Zima Pink offers readers the weekly pulse on the most important information round NFTs. Be part of our neighborhood and take the journey with us by subscribing right here:

Hey everybody! Right here’s what we obtained for you this week:

Information

-

Snapchat eyes NFT integration

-

Huobi on what lies forward for NFTs

-

Magic Eden’s new gaming enterprise arm

-

PROOF acquires Divergence

-

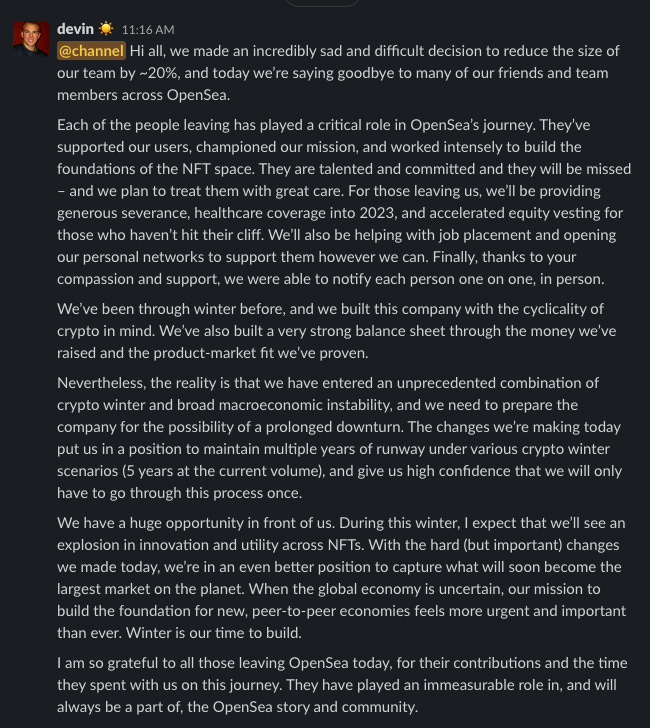

OpenSea lays off 20% of its workforce

Market

Collectibles

Gaming

Digital Worlds

+ The Zima Pink Podcast

The mixing would permit artists to point out off their NFTs as AR filters. Within the trial run, artists will mint NFTs on one other platform earlier than importing them into Snapchat as Lenses. Snap doesn’t plan to take any cash from the artist however moderately give them a approach to monetize their artwork.

Huobi Analysis, the analysis arm of the crypto trade Huobi, launched a report exploring the potential impacts of three huge strikes within the NFT house.

