The latest dip within the value of Bitcoin beneath the $59,000 help stage has despatched jitters by way of the cryptocurrency market. Whereas the value drop triggered liquidations in futures markets, analysts warn {that a} extra vital decline might be on the horizon within the absence of a full-blown market capitulation.

Measured Retreat, Not Mass Exodus

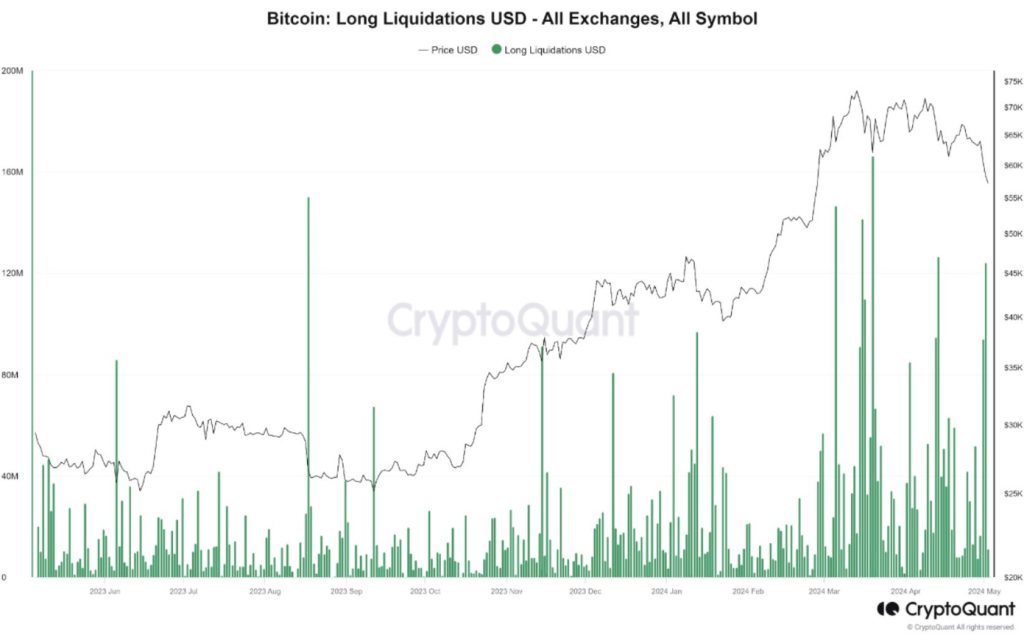

Following the value drop, CryptoQuant, a cryptocurrency evaluation platform, reported roughly $120 million in liquidated lengthy positions (bets that the value would go up). This liquidation is noteworthy, however not like earlier selloffs on the identical help stage, it doesn’t sign a panicked exodus from buyers. Buyers appear to be taking a extra measured strategy, suggesting a potential short-term correction slightly than a long-term bear market.

$BTC Futures Market Not But Signaling Capitulation

“Given the comparatively small quantity of lengthy place liquidation and the shortage of dramatic adverse funding ratios, we imagine {that a} ‘capitulation’ has not but occurred within the futures market.” – By @MAC_D46035

Hyperlink 👇… pic.twitter.com/xqArLQiITf

— CryptoQuant.com (@cryptoquant_com) Could 2, 2024

A Glimmer Of Hope For Lengthy-Time period Buyers

Whereas the short-term outlook seems cautious, there are causes for long-term buyers to stay optimistic. On-chain metrics, which analyze knowledge straight on the Bitcoin blockchain, provide hints of a possible future upswing.

Metrics like MVRV (Market Worth to Realized Worth) recommend there’s an opportunity for an upward transfer within the bigger market cycle. This info empowers strategic buyers to view the present state of affairs as a possible shopping for alternative, notably if a big capitulation occasion unfolds within the futures market.

Bitcoin value motion within the final week. Supply: Coingecko

Navigating The Bitcoin Maze: Knowledge-Pushed Selections Are Key

The present market volatility presents a fancy problem for buyers. Understanding market sentiment is essential for making knowledgeable selections. The funding price, an indicator of sentiment in futures contracts, has dipped into adverse territory at occasions.

BTCUSD buying and selling at $59,167 on the day by day chart: TradingView.com

Historically, this means a stronger presence of bears (buyers betting on a value decline) than bulls. Nevertheless, the negativity hasn’t reached the extremes witnessed throughout previous vital downturns, leaving the general sentiment considerably unclear.

Bitcoin’s Lengthy-Time period Narrative Stays Unwritten

Intently monitoring futures markets for indicators of capitulation, together with analyzing different market indicators just like the funding price, is important for fulfillment on this dynamic surroundings. Sharp buyers armed with a strategic understanding of market dynamics are more likely to revenue from any future strikes.

Bitcoin’s latest value drop has brought about short-term volatility, however the long-term story stays unwritten. Whereas the approaching weeks may check investor resolve, those that can analyze market knowledge and make strategic selections might be well-positioned to capitalize on future alternatives.

Featured picture from Pixabay, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site solely at your individual threat.