock, Constancy and Bitwise main the race.”

DeFiance Capital founder and CEO Arthur Cheong calls BlackRock’s ETF debut a hit primarily based on the funding information.

“BlackRock’s spot Bitcoin ETF achieved $1 billion AUM (property beneath administration) in lower than 5 buying and selling days. $932 million influx alone on day 4. Grayscale most likely sees $500 million outflow, so round $400 million internet. A really profitable launch by any metrics.”

To unfold the phrase, BlackRock dropped a industrial for its ETF following approval.

In accordance with BitMEX, Grayscale’s outflows whole $1.6 billion after Grayscale Bitcoin Belief (GBTC) shares have been transformed from a belief into an exchange-traded fund.

“Bitcoin spot ETFs day 4 replace: GBTC movement quantity for day 4 now out. $458 million of outflow on day 4 and whole GBTC outflow of $1.6 billion. All information for day 4 now out there.”

Some analysts consider that GBTC holders booked losses on their shares with a purpose to maintain ETFs with decrease charges.

The U.S. Securities and Alternate Fee (SEC) permitted 11 spot Bitcoin ETFs on January tenth, making a financial pipeline between Wall Road and Bitcoin.

Bitcoin is buying and selling for $41,223 at time of writing, down greater than 3% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: DALLE3