XRP Value Prediction 2023-2032

So LBRY misplaced its case in opposition to the SEC. Unhappy to say, the ruling nonetheless doesn’t present regulatory readability as to the definitive situations (the important substances) that set up an supplied asset as a safety. Particularly when the Decide touches solely on the third prong on this case. The 76-year-old Howey Check doesn’t appear fairly useful when utilized to cryptocurrencies like XRP.

The issue turns into extra obvious once we attempt to decide simply precisely when XRPs can develop into ‘securities’ in response to SEC’s argument.

If Ripple loses the lawsuit, buying and selling will likely be suspended. Whereas XRP funds will stay safely saved in your account after the buying and selling suspension, you won’t be able to purchase, promote, or convert.

It’s solely when the tide goes out that who’s been swimming bare.

Warren Buffett

How a lot is XRP price?

At this time’s XRP worth is $0.6286 with a 24-hour buying and selling quantity of $793,318,422. XRP is up 1.46% within the final 24 hours. The present CoinMarketCap rating is #5, with a stay market cap of $34,025,393,979 USD. It has a circulating provide of 54,125,149,173 XRP cash and a max. provide of 100,000,000,000 XRP cash.

XRP Technical evaluation: XRP recovers previous $0.627 as uptrend extends

TL;DR Breakdown

- XRP worth evaluation confirms an uptrend.

- Coin worth has recovered previous $0.627.

- Robust help is on the market on $0.603.

The most recent one-day and four-hour XRP worth evaluation for 01 January 2024 confirms an upward swing for the day. The bulls have been in a position to break previous the bearish momentum previously 24-hours, as a serious restoration was recorded. At this time, a substantial rise in bullish energy was noticed as XRP/USD worth hiked previous $0.627 excessive.

XRP worth evaluation on a every day timeframe: Uptrend intensifies as XRP surpasses $0.627 excessive

The most recent one-day XRP worth evaluation signifies a strongly bullish win for the cryptocurrency as we speak. The value has been masking an ascending motion because the previous 24-hours which is an encouraging state of affairs for the consumers. Because the shopping for stress is rising, the coin worth has improved as much as $0.627 as we speak. Furthermore, the Transferring Common (MA) worth has elevated as much as $0.626 on account of the bullish spike.

The volatility is rising which is a bearish trace concerning the continuing market tendencies. Because the volatility is rising, the higher finish of the Bollinger bands indicator has moved to $0.641 excessive. Whereby, the decrease finish of the Bollinger bands indicator is now located at $0.603 low. The Relative Energy Index (RSI) confirms the continuing uptrend as its total worth has spiked as much as 51.16.

XRP worth evaluation on the 4-hour chart: Upswing aids XRP cross $0.627 hurdle

The most recent four-hour XRP worth evaluation confirms a bullish swing for now. The upward swing has been aggravating because the previous few hours, because the shopping for exercise remained significantly excessive. Prior to now 4 hours, an extra bullish spike was noticed because the cryptocurrency worth reached $0.627 excessive. As well as, its Transferring Common worth has stepped as much as $0.620 amidst the continuing upswing.

The four-hour worth chart dictates an rising volatility which is a bearish sign concerning the approaching hours. Because the volatility is on the rise, the higher finish of the Bollinger bands indicator has moved to $0.629. Whereby, the decrease Bollinger band occupies $0.614 place for now. The RSI graph shows a pointy bullish curve and its total worth has hiked up until index 55.

What to Count on from XRP Value Evaluation

The most recent one-day and four-hour Ripple worth evaluation confirms indicators of an rising pattern for the day. The cryptocurrency worth underwent main bullish restoration through the day because it has spiked as much as $0.627 excessive. Facet by aspect, the four-hour worth evaluation confirms a rising bullish wave as effectively, because the coin worth recovered massively previously few hours.

Latest Information/Opinions on the Ripple Community

Ripple’s 2024 Predictions Unveiled: Regulatory Challenges and Institutional Optimism. Ripple’s Chief Authorized Officer, Stuart Alderoty, envisions the conclusion of the Ripple lawsuit however warns of continued SEC enforcement ways in opposition to different trade gamers, predicting authorized battles and potential Supreme Court docket involvement. He additionally anticipates a congressional stalemate on crypto regulation, probably leaving U.S. corporations in limbo. On the flip aspect, Senior Vice President of Merchandise, Adrien Treccani, gives a extra optimistic outlook, foreseeing a maturing crypto trade with elevated institutional acceptance. Treccani predicts world banks actively looking for digital asset options, accelerated adoption charges, and heightened experimentation with tokenized property, signaling a rising belief and collaboration between conventional finance and the crypto sector in 2024.

