Zima Purple provides readers the weekly pulse on the largest information round NFTs. Be a part of our group and take the journey with us by subscribing right here:

Hey everybody! Right here’s what we acquired for you this week:

Information

Market

Collectibles

Gaming

Digital Worlds

+ The Zima Purple Podcast

📰 Information

Why you have to be nervous about Celcius and 3AC going underneath

Three Arrow Capital (3AC), the crypto-focused, Singapore-based hedge fund is rumored to be bancrupt. 3AC backs many extremely notable crypto initiatives and Vincent Van Dough’s $100M NFT fund.

Crypto lender that has come underneath fireplace after it froze withdrawals final weekend, citing “excessive market circumstances.”

Each 3AC and Celcius’ troubles are linked to the low cost between Lido Finance’s Staked Ether (stETH) and the spot value of Ethereum – the 2 are alleged to be pegged 1:1. 3AC and Celcius each held (and dumped) A LOT of Staked Ether.

So why do you have to be nervous?

*FYI, the $ quantity of 3AC’s liquid portfolio (previous to the crash) varies tremendously. $9B is the quantity that we’ve seen essentially the most.

-

3AC borrows from each main lender (BlockFi, Genesis, Nexo, Celsius) thus each lender will and has taken a success due to this.

-

Their $9B liquid portfolio is not less than down an ultra-conservative ~70% —> Now $2.7B

-

Rumors are their portfolio is nearer to <$1B which means they might be unable to fulfill their margin calls

3AC is among the greatest debtors of crypto lenders globally.

-

The lenders will face an enormous P/L distinction between how a lot they’re owed and what they may get from liquidating 3AC’s collateral

-

Working a ten/20B portfolio with a 5% fairness buffer – these lenders are massively ill-prepared which means defaults will trigger a big fairness erosion.

A significant lender and a serious fund each collapsing isn’t any bueno. ETH and BTC and by proxy NFTS (in USD not less than) would get proceed to get rekt as a result of individuals can be compelled to promote what they will (no liquidity in alts.)

OpenSea’s Seaport improve cuts fuel charges by 35%

OpenSea formally moved to the open-source Seaport protocol on June 14th. They estimate it is going to save customers a mixed $460 million in complete charges annually.

Issues to notice:

-

Now you can make affords on objects in a whole assortment or by objects with a selected attribute

-

New accounts will not require the one-time setup price OpenSea had beforehand charged

Coming quickly:

-

Itemizing a number of NFTs in a single transaction

-

A number of payout addresses

📉 Market

Stanley Druckenmiller’s up to date worldview

Stanley Druckenmiller is a billionaire hedge fund supervisor in addition to a bitcoin bull, albeit not overly verbose about it. He has been signaling inflation worries for over a yr now and simply up to date his worldview in a chat with Stripe co-founder John Collison on the Sohn convention.

He was shocked by:

-

The magnitude of inflation

-

How aggressively the bubble burst

-

Valuations have reset as a number of good (public) firms are down 60-70% with no vital change of their fundamentals

-

-

The fed was actually gradual to acknowledge the issue

-

he thought they had been gradual in April of ‘21 however they didn’t pivot verbally till November and had been nonetheless shopping for bonds in March ‘22!!

-

He mentioned that in his 45 years, he has by no means seen a mixture the place there is no such thing as a historic precedent.

-

8% inflation right into a weakening economic system with bond yields at 3%

Kinda apparent however Druck says there’s a excessive correlation between BTC & the NASDAQ and that there’s a excessive overlap between the asset class house owners.

His recommendation to 20-year-old tech traders could be to spend as a lot time within the crypto, much like the web.

Why we’re bearish for the following few months

SuburbanDrone (an account that we fairly like for macro commentary) predicted how Fed tightening will play out this summer season within the Nasdaq. The crypto markets are intently correlated to the Nasdaq.

-

4x tightening means 3 price hikes and $45b QT in June

-

5x means 3 price hikes and $60b QT in July

-

6x means 2 price hikes and $90b QT by September

Arthur Hayes additionally introduced up an essential state of affairs in his most up-to-date weblog submit.

