The Bitcoin worth has considerably slowed down since reaching the unprecedented excessive of $73,000, transferring principally sideways since mid-March. Nevertheless, with the halving occasion lower than a fortnight away, all eyes will likely be on the premier cryptocurrency and all that pertains to it over the following couple of weeks.

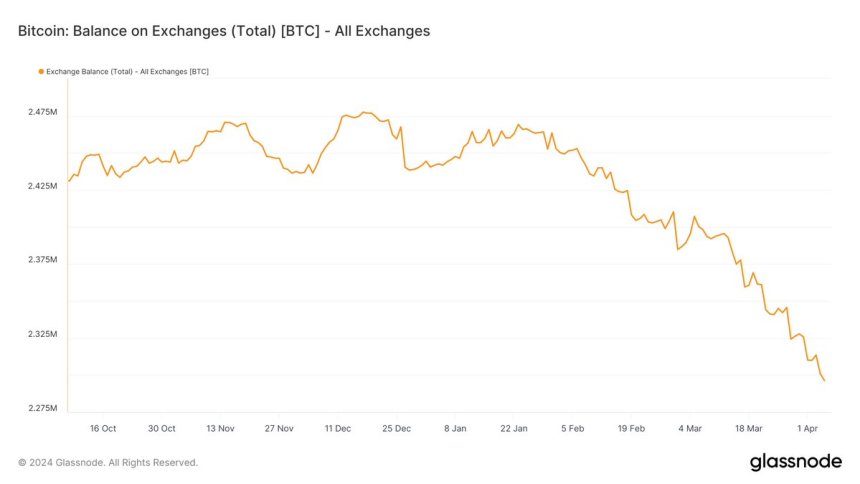

In response to a current on-chain statement, the BTC provide on exchanges has been on a gentle decline over the previous few months. This development has sparked discussions on what this might imply for the Bitcoin worth, each within the brief and long run.

$7.55 Billion Transferred Out Of Change Wallets In The Previous Month

Outstanding crypto pundit Ali Martinez took to the X platform to share {that a} important quantity of Bitcoin has been moved out of crypto exchanges over the previous month. The related metric right here is Glassnode’s Stability on Exchanges, which tracks the full quantity of a cryptocurrency (Bitcoin, on this case) held throughout all change addresses.

A lower within the worth of this indicator implies that buyers are making extra withdrawals than deposits of Bitcoin into centralized exchanges. The metric’s improve, however, signifies that extra BTC is flowing into these exchanges than leaving.

Chart exhibiting Bitcoin stability on all exchanges | Supply: Ali_charts/X

In response to Martinez, about 111,000 BTC (price roughly $7.55 billion) have been transferred out of identified crypto change wallets previously month. Sometimes, an exodus of funds (of this magnitude) suggests a big shift within the sentiment of Bitcoin buyers.

Whereas the precise rationale behind such an enormous motion of Bitcoin stays unclear, the circulation of funds from buying and selling platforms suggests a development in investor confidence. This means that BTC homeowners are extra fascinated with holding their belongings in the long run moderately than promoting for short-term positive aspects.

Moreover, this steady downward development in BTC’s stability on exchanges may set the stage for a bullish rally for the Bitcoin worth. A sustained drop within the BTC’s provide on centralized exchanges may end in a provide crunch – a state of affairs the place the availability of a selected asset is decrease than its demand, resulting in a surge in its worth.

One other potential bullish catalyst for the Bitcoin worth is the upcoming halving occasion, which is anticipated to happen on April 18, 2024. With the miners’ rewards slashed in half and the manufacturing of Bitcoin slowed, this occasion is anticipated to impression the worth of BTC positively.

Bitcoin Worth At A Look

As of this writing, the Bitcoin worth stands at round $69,537, reflecting a 2.7% improve within the final 24 hours.

Bitcoin worth on the verge of $70,000 on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site fully at your individual threat.