XRP’s Potential Bull Run Amid Largest Bull Flag Formation. Latest evaluation means that XRP has fashioned what may very well be the most important bull flag in cryptocurrency historical past on the month-to-month chart, following its 2018 all-time excessive of $3.84. Regardless of challenges, together with a SEC lawsuit in 2020 hindering worth restoration, XRP’s efficiency has resulted on this vital bullish sample. The group speculates on potential worth eventualities, with most respondents anticipating a surge past $22.35. Whereas the present short-term wrestle to take care of $0.60 help is famous, current authorized readability and the approaching breakout from the bull flag might result in a considerable worth run, in response to market commentators.

BitTrade Publicizes XRP and Shiba Inu Lending Providers. On November 21, the well-known Japanese crypto change BitTrade revealed its initiation of lending companies for XRP and Shiba Inu. The lending interval for each cryptocurrencies spans 90 days, accompanied by a 2% annual rate of interest. Notably, XRP loans vary from a minimal of 100 XRP to a most of 500,000 XRP, whereas Shiba Inu loans begin at 10,000,000 SHIB, with a most cap of 10,000,000,000 SHIB. Final month, BitTrade expanded its checklist of supported property to 34 by including Shiba Inu alongside Dogecoin. Cryptocurrency lovers are suggested to completely evaluate the change’s phrases earlier than participating in lending actions, contemplating the inherent volatility of the crypto market.

Ripple vs. SEC: Morrison Precedent and Jurisdictional Challenges. The authorized conflict between Ripple Labs and the U.S. Securities and Trade Fee (SEC) hinges on the Morrison v. Nationwide Australia Financial institution precedent. This U.S. Supreme Court docket case underscores that gross sales in query should happen “within the U.S.” or on a U.S. change, elevating issues in regards to the SEC’s jurisdiction and the extraterritorial utility of U.S. securities legal guidelines in Ripple’s institutional gross sales of XRP. The dispute additionally delves into the extraterritorial impact of U.S. securities legislation, with the SEC looking for a $770 million disgorgement from Ripple. Authorized opinions range, with some anticipating a settlement between the events after contemplating all proof, highlighting the case’s significance in shaping the regulatory panorama for digital property.

SEC Chairman’s Halloween Tweet Sparks Crypto Controversy. SEC Chairman Gary Gensler’s playful Halloween tweet, referencing Satoshi Nakamoto and urging crypto corporations to stick to securities legal guidelines, drew a pointy rebuke from Ripple’s authorized counsel, Stuart Alderoty. The tweet led to trade hypothesis about potential Bitcoin ETF approvals and highlighted the rising significance of cryptocurrency in regulatory discussions. This incident underscores the sensitivity of communication throughout the cryptocurrency regulatory panorama, the place even light-hearted tweets can ignite controversy and reactions from authorized consultants.

Ripple to conduct an Preliminary Public Providing Hypothesis (IPO) quickly. Hypothesis of an IPO by Ripple has arisen as a result of firm’s current job posting for a Senior Shareholder Communications Supervisor in key monetary areas, outlining duties which can be sometimes related to IPO preparations, equivalent to investor relations and communication with shareholders and analysts. Whereas this has fueled hypothesis within the cryptocurrency group and amongst analysts, it’s essential to await an official announcement from Ripple concerning its IPO plans earlier than drawing definitive conclusions.

Ripple declares chance of RWA tokenization on XRPL. Ripple CTO David Schwartz has indicated that real-international asset (RWA) tokenization duties may also launch on the XRP Ledger (XRPL) throughout the subsequent yr or yr and a half, citing XRPL’s low transaction costs and suitability for seamless asset integration. The primary conceivable RWA protocols on XRPL ought to materialize via 2024 or early 2025, with hypotheses suggesting property like Gold and precise property could be the preliminary candidates. As well as, the XRPL community is monitoring the XLS-30d; “XRPL AMM”, suggestion for capability DeFi functionality, though it at the moment lacks vital assist. Whereas the “Clawback” modification, essential for regulatory compliance, has garnered 15.5% help from its validators.

Ripple receives notable recognition in PAY360 Awards. Ripple has unlocked its new achievement, because it has been awarded essentially the most eminent award within the PAY 360 ceremony. This can be a nice accomplishment for the crypto agency, because it has been acknowledged as conducting the perfect utilization of on-line currencies. The ceremony acknowledged Ripple as the perfect amongst different block chain companies suppliers and asset holder. The achievement grants Ripple the chance to hitch arms with 250,000 professionals to discover additional advertising methods and promotions. Ripple has been securing again to again wins, whether or not in skilled sphere or authorized grounds; PAY 360 is the newest addition to its property.