By June 30 (second quarter finish), the Fed could have enacted a 75bps price hike and begun shrinking its stability sheet. July 4 falls on a Monday, and is a federal and banking vacation. That is the right setup for one more mega crypto dump. There are three elements to this humble pie:

Threat belongings will once more rediscover their dislike for tightening USD liquidity circumstances sponsored by the Fed.

Crypto funds should elevate fiat to fulfill redemption necessities by persevering with to promote any liquid crypto asset.

No fiat may be deployed till Tuesday, July 5.

June 30 to July 5 goes to be a wild journey to the draw back.

Why we’re bullish long run

The metaverse is actual and it is taking place now.

Crypto = cash of the metaverse

NFTs = all the products within the metaverse

Irrespective of the costs of crypto, the metaverse just isn’t going away

👤 Collectibles

One thing unusual occurred with CryptoPunks… now we all know why

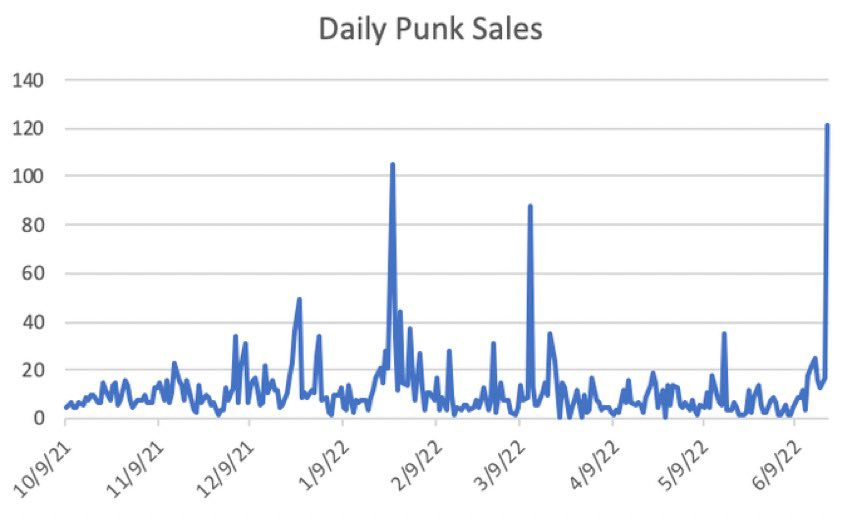

One thing uncommon was occurring with CryptoPunk quantity. The best variety of gross sales within the final yr+ occurred in a condensed timeframe.

Seems insiders had been front-running the information that NonFungibleNoah could be leaving Christie’s to take over because the CryptoPunks model lead.

Essential takeaways from the announcement:

-

No Punks on lunchboxes or in films

…thats about it to this point.

Noah needs to make it possible for, for essentially the most half, much less is extra. He needed to make sure the group understands that the Punks ethos will stay unaltered by him or Yuga.

