Zima Purple offers readers the weekly pulse on the most important information round NFTs. Be part of our group and take the journey with us by subscribing right here:

“Trevor, I feel a bearish publication is so as”

– Andrew Steinwold

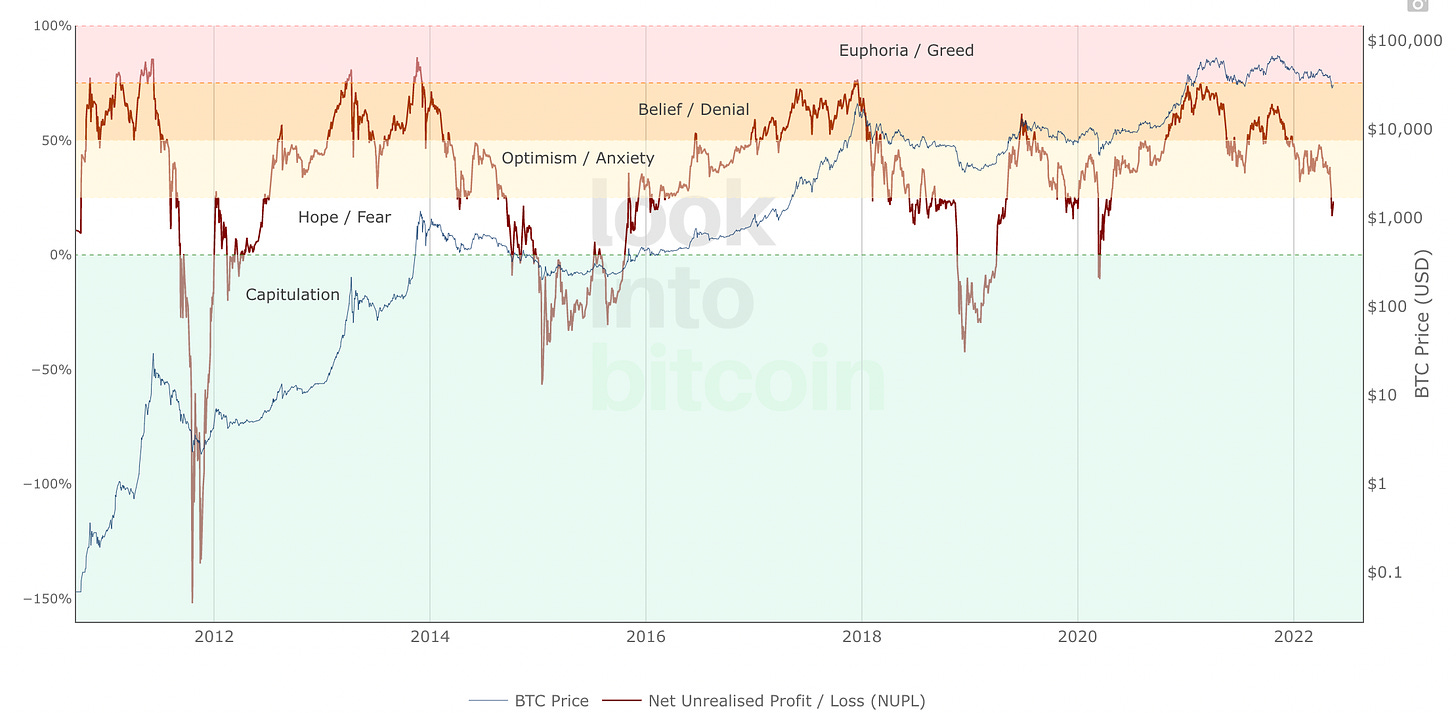

Public markets have been getting demolished, inflation remains to be excessive, and the Fed continues to lift charges – issues aren’t trying peachy. Many enterprise traders are telling founders to get burn charges underneath management, elevate no matter you may, and get to “ramen” worthwhile ASAP. Regardless of the carnage within the markets and the bearish macro view that many maintain, it’s trying just like the market is close to capitulation in line with the Internet Unrealized Revenue/Loss chart.

Clearly, one chart can’t let you know the longer term nevertheless it may give you a historic look into different durations of max ache. For my part (not monetary recommendation) the Fed decides which route the market will head. Elevate charges = market down. Minimize charges = market up. Maintain shut tabs on what they determine.

Except you’ve been dwelling underneath a rock you’ve nearly definitely heard that $LUNA has hit mainly 0.

So what occurred?

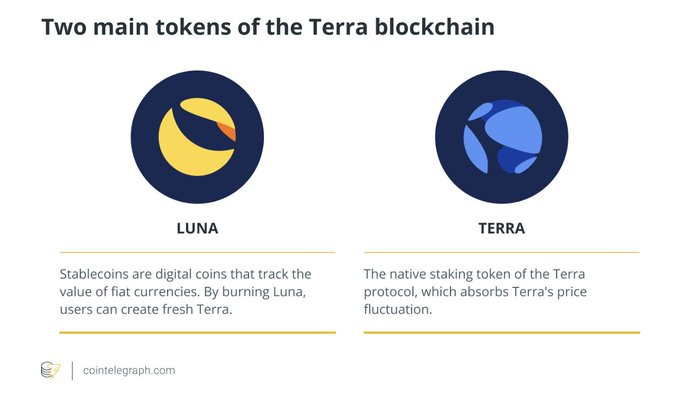

The Terra Ecosystem has two tokens: UST and LUNA

LUNA is a Layer 1 blockchain (like Ethereum) however is exclusive because of its stablecoin, $UST.