Ripple recordsdata case in opposition to GCC change. Ripple has launched a lawsuit in opposition to the famend entity GCC which gives cash switch and overseas change companies. Ripple Singapore has sought this authorized battle to get better $14.9 million price of property. A Singapore franchise executed this switch, whereupon GCC did not pay the due quantity on the time of transaction. GCC has did not pay for a complete of 40,000 XRP models after transacting it beneath an official deal.

SEC v/s Ripple: Court docket denies SEC’s interpretations of Ripple property. Ripple’s lawyer, Invoice Morgan has expressed reduction on the court docket’s dismissal of SEC interpretations. The Decide has permitted BTC and ETH standing as commodities. Morgan is hoping for an opportunistic determination, reaffirming Torres’s verdict concerning XRP being non safety. The most recent court docket determination has highlighted that the continuing contracts are lawful, coping with ETH and BTC commerce.

Ripple declares partnership with BlackRock and JP Morgan to increase its ventures as a brand new member of the ISDA. This may help get better nice highs for Ripple, as this enterprise may welcome different monetary giants together with Goldman Sach and Citigroup within the close to future. This deal may set off alternatives on a bigger scale, flowering probabilities for larger names to go for a handy adoption for flagship crypto.

Ripple declares affiliation with Worldwide Swaps and Derivatives Affiliation, a famend commerce group. This company permits a number of our bodies for instance; traders, merchants and cryptocurrency labs to work together. Now Ripple is part of greater than 1000 establishments from adjoining nations because it forges alliance with ISDA.

Bitstamp, a serious crypto change, introduced a everlasting 2% APY increase on lending XRP to draw customers trying to earn yield on their crypto. The lending will likely be restricted to respected establishments after rigorous danger assessments via their partnership with Tesseract.

Ripple not too long ago partnered with Quicker Funds Council and launched a white paper outlining their plans to revolutionize world cash motion utilizing crypto. The paper highlights dissatisfaction amongst cost trade leaders with conventional cross-border cost programs and emphasizes how the crypto and blockchain trade can rework cost applied sciences worldwide.

Breaking: Partial victory for Ripple Labs in opposition to SEC case

Decide Analisa Torres decided in favor of Ripple Labs in a case in opposition to the Securities and Trade Fee (SEC), giving them a partial victory. The Ripple token, XRP, was discovered by the court docket to not be a safety when traded on digital asset exchanges however to be one when supplied to institutional traders. Regardless of this triumph, the SEC nonetheless prevailed by defining the necessities for XRP to be thought of a safety. The lawsuit sought to impose authorized limitations on Ripple’s XRP distribution. In simply sooner or later, the worth of XRP has elevated by an astonishing 96%.

XRP investor class granted lawsuit certification in opposition to Ripple and it’s CEO

The XRP investor class was granted certification on June 30 by Decide Hamilton of the U.S. District Court docket for the Northern District of California, enabling them to proceed their authorized motion in opposition to Ripple, CEO Brad Garlinghouse, and subsidiary XRP II. This ruling is a key improvement within the Zakinov v. Ripple Labs case, which facilities on accusations that Ripple engaged in a plan to lift a large sum of cash by promoting XRP to particular person traders. Bloomberg Legislation reviews that regardless of the corporate’s objection, the court docket discovered that the category happy all 4 standards for certification.

Singapore regulators grant Ripple an in-principle license for funds, permitting regulated digital asset companies and facilitating buyer use of #ODL. Tweet confirms the event.

An thrilling partnership between Ripple and Colombia’s central financial institution has been unfolded, highlighting their shared imaginative and prescient of exploring blockchain expertise’s potential. By an intensive pilot program scheduled for the whole thing of 2023, the collaboration goals to showcase the tangible advantages of blockchain to the broader viewers. Overseeing this initiative is Colombia’s Ministry of Info and Communications Applied sciences, whereas Ripple’s cutting-edge central financial institution digital forex (CBDC) platform will function the inspiration for this joint endeavor.

The unsealing of the long-awaited Hinman paperwork led to a surge within the worth of XRP, reflecting market optimism concerning Ripple’s authorized battle with the SEC. Nevertheless, the preliminary worth improve was short-lived because the XRP worth reversed its positive factors shortly after. The market’s response signifies ongoing volatility and uncertainty surrounding the result of the authorized proceedings.

The XRP Ledger has achieved a major milestone in its quest to surpass Ethereum. XPPL Labs confirms the profitable safety audit of the Hooks modification, enabling expanded companies for customers. Wietse Wind highlights the significance of Hooks in connecting XRPL and Ethereum, empowering transactions with enhanced intelligence and comfort via customizable logic and automation.