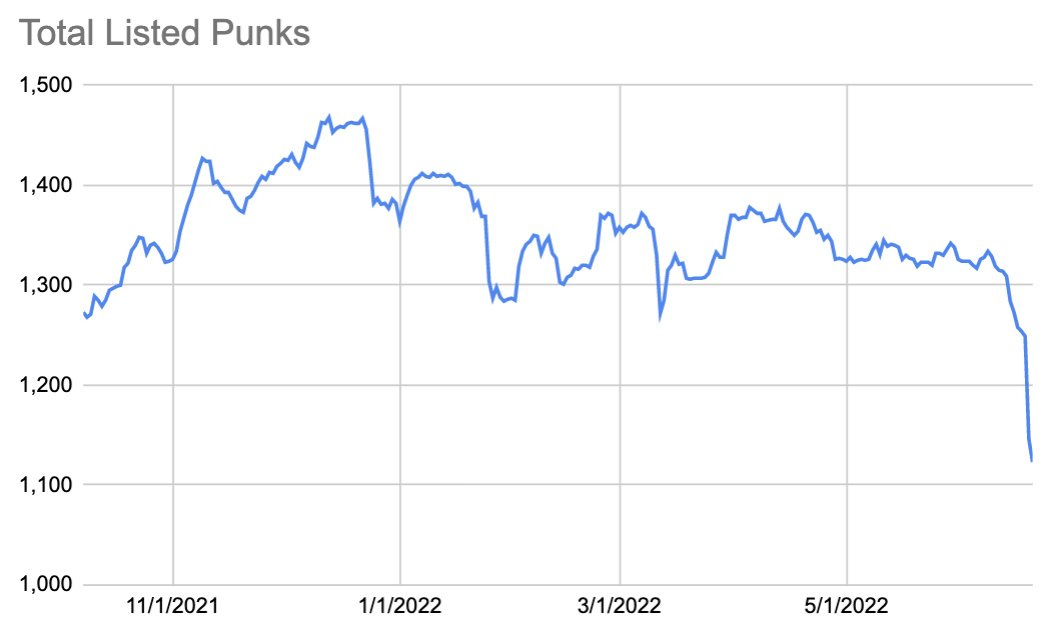

Whole Punks listed has additionally dropped a ton!

Fact Labs is revealed because the staff behind Goblintown

As many had suspected, Goblintown was launched by an skilled staff. Fact labs are additionally the staff behind The Illuminati Collective and The 187.