-

Uniswap and OpenSea’s acquisition of Genie and Gem, respectively

-

eBay’s acquisition of KnownOrigin

-

Shopify’s New NFT Storefront

Uniswap Acquires Genie – why Uniswap needs an NFT platform

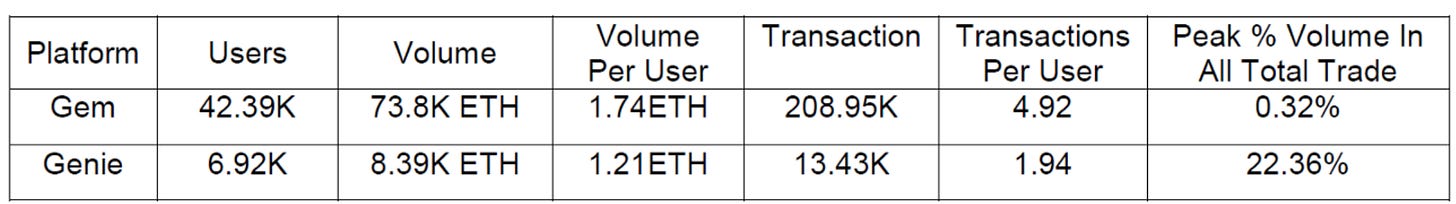

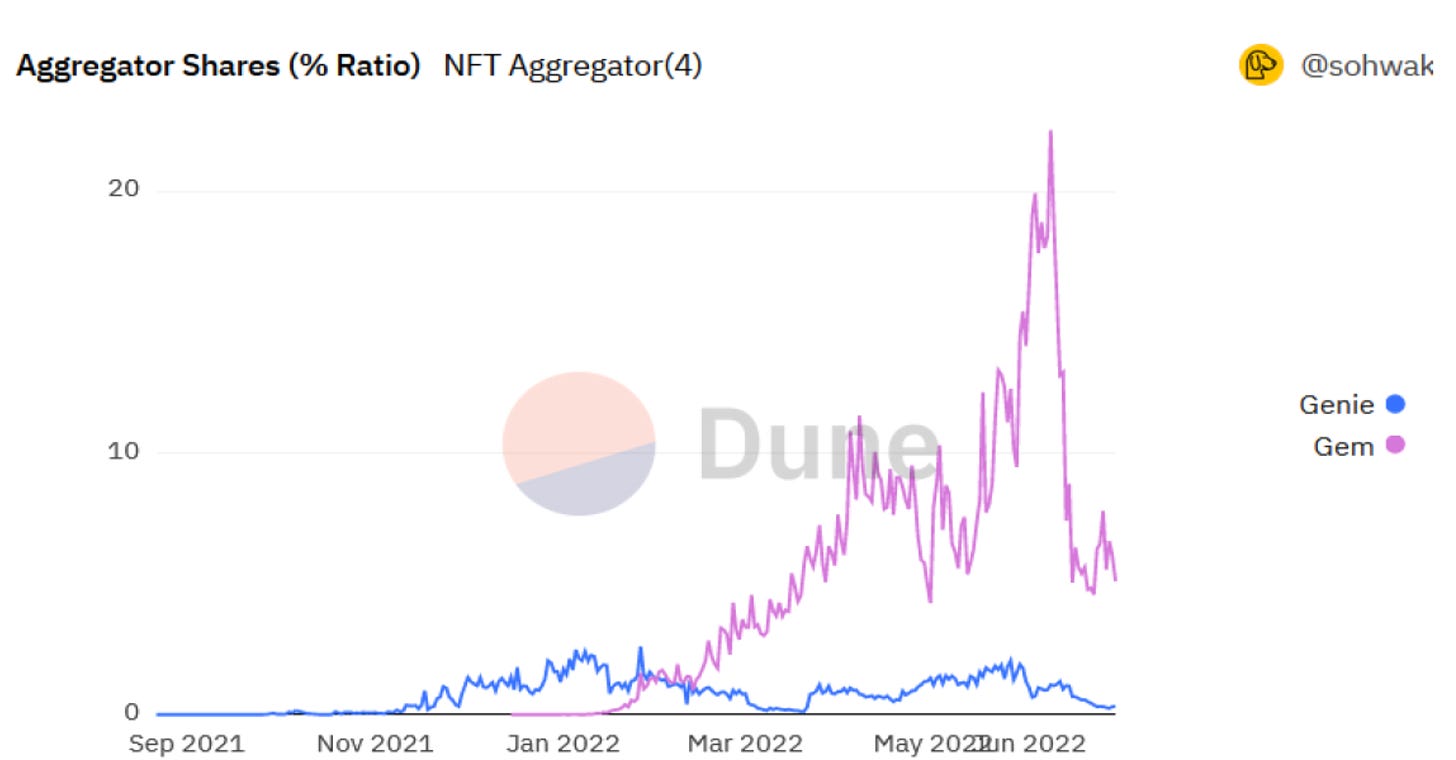

Genie is an NFT market aggregator. Uniswap will combine Genie into its net app and start cross-selling NFT merchandise to its 170,000 month-to-month lively customers starting this fall. With this userbase and repute, Uniswap might be a powerful competitor to OpenSea. Nevertheless, OpenSea’s new acquisition, Gem, is thrashing Genie in each method potential

Compatibility is 👑

As extra NFT marketplaces emerge, the necessity for aggregators will develop exponentially. The metrics bear out simply how necessary it’s for market aggregators to achieve compatibility with new marketplaces as quickly as potential

Gem turned suitable with LooksRare simply 10 days after the latter’s launch, whereas Genie took months. Regardless of its first mover benefit, Genie was overtaken by Gem because the main NFT market aggregator in February as a result of its incompatibility with Seems to be Uncommon.

Cost flexibility will turn out to be the norm

Most NFT marketplaces immediately solely take ETH as fee. Uniswap is predicted to just accept any cryptocurrency as fee, even permitting NFTs to be priced in a number of kinds of tokens on the similar time. Gem already accepts all ERC-20 tokens as fee.

Fixing the liquidity downside

Liquidity is among the largest issues going through the NFT market as every commerce requires a novel purchaser. This downside could be resolved with NFT liquidity swimming pools by permitting customers to commerce immediately with a liquidity pool with out the necessity to discover an precise purchaser. Uniswap is already experimenting with NFT liquidity swimming pools by way of Unisocks.

Competitors advantages customers

Competitors amongst NFT marketplaces considerations performance, stability, and transaction charges. The competitors will power marketplaces to maintain charges low whereas on the similar time providing strong platforms with excessive performance – or danger loss of life by abandonment.

E-commerce 🤝 NFT integration

eBay acquired KnownOrigin – an NFT market with few customers or quantity.

Why?

Ebay has the customers and quantity – simply not the platform or know-how.