A lawsuit was filed in opposition to the XRP in late 2020, by the U.S. Securities and Trade Fee (SEC), alleging that the corporate had unlawfully offered $1.3 billion price of unregistered securities via its XRP cryptocurrency. Ripple’s chief government, Brad Garlinghouse, expressed confidence that the case can be resolved expeditiously, stating that it might conclude in “weeks, not months.” This optimistic outlook has had a constructive influence on XRP’s worth, with a ten% improve noticed previously week, whereas Bitcoin’s worth declined.

XRP Is Not a Safety: The clarifications by Ripple-pro lawyer John Deaton is that XRP isn’t a safety however may very well be thought of as such within the major market. Ripple CEO Brad Garlinghouse expects a closing court docket determination on the continuing lawsuit inside six months, emphasizing the necessity for regulatory readability to keep away from lagging in blockchain expertise adoption. Potential outcomes of the lawsuit might embrace a settlement between the SEC and Ripple whether it is confirmed that XRP was offered as a safety.

The SEC’s shifting stance on the joint enterprise argument within the Ripple case has drawn criticism from legal professional John Deaton, who describes it as a “schizophrenic protection.” Ripple’s Common Counsel Stuart Alderoty and legal professional Invoice Morgan have challenged the SEC’s widespread enterprise argument, highlighting its potential shortcomings in satisfying the Howey take a look at.

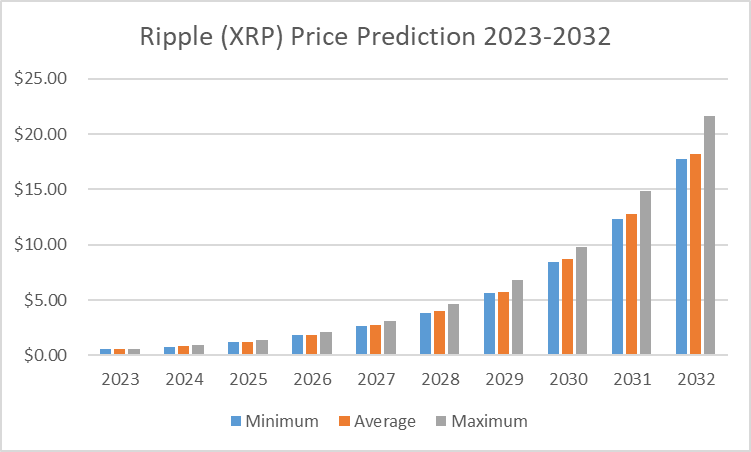

XRP Value Predictions 2023-2032

Value Predictions by Cryptopolitan

| Yr | Minimal | Common | Most |

| 2023 | $0.55 | $0.57 | $0.61 |

| 2024 | $0.79 | $0.82 | $0.95 |

| 2025 | $1.19 | $1.23 | $1.41 |

| 2026 | $1.80 | $1.84 | $2.10 |

| 2027 | $2.66 | $2.73 | $3.07 |

| 2028 | $3.86 | $3.97 | $4.62 |

| 2029 | $5.61 | $5.77 | $6.79 |

| 2030 | $8.42 | $8.71 | $9.79 |

| 2031 | $12.35 | $12.78 | $14.84 |

| 2032 | $17.70 | $18.21 | $21.63 |

XRP Value Prediction 2023

The present XRP worth prediction for 2023 suggests a minimal worth of $0.55 and a median buying and selling worth of $0.57.Ripple cryptocurrency is predicted to achieve a most worth of $0.61.

XRP Value Prediction 2024

Our Ripple worth forecast for 2024 suggests the altcoin might commerce at a minimal worth of $0.79 and a median forecast worth of $0.82.Ripple worth might hit a most worth of $0.95.

XRP Value Prediction 2025

The Ripple worth forecast for 2025 is for Ripple cryptocurrency to commerce at a minimal worth of $1.19 and a median worth of $1.23.The utmost forecast worth for 2026 is $1.41.

XRP Value Prediction 2026

In 2026 our XRP worth forecast for 2026 suggests Ripple cryptocurrency might attain a minimal worth of $1.80 and a median worth of $1.84.Ripple coin is estimated to achieve a most worth of $2.10.

XRP Value Prediction 2027

Ripple XRP worth forecast for 2027 estimates a minimal worth of $2.66 and a median buying and selling worth of $2.73.The utmost worth forecast for 20227 is $3.07.

Ripple Value Prediction 2028

Our Ripple forecast for 2028 expects the worth of 1 XRP to achieve a minimal of $3.86 in 2028. The XRP worth can attain a most degree of $4.62, with a median worth of $3.97 all through 2028.