Observe Zima Purple on Twitter

🕹 Gaming

Advantage Circle DAO vs YGG

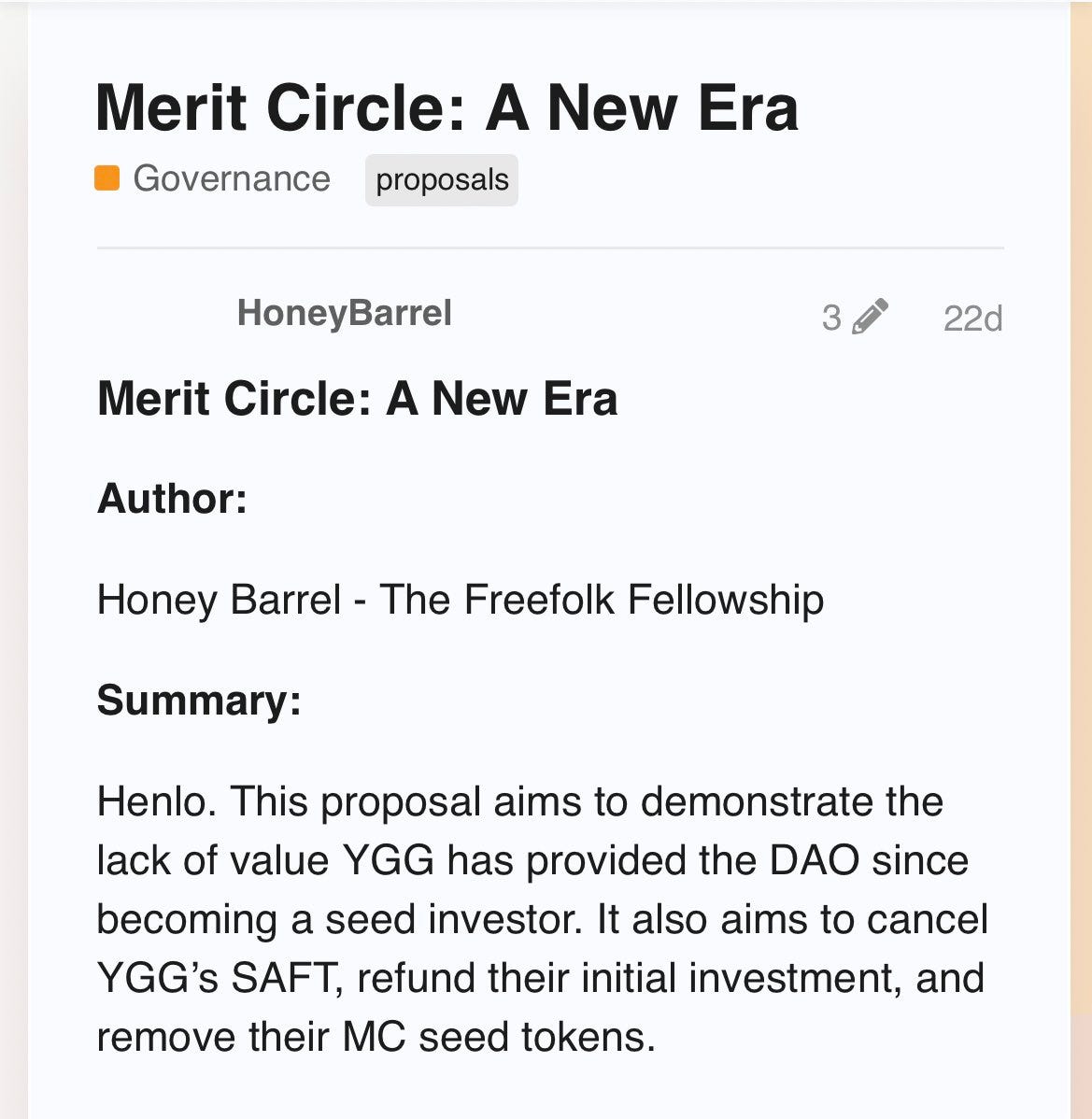

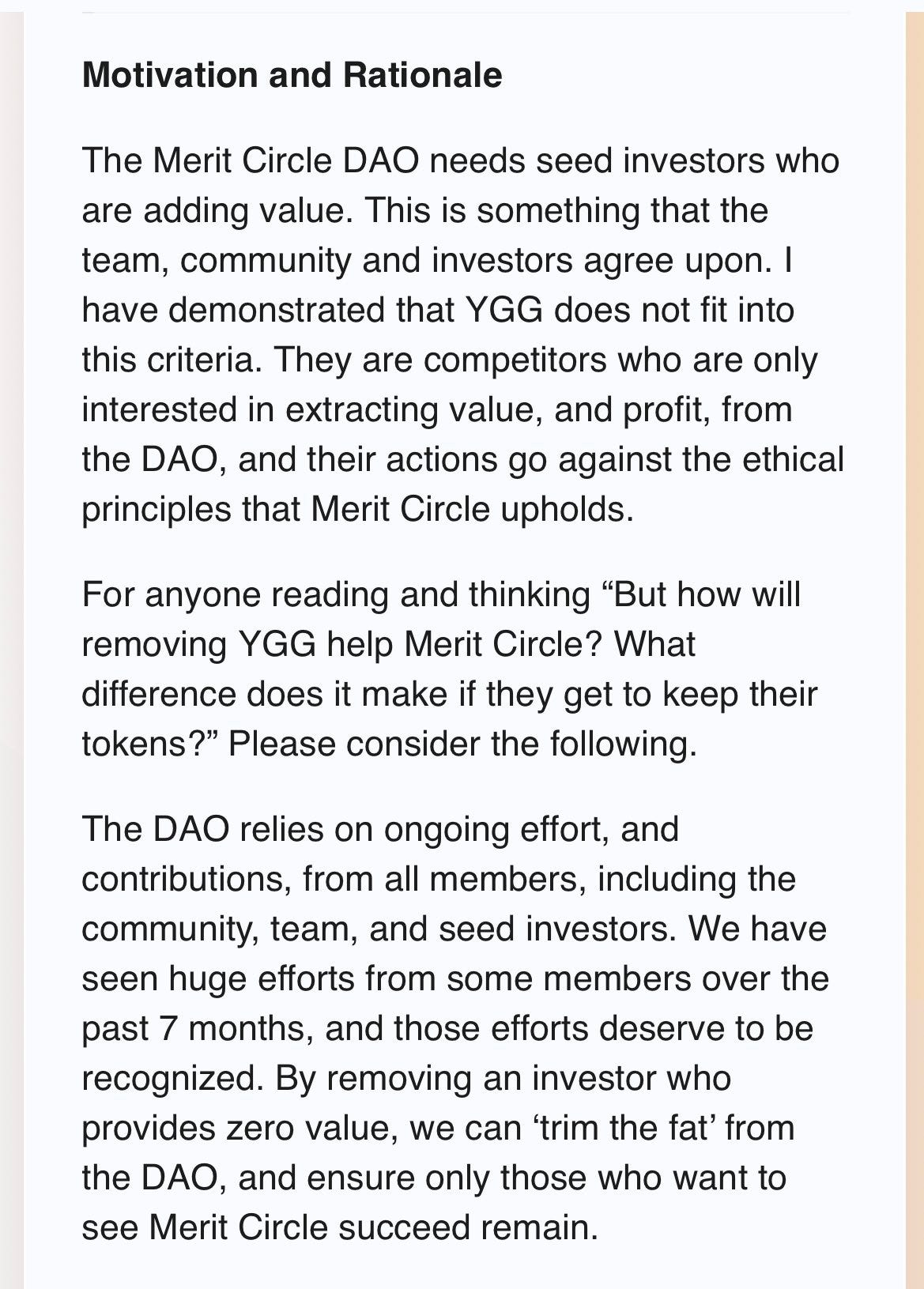