-

Stablecoins are ideally backed in a way that’s 1 stablecoin = $1USD

-

USDC is one of the best instance of this. 1 USDC will theoretically all the time be backed by 1 buck.

-

The issue with these 1-1 stablecoins is that they’re centralized and will be censored by governments/firms.

Enter Luna, a decentralized stablecoin.

1 LUNA all the time* equals 1 UST

LUNA builders, group, and traders believed that this mechanism would preserve UST pegged to $1 USD. Nearly all of UST’s customers got here from Anchor Protocol which allowed liquid UST staking at 20%. UST/LUNA critics argued {that a} vital UST outflow from Anchor would result in a LUNA loss of life spiral.

A considerable amount of capital exits UST —> They promote increasingly more LUNA —> The 1 UST – $1 USD peg breaks —> a financial institution run triggers a UST and LUNA loss of life spiral.

LUNA tried to guard towards a financial institution run by shopping for BTC.

On Might Seventh-Eighth, $UST depegged to 98 cents after a number of $100M was pulled out. The BTC backstop got here out and buying and selling corporations backing LUNA injected capital to defend the peg.

The loss of life spiral that LUNA backers stated couldn’t occur…occurred. The tip.

Jack Niewold wrote a nice thread on this with some extra context about Terra’s founder Do Kwon’s try to reserve it, in addition to making an attempt to reply the query of…Now what?

Additionally, the loss of life spiral’s results weren’t solely felt by the Terra holders. Take a look at this thread to be taught among the second-order penalties.

This previous week, the Azuki undertaking has been embroiled in drama after considered one of its 4 founders, Zagabond, launched an article that masqueraded previous rug pulls as “studying experiences.”

What went down:

Zagabond dropped an article the place he mentioned his founding of three initiatives previous to Azuki:

-

Phunks

-

Tendies

-

Zunks

He described the training experiences gathered from every undertaking and the way they in the end strengthened Chiru Labs and Azuki.

To most, these “studying experiences” had been thought-about to be rug pulls – i.e. he deserted the initiatives.

The backlash incited Zagabond to go on a Twitter House with Andrew Wang to hopefully clarify the scenario and clear the air….

…that didn’t occur

Azuki’s flooring began to spiral nearly instantly after the House.

Regardless of all this… Azuki is again to 13ETH+

You possibly can examine the transaction historical past right here

Declare right here

-

Might 12: Claiming began

-

June twenty first: Claiming ends

-

June twenty second: Trailer premiering @ NFT NYC that includes the Dooplicator

-

June twenty third: Traits & rarities revealed

-

Summer time 2022: Dooplication begins

On a name, Roblox’s CEO reportedly spoke concerning the means to wrap Roblox digital objects in an NFT and take them off-platform.

Jiho and the Axie workforce launched an outline of land staking:

-

337,500 AXS per 30 days is devoted to this initiative

-

Proof of engagement and gameplay ic required to assert tokens

-

Going down June 2nd

-

Dutch public sale

-

Worth begins 2ETH

-

Complete provide of 20,000 plots throughout seven distinctive areas

-

~5% of all in-game revenues go to landholders

Instagram tweeted that they’re testing methods for creators and collectors to share NFTs on the platform.

Some particulars:

-

They’ve begun testing the product with choose creators

-

Rainbow pockets might be supported

-

The platform will help Ethereum and Polygon NFTs initially earlier than including help for Solana and Stream

The MLB has reached an settlement with the NFT-based fantasy sports activities firm, Sorare. Just like Sorare’s agreements with European soccer, this deal will enable customers to gather tokens representing gamers.

MechaFightClub ($40M) | Fight sports activities within the metaverse with artificially clever NFT fighters. The spherical included participation from Andreessen Horowitz, Michael Ovitz, Sonam Kapoor, Solana Ventures, The Chainsmokers, Mantis VC, Advancit Capital, KeenCrypto, Capitoria, Unlock Enterprise Companions, and Infinity Ventures Crypto.

Co:Create ($25M) | A brand new protocol that gives foundational infrastructure for decentralized manufacturers. The spherical’s members embody Andreessen Horowitz, VaynerFund, Not Boring Capital, and Amy Wu.

Spotlight ($11M) – Platform to construct blockchain-based membership communities. The spherical included participation from Haun Ventures, 1kx, SciFi VC, Floodgate, Coinbase Ventures, Thirty-5 Ventures, Offline Ventures, DAO Jones, Mischief, Polygon Studios, WME, Chris Zarou, Scott Belsky, Tarun Chitra, Mark Gillespie, Robert Leshner, Lenny Rachitsky, Gokul Rajaram, Linda Xie, Lucy Guo, Magdalena Kala, Technique Music, A.capital, & 2PunksCapital.

Cometh ($10M) | A DeFi-powered videogame that includes yield producing NFT. White Star Capital, Stake Capital, Serena Ventures, Shima Capital, IDEO Colab Ventures, and Ubisoft all participated within the spherical.

InfiniGods ($9M) | A blockchain gaming studio. Participation from Pantera Capital, Framework Ventures, Animoca Manufacturers, Jefferson Capital, and Double Peak.

(Hear) The total Aku story with Micah Johnson

Hey! You made it to the underside 🙂