XRP Value Prediction 2029

The Ripple coin worth prediction for 2029 estimates Ripple to achieve a minimal worth of $5.61 and a median worth of $5.77, with a most worth of $6.79.

XRP Value Prediction 2030

In accordance with the Ripple worth forecast for 2030, Ripple is predicted to hit a minimal worth of $5.61 and a median worth of $5.77 all year long 2030. The utmost forecasted Ripple worth for 2030 is about at $6.79.

XRP Value Prediction 2031

The Ripple worth prediction for 2031 suggests Ripple coin will attain a minimal worth of $12.35 and a median worth of $12.78, with a most worth of $14.84.

XRP Value Prediction 2032

The Ripple coin worth prediction for 2032 predicts the XRP to have a minimal worth of $17.70, a median of $18.21, and a most worth of $21.63.

XRP Value Prediction by DigitalCoinPrice

DigitalCoinPrice’s bullish short-term prediction states that the XRP worth will improve by 116.3% by the tip of Might. The present indicators point out the Impartial zone, and the worry & greed index exhibits 27.28 excessive fears, which suggests the worth is at the moment secure. If all elements stay favorable, this may result in an extra surge in XRP costs in the direction of the tip of Might.

DigitalCoinPrice estimates the worth of Ripple to achieve a minimal of $1.65, a median buying and selling worth of$1.77, and a most forecast worth of $1.96 by the tip of 2026. For the long-term forecasts, Ripple is estimated to commerce at a most worth of $4.46 in 2030, whereas by 2032, the worth of XRP is predicted to achieve a peak of $8.34.

XRP Value Prediction by Pockets Investor

Pockets Investor is bullish on Ripple worth within the short-term forecast, stating that XRP can attain $0.414 by the tip of Might 2023. That is fairly near the present worth of $0.428. Within the one-year forecast, Pockets Investor expects XRP worth to achieve a median of $0.144 with a minimal and most worth estimation at $0.37 and $0.724, respectively, by Might 2024.

Pockets Investor phrases Ripple as a nasty long-term funding and predict that XRP won’t be able to achieve its all-time highs within the coming years.

XRP Value Prediction by Coincodex

Coincodex makes use of deep technical evaluation of Ripple’s worth motion to estimate predictions on the place the worth is headed shortly. The group of analysts follows a spread of indicators and technical evaluation strategies – from analytical fashions to elementary evaluation – to provide correct Ripple worth forecasts. In accordance with Coincodex’s Ripple worth predictions, the present worth of Ripple might drop by 5.05% and attain $ 0.407420 by Might 20, 2023.

Nevertheless, as a result of present bearish sentiment available in the market, as indicated by their technical indicators and Worry & Greed Index of fifty (Impartial), now won’t be the perfect time to spend money on Ripple. Furthermore, XRP recorded 12/30 (40%) inexperienced days with 6.08% worth volatility over the past 30 days.

Coincodex’s long-term worth predictions for Ripple recommend the worth might attain $ 9.05 if it follows Fb’s development. If XRP adopted Web development, the prediction for 2026 can be $ 1.037854.Furthermore, primarily based on the info from Might 15, 2023, the final XRP worth prediction sentiment is bearish, with 13 technical evaluation indicators signaling bullish alerts and 20 signaling bearish alerts.

XRP Value Prediction by Market Consultants

Ripple worth motion in the last few days noticed XRP/USD driving excessive earlier than plunging to the current low. In accordance with BULLRUNNERS market knowledgeable primarily based on Youtube, Ripple is predicted to interrupt out of a long-term triangle, which might result in vital positive factors shortly. He has predicted that Ripple might attain as excessive as $0.60 within the quick time period and probably $1 within the medium time period if it doesn’t escape from its present ranges. Finder concluded from a panel of thirty-six trade consultants that XRP must be at $3.61 by 2025.

XRP Overview

Forecasts can change on the slightest discover

Taking a look at this overview, it’s simple to see the excessive volatility of XRP previously few months, which makes it tough to have a Ripple forecast. However the volatility has not stopped analysts from making XRP predictions primarily based on tendencies. It solely implies that these forecasts can change on the slightest discover. Nevertheless, they nonetheless give a tough estimate of what to anticipate from them.

Given how previous developments and even bulletins have led to a rise within the worth of XRP, the forex may attain $2. This may occur if the actions of Ripple expertise result in a partnership with extra monetary establishments.

Prior to now, XRP’s reputation and, by extension, its improve in worth have been closely influenced by the partnership with these conventional establishments. Extra partnerships will imply extra adoption, which invariably means greater worth.