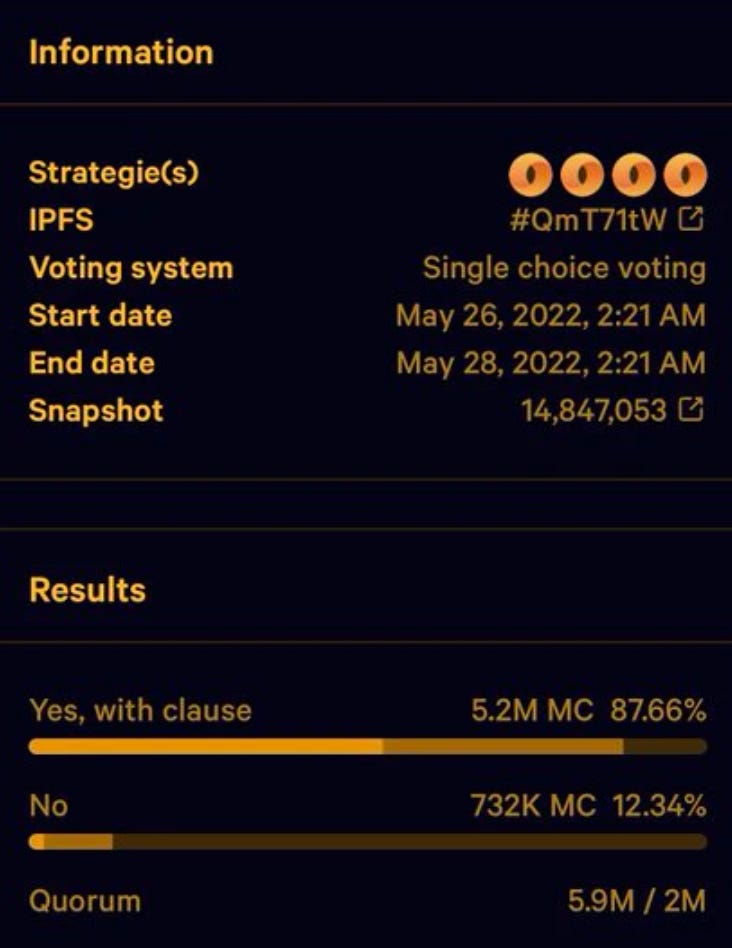

A decision has lastly been reached concerning the Advantage Circle DAO vs YGG drama.