The acquisition will convey NFTs to eBay’s 150M+ lively customers.

The primary market eBay will reportedly deal with is digital buying and selling playing cards. eBay has a really massive userbase of card merchants.

Shopify’s GM store

Shopify constructed an in-house storefront platform focusing on present NFT tasks. This might assist many tasks unlock the second section of worth creation – turning into life-style manufacturers.

So, what lies forward for NFTs?

-

Extra conventional -commerce platforms integrating NFTs into their shops

-

The demand for NFT market aggregators will develop

-

OpenSea and Uniswap have positioned themselves as main NFT buying and selling platforms

-

Competitors between marketplaces will result in extra advantages for NFT merchants

Magic Ventures plans to make use of the fund to make strategic Investments and onboard builders. The corporate employed Tony Zhao – formally of Tencent – to steer its gaming investments.

Zhao stated that the fund’s investments are “purely strategic in nature”

“We’re not desirous about returns – by no means have and by no means will”

Zhao and Magic Ventures wish to assist Magic Eden cement itself because the go-to platform for NFT recreation builders.

PROOF introduced that it has acqui-hired a web3 engineering workforce known as Divergence. The workforce beforehand labored on PROOF’s good contracts in addition to different tasks like PREMINT and Admit One.

Earlier than deciding to hitch PROOF, Divergence was planning to boost cash and proceed independently. The workforce reportedly had an “A-Record slate of traders” lined up – together with PROOF founder Kevin Rose by way of his agency, True Ventures.

The OpenSea each day quantity continues to stay within the vary of $10-$20M. NFT curiosity by way of Google developments is about flat close to the lows. NFTs are buying and selling a bit decrease, however that’s seemingly as a result of short-term rally in ETH/USD.

-

Punks are doing nice (scroll down for extra)

-

OtherDeeds continues to be flat at round 2.85 ETH regardless of the Otherside recreation demo going reside

-

STEPN shoeboxes are performing nicely within the brief time period

-

Generative artwork venture Faktura is performing very nicely

-

Notable collectors ledger, Tyler Hobbs, XCOPY, and Punk6529 all minted/purchased one

-

Their fund owns ~1000 NFTs with some very high-priced collectibles

The authorized docs are open, nevertheless it nonetheless isn’t clear if Vincent Van Dough’s Starry Evening NFT fund is technically a part of 3AC or whether it is separate. If it’s separate, then it might be okay, but when it’s not, then it’ll most likely be liquidated like the remainder of 3AC.

What impression might this have in the marketplace?

Ape flooring – 94 ETH

Punks flooring – 83.75 ETH

The CryptoPunks flooring is closing the hole on Bored Ape Yacht Membership. The Punks flooring has practically doubled within the span of the previous couple of months. Sentiment surrounding the venture on CT is admittedly excessive, and we’re even seeing holders of different blue chips promote to purchase extra Punks.

The run-up can largely be attributed to Noah Davis leaving Christie’s to take over as CryptoPunk’s Model lead.

Pudgy Penguin holders can now license their NFTs to be made into toys. Not all NFTs can be chosen, nonetheless. This baked-in monetization scheme for holders is one thing to observe. Pudgy Penguins didn’t elude to their choice standards aside from it’s depending on in the event that they really feel it suits the product line finest.

Andreesen Horowitz companion Arianna Simpson spoke with Enterprise Beat in regards to the intersection of web3 and gaming.

Listed below are the takeaways:

-

a16z believes gaming can be an enormous catalyst able to bringing thousands and thousands of individuals into the web3 house

-

Lots of the finest companies had been in-built a bear market

-

NFT criticisms are sometimes unfounded

“That is the plain reply. I can’t consider anything. It simply makes a lot sense. This solves so many issues.”

– One gaming business veteran on web3 in line with a16z

Regardless of the market massacre, Animoca managed to keep away from taking a down spherical – they raised at the next valuation ($5.9B) than they’d earlier than the crash.

Though the spherical is at a barely increased valuation in comparison with its final, $5.9B vs. $5B, it’s considerably smaller. They beforehand raised $359M and $139M in separate raises. The financing will go in the direction of new acquisitions, investments, and “common mental properties.”

Otherside opened up its first journey reside recreation demo on July sixteenth. Individuals who participated had been typically fairly impressed.

Otherside additionally dropped its lite paper – learn it right here

The Sandbox has partnered with Playboy to create a Playboy MetaMansion social recreation inside The Sandbox. The sport will characteristic particular NFTs and experiences.

Andrew spoke with one of many web3 house’s biggest minds, @0xfoobar

Foobar is a polymath concerned with all points of web3 constructing, investing, studying, and educating – we talk about all of it on this episode, and you may’t miss it!