Nevertheless, it isn’t so easy for XRP. The SEC lawsuit complicates the entire difficulty even additional. Earlier than the SEC filed the case, the outlook for XRP was constructive, even when it didn’t make many optimistic. However the lawsuit cuts its breakout quick and makes a Ripple worth prediction trajectory more difficult, in contrast to different digital currencies.

Contemplating how tough it’s to foretell a digital asset precisely, it’s much more tough for XRP. After the lawsuit, extra merchants are appearing bearish with the XRP cryptocurrency, elevating fears that it might drop to beneath 10 cents. Nevertheless, the worth pump by retail traders and merchants has allowed it to select up once more.

In accordance with Coinpedia, even with the lawsuit hanging over its head, Ripple XRP will commerce at a median of $20 within the subsequent 5 years.

XRP Value Historical past

For years after its creation, the coin’s worth was so inconsequential that it was nearly nugatory. Earlier than 2017, the asset’s worth hovered round $0.01, however this quickly modified because the token started to realize wider protection, and it additionally leveraged on the bull run of the crypto trade in that yr. By April 2017, XRP rose to $0.05; the gradual climb quickly continued because it reached $0.25 in Might.

After this, there was no going again for the asset, because it had snared the eye of crypto lovers who noticed the worth it created and the potential it had. The worth of the asset rose all via 2017 and into the early interval of 2018 when it acquired to an all-time excessive of $3.84.

However this was quickly adopted by a large drop in worth that affected each different cryptocurrency, too; many had labeled the unbelievable run of the trade as only a bubble, and like each bubble, it was going to burst. This was panned out within the case of the 2017 crypto trade bull run.

In direction of the tip of 2019, its worth stabilized at round $0.30 and didn’t cross the $0.5 mark all year long. Which means that Ripple XRP hasn’t been in a position to construct on its previous glory since then, as its worth by no means acquired to as excessive as even a greenback.

Nevertheless, the bullish run of 2020 that was ignited in the direction of the tip of the yr helped the asset’s worth to ascend. The token’s worth acquired to as excessive as $0.8 earlier than ending the yr at $0.66. Early 2021 was imagined to proceed the rise in XRP worth, however that would not occur as a result of SEC’s announcement of a lawsuit.

Upon the announcement, some exchanges delisted XRP from their platform. A lot of these holding the token additionally offered in panic. This led to the worth of XRP plummeting to as little as $0.166. Nevertheless, it has picked up once more, going as excessive as $0.755. Ripple at current is buying and selling between $1.11.

Thus, the very best projected worth for the yr is $2, whereas it might additionally go at least worth prediction is $0.561 if the SEC lawsuit isn’t settled in favor of Ripple.

The XRP worth has been consolidating in a sideways channel because the crypto market crash in Might 2021. The value has been consolidating between $0.56 and $1.39. The pattern is at the moment impartial; nevertheless, it’d retest the 0.618 Fibonacci degree round $0.89 earlier than transferring to the upside. The Stochastic RSI for the every day timeframe can be on the backside (18); thus, there’s a enormous potential for the upside so far as there isn’t any unfavorable information within the crypto house.

Additionally, there’s a flat quantity. This means that the availability from sellers and the demand from consumers are in equilibrium.

Extra on the Ripple Community

What’s XRP?

On the planet of cryptocurrencies, XRP is sort of totally different. It’s decentralized, however not as a lot as Bitcoin, Ethereum, and the like. Not like them, it doesn’t search to be a substitute for the standard banking system however quite to collaborate and enhance the traditional banking system. Nonetheless, it’s a cryptocurrency that would outlast others as a result of its many distinctive options and landmark developments.

What’s the Liquidity Hub

In accordance with the official assertion shared by Ripple, its liquidity hub is now formally open for enterprise. After an intensive stress-testing marketing campaign, it is able to onboard the primary technology of customers. The primary iterations of the liquidity hub will help Bitcoin (BTC), Ethereum (ETH), Bitcoin Money (BCH), Ethereum Traditional (ETC), and Litecoin (LTC), in addition to the fiat U.S. Greenback (USD).

This improvement solely means one factor, Crypto is Good Enterprise. The longer term is vibrant for modern #crypto functions, with the potential to:

- Simplify real-time safe cash transfers

- Streamline back-office reconciliation

Learn the way your online business can unlock speedy, real-world worth via crypto and blockchain with Ripple Liquidity Hub. https://on.ripple.com/3KEwHPI

The 76-year-old Howey Check doesn’t appear useful when utilized to cryptocurrencies like XRP. Fairly seemingly as a result of every XRP is indistinguishable from one other XRP, as one pundit identified. Certainly, there’s LBRY CEO Jeremy Kauffman warns that the court docket determination “threatens the complete U.S. cryptocurrency trade” by setting an ordinary that will deem “nearly each cryptocurrency” a safety.