Backing up a bit – Advantage CircleDAO needed to cancel Yield Guild Video games SAFT, refund their preliminary funding, and theoretically reduce them out of a 30X (after the completion of a 4-year vesting schedule) return for “not offering any worth.”

A proposal laying this all out hit the Advantage Circle DAO discussion board on Might twentieth and was met with resounding assist 👇

YGG snapped again of their weblog 5 days later principally stating that they had been underneath no authorized requirement to offer something however $$$

Full quote:

…not one of the seed traders are obligated underneath the authorized documentation of the SAFT to offer any particular worth add companies. Additional to that, there is no such thing as a provision for Advantage Circle Ltd to unilaterally cancel the contract no matter how this has been introduced by them to the group.

Though the Advantage DAO core staff (Advantage Circle Restricted) mentioned that they would like to “honor all agreements,” the DAO itself legally held the authority of the tokens by way of the investor settlement.

The official vote handed with flying colours on Might twenty eighth.

The Advantage Circle Core staff stepped in and renegotiated to permit YGG to take a “decreased return” on their funding.

A proposal handed for Advantage Circle DAO to purchase out all of YGG’s locked tokens for $0.32/token. This may web them $1.75M as an alternative of the ~$5M (or extra) that they might have obtained following their vesting schedule.

YGG formally agreed to the buyout on June 14th.

The staff behind Phrases with Associates is constructing an NFT recreation

Phrases with Associates developer Playful Studios has raised $46M to construct out The Wildcard Alliance NFT recreation. Playful Studios thinks by constructing Wildcard Alliance to be simple, accessible, and enjoyable., they will onboard the following billion players to web3. The sport will function components much like Hearthstone or Magic: The Gathering the place you handle card decks. It can additionally embody the gameplay of a multiplayer on-line battle enviornment (MOBA) recreation or an enviornment recreation like Rocket League.

🌐 Digital Worlds

Why the metaverse wants crypto

The legendary Punk 6529 wrote one other nice thread. This time on why the metaverse wants crypto.

Listed here are the takeaways:

-

The metaverse is an summary layer of the web – however nonetheless the web

-

The visualization layer of the web

-

4k Video & international video conferencing —> Useful prolonged and combined actuality

-

-

Most time can be spent in augmented actuality (partial augmentation) not digital actuality (absolutely immersive)

-

FYI some individuals like Sam Lessin ( VC and one in all Zucks greatest pals) disagree and suppose it’s going to be the opposite approach round

-

-

The motion to AR/VR can be seen as a way of life enchancment and can make bodily places irrelevant for enterprise apart from the social points (consuming & consuming)

An important questions for the well being of the web/metaverse/human society can be determined now.

Who shops the definitive possession information of these digital objects?

There are two solutions: an organization’s database OR a blockchain

If it’s an organization’s database, that may result in the identical issues seen in web2..however worse.

Why:

-

Hire-seeking platforms like Fb

-

47.5% price on metaverse gross sales – increased than a socialist tax regime

-

-

If the metaverse is your digital actuality and you may be banned based mostly on an algorithm, that’s terrifying

-

Political safety

-

The persistence and ambiance of the metaverse would make its influence on elections, et al 100x worse than Fb/Twitter

-

-

International nationwide safety

-

What if the video that was captured by augmented actuality glasses was hosted on an organization’s database?

-

(insert essential individual)’s personal moments are despatched to those databases

-

It’s obtained by hackers, and so forth.

-

If the possession information are on public blockchains, these issues are averted.

NFTs > personal firm databases

🎙 Zima Purple

Kevin is the founding father of Atmos an upcoming recreation universe that mixes sports activities, lore, and crypto-economics to create an enticing and aggressive digital expertise

On this episode we chat:

-

Being a crypto founder in 2013

-

Trying to construct a fantasy NFT basketball recreation in 2019

-

Sports activities as the last word malicious program to crypto mass adoption

-

Balancing skill-based gameplay with crypto-economics

-

Making a aggressive recreation mixed with a digital world

-

Atmos preliminary core recreation loops of Mining – FGabricating – Racing

-

And a lot extra