A notable improvement as a turnkey resolution for monetary establishments, Ripple Liquidity Hub will leverage sensible order routing to supply digital property at optimized costs from market makers, exchanges, and OTC desks. As a crypto liquidity platform constructed for the enterprise, it would unleash the potential to entry deep liquidity inside markets, accelerating the shift to crypto.

Ripple Liquidity Hub will initially help BTC, ETH, LTC, ETC, BCH, and XRP (availability will range by geography), with plans so as to add extra digital property over time. Ripple plans so as to add performance equivalent to staking and yield-generating functionalities sooner or later.

Can XRP attain $1 quickly? Why not? Because the group pushes for motion: It will likely be good to see this snowball! Subsequent up, 40% in a yr!

SEC vs. Ripple: XRP Value Prediction After Lawsuit

The lawsuit in opposition to Ripple has considerably hindered the worth surge throughout this bull market. Despite the fact that the Securities and Trade Fee (SEC) doesn’t take into account Ethereum and Bitcoin, which have comparable traits as XRP, to be securities, the SEC has continued to be harsh in the direction of Ripple Labs, Inc.

The XRP worth fell by 70% instantly after the go well with was filed and has by no means been in a position to break its earlier all-time excessive of $3. XRP holders have been affected as main crypto exchanges like Coinbase, and Crypto.com suspended buying and selling, so that they couldn’t money out. JP Morgan’s North America Fairness Analysis additionally printed a report earlier this month stating that the XRP asset is poised for vital adoption.

Preserve up to date with this unfolding information of SEC versus Ripple, which might topple the market if the predictions go south.

XRP Distinctive Options

Ripple has been in existence for some time. It was created in 2004 as RipplePay, however the case of its innovation got here too early for its time, because it made no vital mark then. Nevertheless, it returned in 2012 as Ripple and launched the XRP token quickly after. Ripple XRP is in contrast to every other cryptocurrency. XRP is a product of Ripple Labs, and it differs on many ranges, and this contains:

Ripple isn’t blockchain-based

Not like a lot of the cryptocurrencies in existence, the coin doesn’t function on blockchain expertise. As an alternative, it’s primarily based on the Ripple Protocol Expertise, which suggests it has no use for a distributed ledger database. This makes use of gateways linked to servers of the corporate in a number of international locations to confirm and course of transactions.

XRP can’t be mined

Whereas the mining course of is taken into account an integral a part of all tokens, it isn’t the identical for XRP. The restrict for XRP cash is about at 100 billion cash created by the corporate. Over 35% of that coin has been launched into the market. The remainder is held by the corporate that releases it periodically to regulate the availability and circulation of the token. The cryptocurrency is a deflationary one because the variety of cash available in the market reduces with every transaction.

Is the Ripple community centralized?

In accordance to the report, Ripple’s milestone is critical as a result of it disproves claims that the Ripple community is centralized.

Technically, the digital asset is centralized, and its mum or dad firm, Ripple Lab, strives to create partnerships with conventional monetary establishments like banks. The corporate sells its RippleNet expertise to those establishments, thereby rising the recognition of its native token, Ripple XRP. RippleNet expertise is a system that connects banks and facilitates cross-border funds and settlements.

As a result of variations between Ripple XRP and different cryptocurrencies, it additionally has some benefits. A few of them are:

This is without doubt one of the most important promoting factors of Ripple expertise. The swiftness of transactions surpasses different cryptocurrencies and beats that of SWIFT wire switch, the generally used system in conventional banking. This makes it a greater different for banks to facilitate cross-border funds, as its XRP transactions are exceedingly quick. The ripple transaction protocol is sort of environment friendly too.

Conventional banking system transactions and that of some cryptocurrencies are likely to incur hefty transaction charges. However with digital forex, this charge is drastically diminished to a pittance.

- Reversibility of transactions

One other constructive for it’s that the transaction may be reversed or edited to take care of an error if there’s one.

All these options have enabled the Ripple community to realize vital partnerships amongst conventional monetary establishments. And it has additionally influenced the expansion within the worth of Ripple XRP over time.

Development in South Pacific

It’s a undeniable fact that the current partnership of Ripple with the Japanese cost big SBI has introduced the eye of varied technical firms throughout the South Pacific area, and it’s anticipated that the complete area will see an growth and adoption of Ripple tech.

It has been stated that the Ripple remittance deal is setting the stage for the a lot broader adoption of Ripple. The lawsuit on Ripple about its safety doesn’t appear to trouble Japanese regulators or SBI officers.

Is XRP a safety?

Particularly, the SEC claims that XRP is a safety whose supply and sale may be made solely pursuant to a statutory prospectus and an efficient registration assertion and that as a result of Ripple didn’t file a registration assertion its traders have a rescission proper.

“Cryptocurrency” means “a digital asset applied utilizing cryptographic methods designed to work as a medium of change.” As essential as that definition is, extra essential is what “cryptocurrency” isn’t—it’s neither a safety nor a commodity, each of that are individually outlined.

The Accountable Monetary Innovation Act launched on 7 June 2022 features a complete regulatory framework for digital property and seeks to supply readability on how digital property, equivalent to cryptocurrencies, are handled beneath US securities legislation. The lynchpin of the invoice is the codification of the US Supreme Court docket’s decades-old normal for figuring out when a monetary providing is a “safety,” i.e., the Howey test.

If cryptocurrency is a “safety,” then crypto-companies issuing them should adjust to Securities and Trade Fee guidelines for registration and reporting—failure to take action can result in vital penalties, such because the $100 million SEC nice. issued by the SEC in 2021.

Nevertheless, many within the trade imagine that cryptocurrencies act extra like commodities than securities and would like them to be handled as such, topic to the Commodity Futures Buying and selling Fee’s guidelines. The “safety” vs. “commodity” debate has many sensible implications for the cryptocurrency trade and shoppers and is already heating up in Washington.

These fascinated with coverage within the digital asset, cryptocurrency, and web3 industries can be effectively served to grasp the principles that public officers already are topic to when dealing with digital property of their very own. See the dialogue right here.

There are over 220,000 XRP holders, however the high 10 holders management over 70% of the present XRP provide. Proper now, cryptocurrency change Binance shops essentially the most XRP, with its customers holding over 30% of the present XRP provide.

Conclusion

XRP has been probably the most common digital currencies lately, seeing a surge in reputation and adoption. Many market consultants have constructive outlooks on XRP and imagine it might attain new heights sooner or later. Ripple’s Q2 earnings report revealed that even with XRP’s worth dropping, the demand for his or her On-Demand Liquidity service elevated ninefold yearly. ODL gross sales totaled a powerful $2.1 billion in Quarter 2 alone! Moreover, Ripple is placing its cash the place its mouth is by pledging a beneficiant $100 million to spend money on carbon removing actions as a part of its accountability to take care of environmental sustainability aims and stay carbon impartial.

In accordance with Ripple’s Crypto Developments report, Non-Fungible Tokens and Central Financial institution Digital Currencies are nonetheless of their infancy. As these two applied sciences manifest their true potential, their affect on Ripple’s community and the complete blockchain house will develop into obvious.

XRP’s future appears vibrant primarily based on the opinion of trade consultants. Ripple expertise and merchandise have enthusiastic backing from builders, supporters, and powerful believers in its long-term potential. All indicators level to XRP as having a safe footing for continued success.

Typically, consultants are optimistic about XRP’s future development and predict potential positive factors within the coming years. Nevertheless, there may very well be some short-term worth adjustments sooner or later. A powerful group will assist XRP achieve the long term. As well as, a number of different elements have an effect on its future efficiency.

Considered one of these is elevated developments inside Ripple’s merchandise. For instance, The XRP Ledger has been growing its personal sidechain, which has simply began to undergo testing. Because of its compatibility with the Ethereum Digital Machine, the sidechain goals to extend the interoperability of the blockchain (EVM). This permits programmers to make use of the Ripple Ledger to execute Ethereum sensible contracts.

However this sidechain is a prolonged enterprise with three phases. The second stage, which is able to let any developer be part of the community, will begin in early 2023 and develop into on-line within the yr’s second quarter.

Lately, Ripple launched its Q3 markets report. This indicated that, for the primary time, the corporate’s XRP holdings had been lower than 50% of the general provide. Ripple’s internet acquisitions, in the meantime, had been reported to have decreased by roughly $100 million from the prior quarter. Nevertheless, this hasn’t impacted the general XRP provide, as its worth continues to extend.

There are a number of explanation why consultants imagine that XRP’s future efficiency is promising. For one factor, a robust group of supporters and builders continues to see super potential in Ripple’s expertise and merchandise. Regardless of some short-term worth fluctuations and a bear market, many analysts imagine XRP has a vibrant future forward. Whether or not it would attain new highs or proceed to develop steadily stays to be seen, however there isn’t any doubt that this crypto asset will proceed to play an essential function in world monetary establishments.